It is about to happen: silver has everything it takes to start its move back to 28.50 USD and initiate a multi-decade (secular) breakout. We are super excited about silver’s prospects, because of its (a) chart structure (b) secular cup and handle reversal over 50 years (c) intermarket setup and conditions as explained in Investors Moving Out Of Cash And Also Into Treasuries: Odd, But Strongly Bullish Precious Metals. Our silver forecast (+30 USD) is underway, silver miners will do really well.

Our premium members received some really cool silver and intermarket charts earlier this week. We showed cycle counts, chart structures, intermarket setups. All of them point to a bull run to start in both gold and silver, with silver being the strongest and hence most promising of both precious metals.

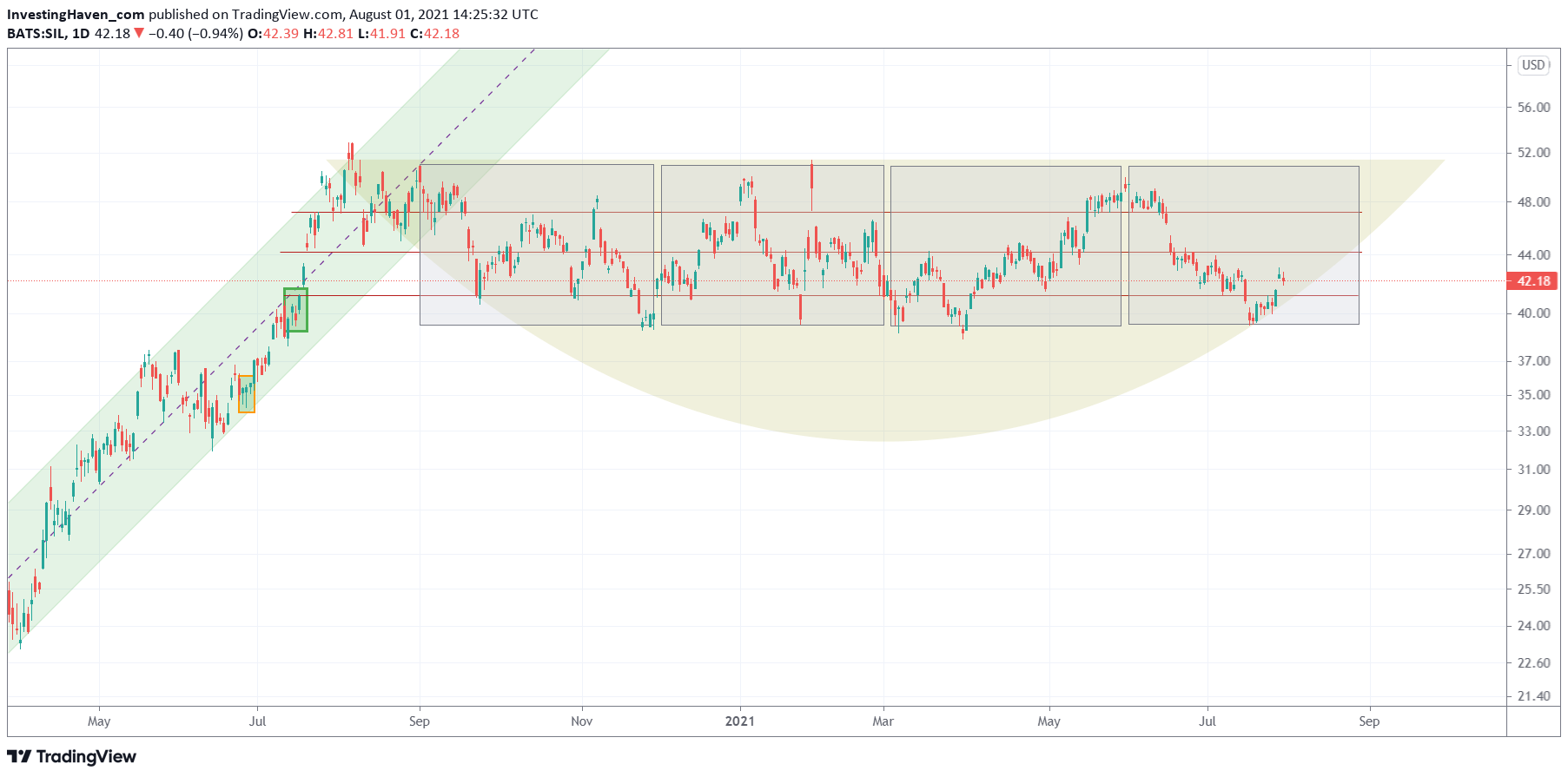

We’ll pick out one chart in this post: silver miners (SIL ETF).

The cycle counts (3 month cycles) are highlighted with the grey boxes: 4 x 3 months. We are entering the 3d month in the 4th cycle. Look how perfect this rounded bullish pattern did hold when silver miners had the last sell off day on July 17th. It’ so perfect, it’s so promising.

SIL ETF has almost 100% upside potential. Imagine what the top performing silver miners will do. Time to fasten (y)our seat belts.

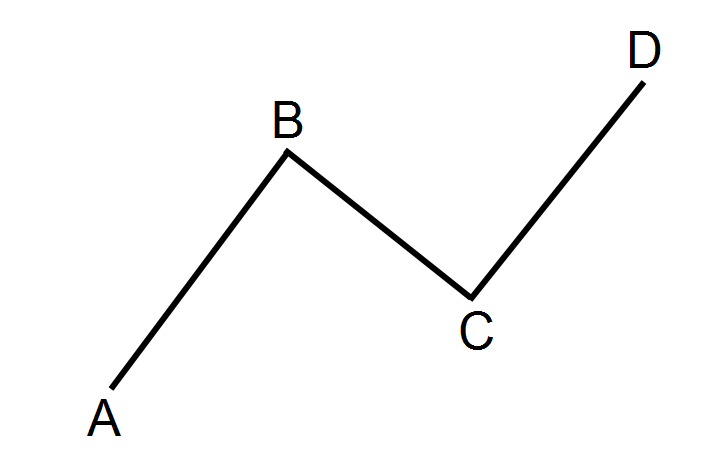

We are excited about silver’s prospects because of so many reasons, but probably the most important one is the swing structure. Below you can see this classic ABCD pattern. Silver printed an AB leg last year in May/June/July. Since August 6th, it is going through a ‘violent’ BC consolidation which is now about to complete (clearly it is a morphing into a bullish reversal). You can’t imagine how powerful the subsequent CD leg will be.

Silver is one of the few assets that is stuck in its BC leg post-Corona crash. That’s one of the reasons why we are so focused on silver. It gives us so much confidence.