Platinum prices are surging in 2025, driven by a third consecutive year of supply deficits and escalating demand from Chinese investors and hybrid vehicle manufacturers.

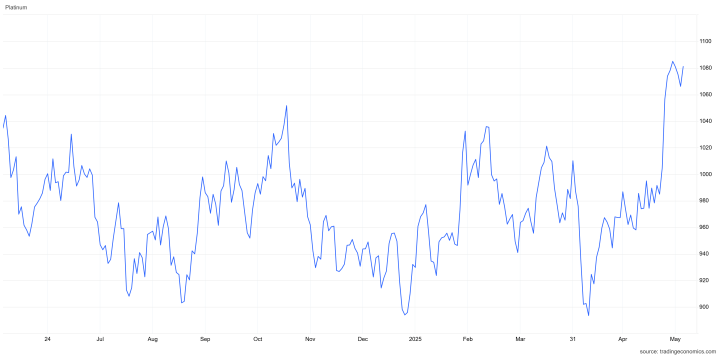

Platinum prices have surged over 20% year-to-date, reaching a two-year high of $1,096.40 per ounce as of May 29, 2025.

This rally is fueled by persistent supply deficits and a significant uptick in Chinese demand, positioning platinum as a standout performer in the precious metals market.

Structural Supply Deficits Tighten the Market

The World Platinum Investment Council (WPIC) forecasts a substantial market deficit of approximately 848,000 ounces for 2025, marking the third consecutive year of undersupply.

Total platinum supply is projected to decline by 4% to 7.002 million ounces in 2025, the lowest in five years, primarily due to reduced mining output in South Africa and lower recycling rates.

Above-ground stocks are expected to fall by 25% to 2.535 million ounces, equating to less than four months of global demand.

Chinese Demand Accelerates

Chinese platinum imports in April 2025 soared to 10 metric tons, a 47% increase from March and the highest monthly import volume in a year. This surge is attributed to increased purchases of platinum bars, coins, and jewelry, as investors seek alternatives amid gold’s high prices.

Retail investment demand in China jumped 48%, with smaller platinum bars seeing a 140% surge, indicating a broad-based increase in consumer interest.

Investment and Industrial Demand Bolster Prices

The Abrdn Physical Platinum Shares ETF has risen 18% in 2025, reflecting growing investor confidence in platinum’s prospects. Despite a projected 2% reduction in automotive demand to 3.102 million ounces, due to the rise of electric vehicles, platinum’s use in hybrid vehicles and industrial applications remains robust.

Conclusion

With structural supply deficits and surging demand, particularly from China, platinum is positioned for continued strength in 2025. This unique position offers investors seeking value in the precious metals market compelling opportunities.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- [Must-Read] Spot Silver – This Is What The Charts Suggest (May 24)

- Gold Close To Hitting Our First Downside Target. Silver Remains Undervalued. (May 18)

- A Divergence In The Precious Metals Universe (May 10)

- Gold Retracing, Silver and Miners at a Critical Level (May 4)

- The Precious Metals Charts That Bring Clarity Through Noise (April 27)

- Highly Unusual Readings In Gold & Silver Markets (April 20)