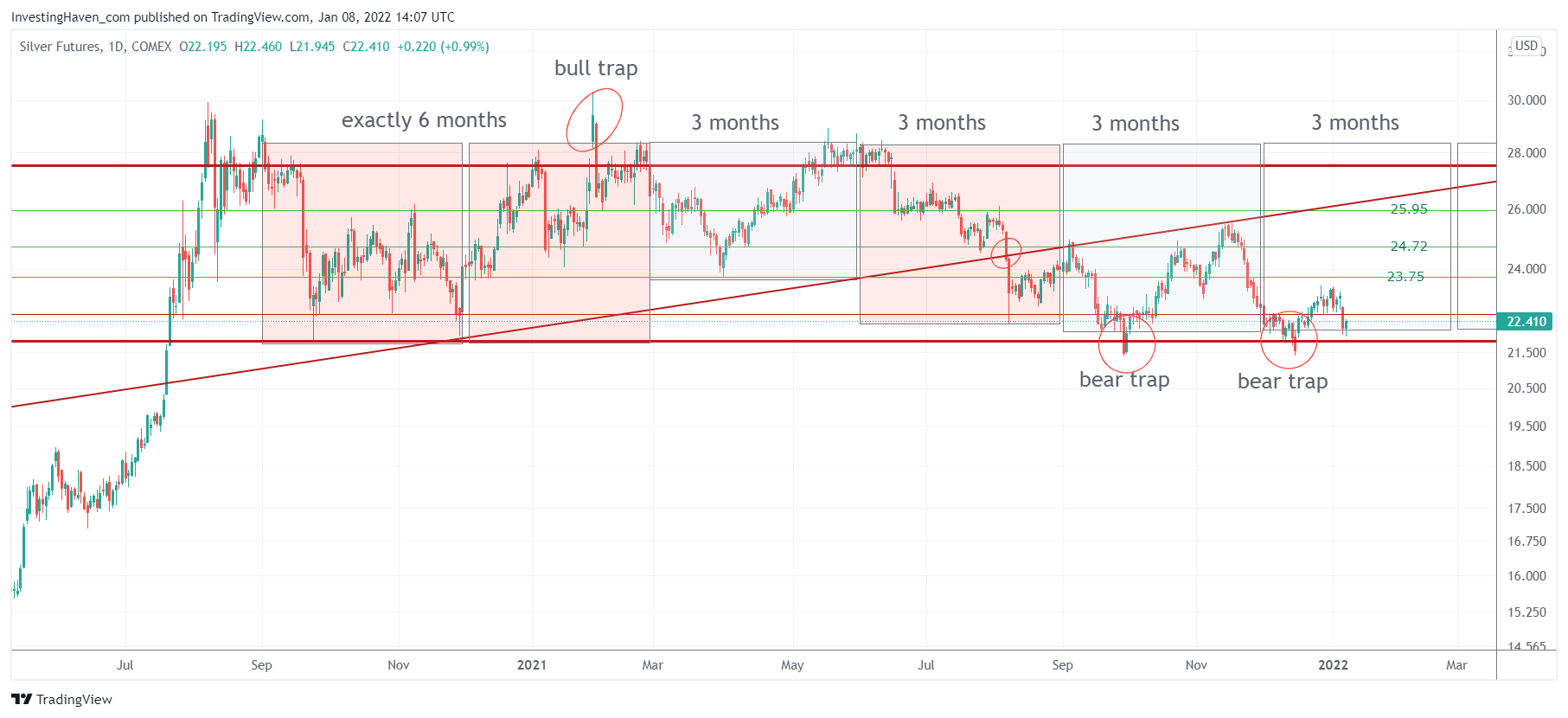

Silver is testing, again, key support levels. The long and strong consolidation in silver is looking better with each passing day. However, key support of the lows since summer of 2020 absolutely must hold. Based on the assumption that silver support holds we stick to our 2022 silver forecast of up to 40 USD.

The consolidation in silver is now long and wide enough to start thinking of increasing exposure. Maybe not immediately, certainly not as a trade, but for a long term portfolio we believe silver is getting really attractive here.

The difference compared to gold is that silver is seemingly unable to deal with its lowest support level. It is gravitating towards that lowest support level for several months now.

Gold, on the contrary, is printing higher lows. This is not bullish yet, there is zero probability of a bullish momentum trend to start in the short term. That’s why we re-iterate: these are long term investment ideas.

What’s the problem with gold and silver? Why are they not in a big bullish momentum trend amid monetary inflation?

The answer is simple: intermarket dynamics. Stated differently, as per our gold forecast, leading indicators favor other asset classes to perform well currently.

- In the 2nd half of last year, the USD was too strong. It pushed precious metals lower.

- This last week, bond yields were way too strong. They pushed precious metals lower.

Leading indicators like the Euro (positively correlated to precious metals) and bond yields (negatively correlated to precious metals) must be trending in the ‘right’ direction for precious metals to perform well. It will happen eventually, the only question is when exactly. The charts should guide us in spotting the right moment, as always.

The one thing we really like about this silver setup is that the candles are getting smoother, for sure compared to a year ago when candles and wicks were wild (ugly). A smooth structure in a consolidation is a good thing, but before getting really excited we want silver to clear 23.75 USD followed by 25 USD.