Investors with exposure to the silver market are anxiously asking us whether silver will ever move higher. Our answer is that we stick to our silver price forecast which says that the USD ultimately has to set a top, in the not too distant future. This will be the fuel for silver to move aggressively higher.

It is a tough ride for silver investors.

Admittedly, the price action in silver is disturbing because of the wild swings. Also, our USD forecast eventually will work out but not immediately. In other words, it is important to stomach the silver swings for longer until silver starts a trend.

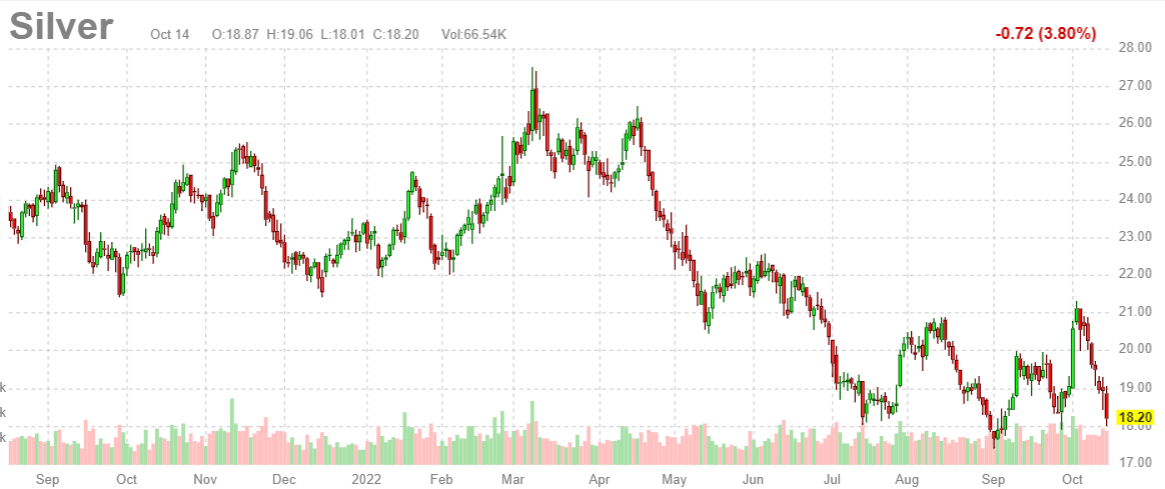

As seen on the most basic silver price chart, without our annotations, it is clear how silver is in a trendless state for 4 full months now. Up until this point, this is a violent consolidation.

Whenever it feels uncertain and whenever there is a consolidation, it is important to zoom out.

The big picture silver chart that helps us understand the big picture trend is the monthly silver chart, as seen below. The monthly chart, contrary to the daily, has a really bullish setup. It is the type of chart that makes us happy.

The monthly silver chart suggests that even a silver spot price of 16 USD/oz would not create any damage to silver’s long term profile.

We do acknowledge that we are bullish on silver for a while now and that our bullish sentiment did not translate in higher silver prices.

We also have to acknowledge that the market is not creating any trend since November of 2021. For one full year, markets are either in a downtrend or consolidating. Any uptrend in any market has been short-lived at best and violently sold worst case.

The reason for silver’s inability to move higher is the USD, simple as that. We do wait for the USD to find a top which, if and when it happens, will lit a fire in the silver market.

Sooner or later, our silver call will deliver. Between now and then, it is important to be patient and seize your silver position(s) to be able to mentally disconnect from your silver holding(s).