The price of silver has been consolidating for nearly 2 years now in the 21-28 area (roughly). It has been a laggard compared to other commodities and a big part of that is due to the pressure from a strong US dollar. As we’ll see in this recent article, it looks like the US dollar might have peaked which should open the door for a Silver or Gold rally.

Silver investors, current or former, might be going through a rough time. Many will be frustrated, others will be disappointed. This typically leads to ‘revenge trades’ which in the current environment probably have failed even more!

As per our must-read article 7 Secrets of Successful Investing we identified successful investing secret #1 which is Emotions lead to bad decisions.

Investors should always stay rational, no matter how tough conditions may be. Focusing on the chart which by the way has 2 axes (time + price) brings peace of mind and comes with resolutions.

That said, if we focus on the silver price chart, we believe it’s clear that the focus should be on the sensitive price levels. We approach the silver chart with an open mind and keep our ego as well as opinions in check.

Silver Price: The Short, Medium and Long Term Chart

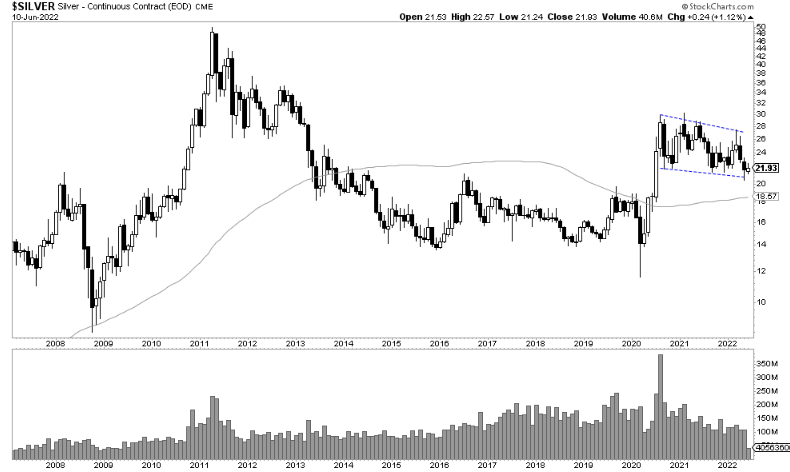

Silver’s monthly chart is very bullish. We have a very well defined, so far well respected Bull flag. Based on the monthly chart, the real breakout happens above $27. It is crucial that the support at $20 holds otherwise, the setup is invalidated.

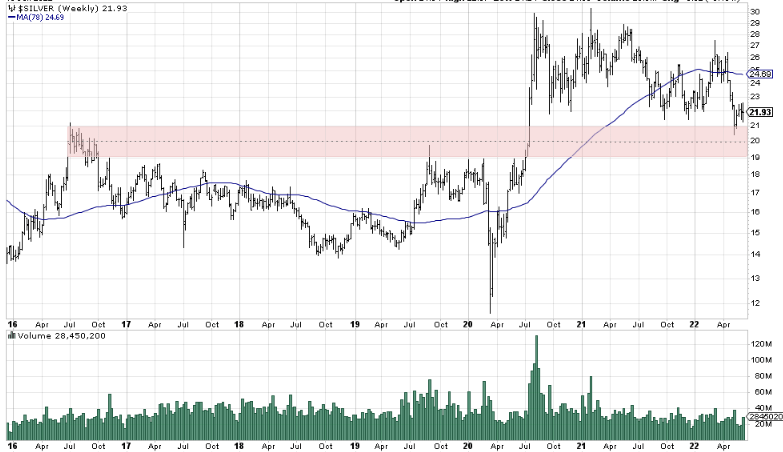

Silver’s weekly chart is constructive. We have a very strong support area and the $19 to $21 support has to hold. So far, the $22 to $22.5 area is acting as a strong resistance.

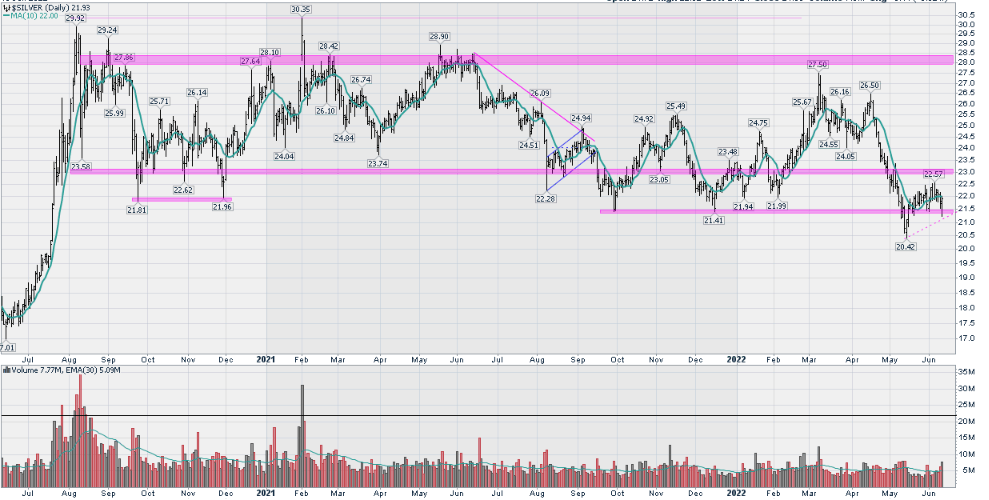

Silver’s daily chart shows how after a strong rally to $29.9 in August 2021, the price as been consolidating in a horizontal channel for almost 2 years now. “The longer the base, the higher in space” is exactly what comes to mind when we look at this chart.

There is however a reason to remain cautious in this chart below: The dotted trendline (2 touches so far, therefore not valid yet). That could turnout to be a double bottom with a higher high or a bear flag in the making. Should that bear flag materialize, we could see silver price trading at $19. That would be in line with the weekly support area highlighted above so no damage there to the bullish setup in Silver price.

If the price breaks below $19, that would invalidate the assessment above.

To conclude, Silver is clearly about to make a big move. Soon, we will either a strong bounce from these meaningful support levels it is currently trading at or a breakdown if those flags break down.

Written by hdcharting.