Platinum prices are surging in 2025, thanks to structural deficits and rising Chinese demand. Supply constraints may sustain momentum.

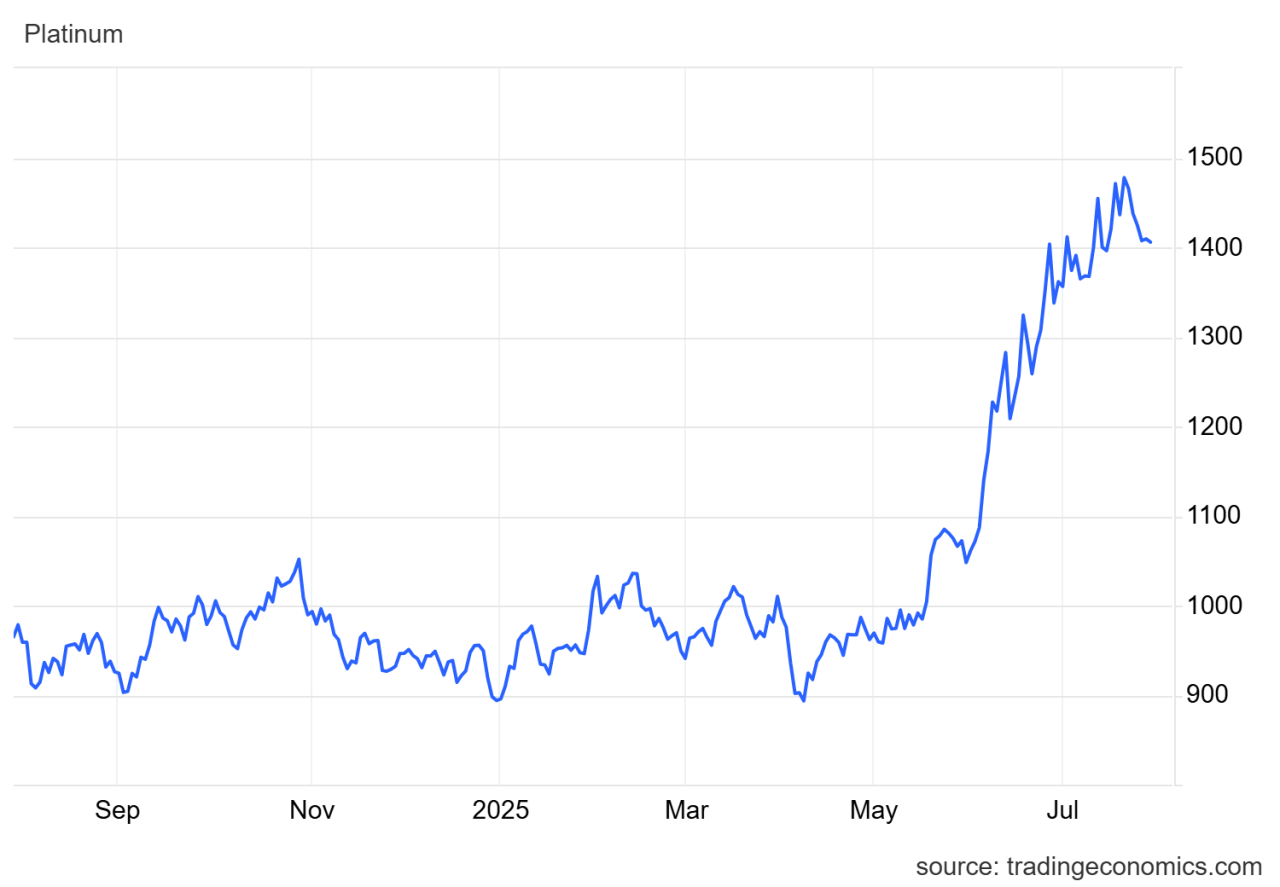

Platinum has surged over 55% year‑to‑date, breaking out from a long-standing trading band below $1,100/oz to reach highs above $1,400/oz in mid‑2025.

This platinum price surge in 2025 reflects a rare shift in market dynamics. With fundamentals shifting, the key question is whether this marks a durable rally or a temporary spike.

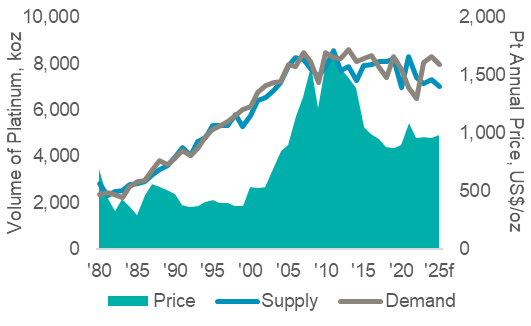

Platinum Supply–Demand Fundamentals: A Structural Deficit

The platinum supply deficit projected by the World Platinum Investment Council (WPIC) is estimated at 966,000 ounces in 2025, equivalent to 12% of global demand and marking the third straight annual shortfall.

Mining output is expected to drop 4–6%, with Q1 production down 13% year-on-year, making 2025 output the lowest in five years . Above-ground inventory is projected to fall to around 2.1–2.5 million ounces, equal to just three months of demand.

Supply is structurally inelastic, meaning even a steep price rise fails to spur new production quickly.

Platinum Demand Drivers: Investment, Jewelry & Industrial Shift

Investment demand for platinum has exploded, especially in China. WPIC estimates investment demand for 2025 at 688,000 ounces, led by strong bar and coin inflows and renewed interest in platinum as a gold alternative .

China’s platinum jewelry fabrication jumped about 26% year‑on‑year in Q1, as jewelers turned away from expensive gold toward platinum.

Automotive demand remains resilient too; WPIC forecasts 3.05 million ounces, just a 2% reduction from 2024, supported by slow EV adoption and ongoing hybrid engine support.

Risks & What Could Halt the Rally

A potential risk is that the platinum vs gold ratio narrows further, or auto demand falls sharply if EV adoption accelerates. Moreover, indicators such as lease rates have eased – dropping from 22.7% to 11.6% – suggesting some relief in tight physical supply conditions.

Above-ground inventory near 14 months of demand may absorb deficits for now, limiting further upside potential.

Conclusion

The structural deficit, constrained supply, and robust Chinese platinum jewelry demand and investment flows are driving this rally. While risks like easing tightness or weakening auto sector support remain, platinum appears poised for a sustained bull phase.

However, investors should monitor auto demand trends, inventory levels, and shifts in investor sentiment to assess whether platinum continues its ascent or plateaus soon.