Silver: the one market that is barely moving. It is as trendless as anyone can imagine. This is one of the many (MANY) reasons we like silver so much. Leading indicators are turning really bullish since this week, one of them the USD rejection. Do you see the similarities with the Bitcoin chart prior to its giant move from 12k to 62k (some 16 months ago)? We stick to our bullish silver price forecast for 2022, and we dare adding that our forecast is conservative!

In this short article we will compare the chart structures of silver (currently) with Bitcoin (back in Sept of 2020).

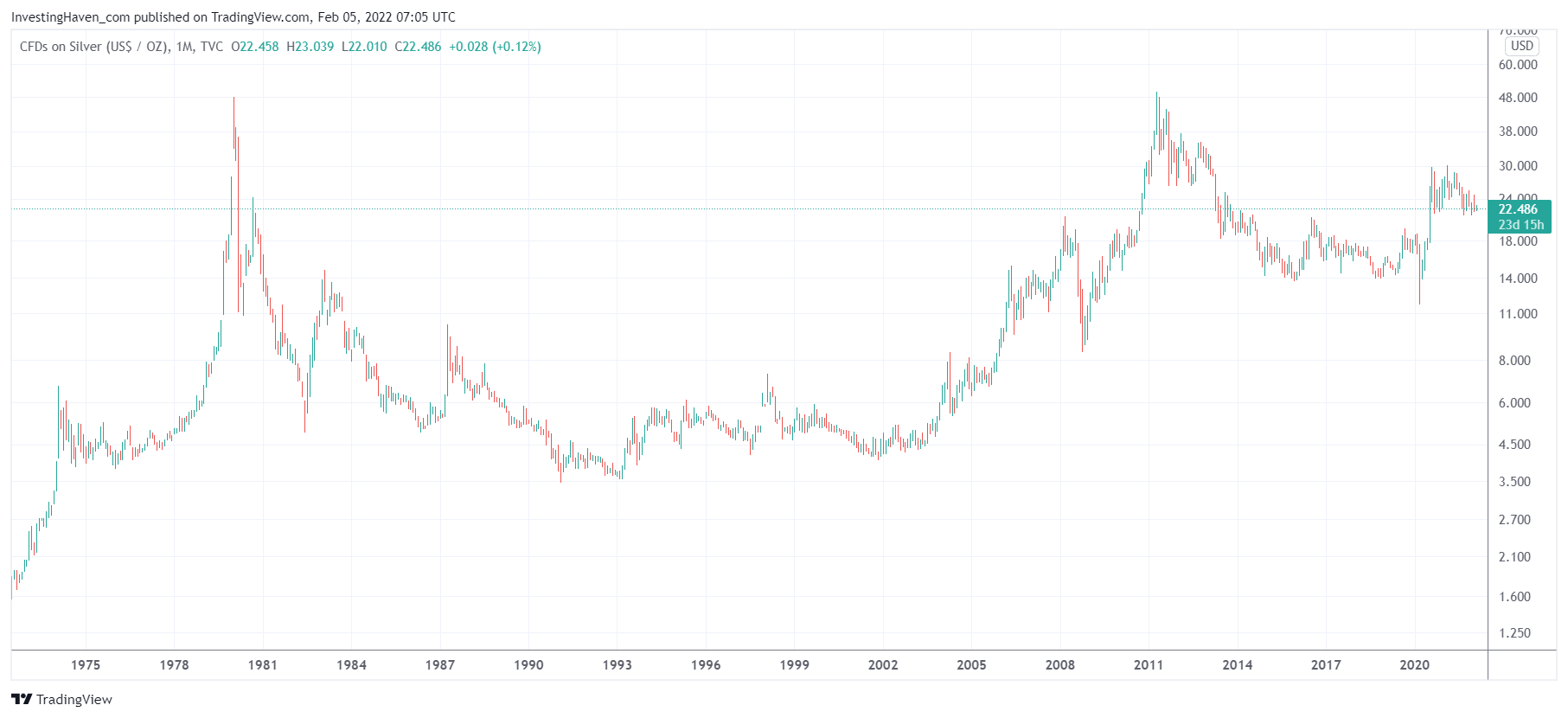

First, silver, the monthly chart.

We went back 50 years in time with this chart. We did say this and will repeat it: silver has the longest and strongest bullish reversal in history.

Here is a question of critics: so then why did silver not move higher in 2021, it had the opportunity to do so. Here is the answer which is as meaningless as the question itself: because 2022 or 2023 might offer a more appropriate market environment than 2021.

The chart structure we see below is a huge cup and handle pattern. It is clear that the ‘handle’ is incomplete. It is also clear that the ‘handle’ is respecting key levels. We did not annotate them, but you can see it, clearly, by looking for horizontal levels within the structure that was created in the last 10 years.

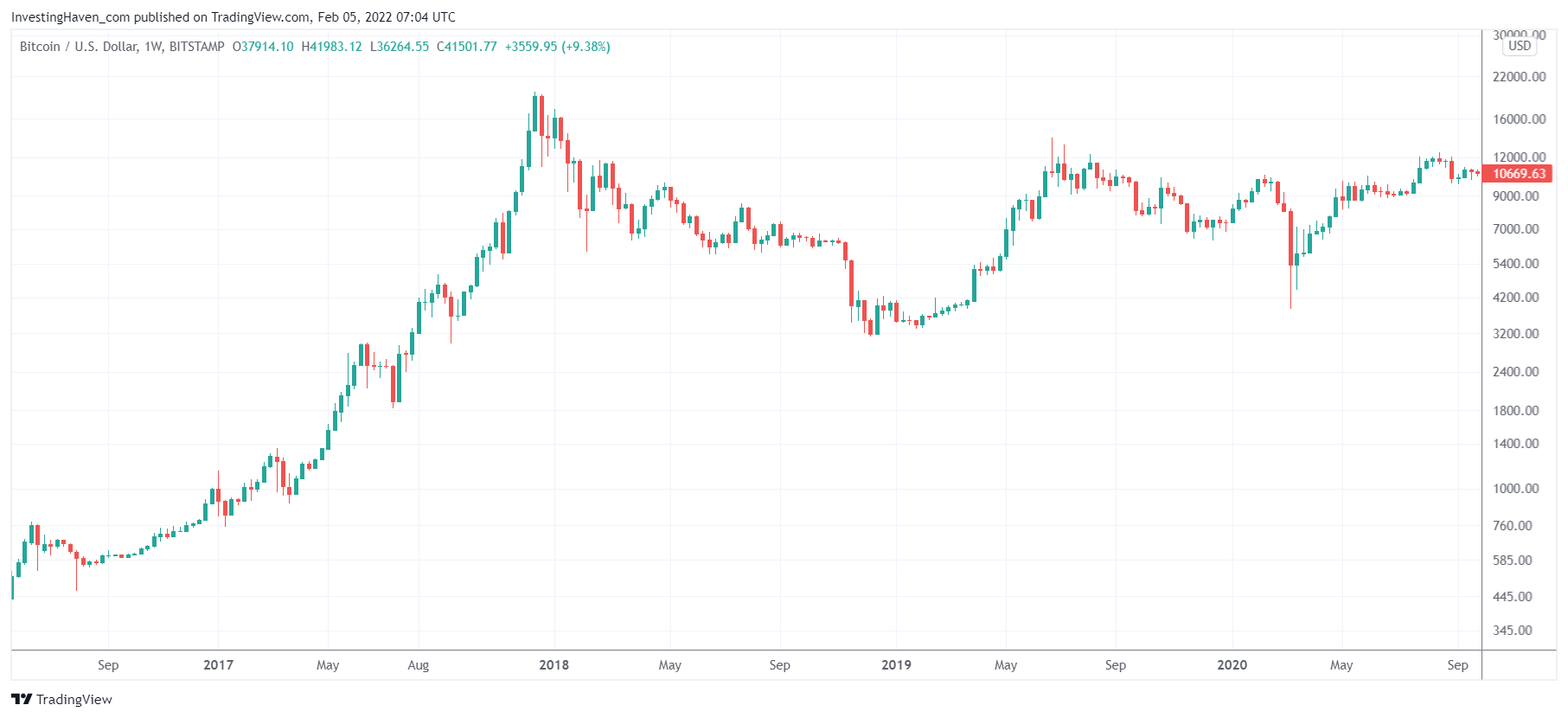

Now let’s look at the BTC chart.

Below is a weekly chart of 5.5 years. We do not need 50 years of data for BTC because BTC moves ten times faster than any other market. So with 5 years of data and the leverage effect of 10x we are comparing ‘apples to apples’.

Below is the BTC situation in Sept of 2020. It’s a nice cup and handle reversal, not identical to the silver chart but it has lots of similarities.

Fast forward some 6 months and you see how these long and strong cup and handle formations tend to evolve. The bullish power that comes with these patterns is immense.

While we don’t know when exactly silver will complete its ‘handle’ formation, which will be a pre-requisite before breaking out above 50 USD, we do know that it eventually happen.

Again, this comparison of chart structures is simply of the many indications that silver will eventually resolve higher. We have more evidence from fundamentals, intermarket dynamics, timing analysis.