Most investors tend to believe that we are in a secular bull market in commodities. This is one of the fallacies that the market in 2022 created. It is certainly true that some commodities look good but the ‘commodities bull market’ perception was created between February 10th and March 6th. The commodities boom was an anomaly. Too much volatility in the rate of inflation is not good for commodities, contrary to the belief of many. Also, note that this inflation indicator was forecasting a lower inflation rate, about a month ago, it is confirmed now. This suggests a bifurcated commodities market. That’s why there is only a handful of commodities that look good, one of them is wheat.

On a macro level we have to flash a warning about the market in 2022, but more so commodities in 2022. While commodities tend to move in the opposite direction of the US Dollar, it was certainly a very different market in 2022.

Again, 2022 was an anomaly. Whatever happened in the period April 5th till July 7th was an anomaly and cannot be considered a market trend, on the contrary.

We explained this in great detail in 2022 Market Anomaly: Can Commodities And The US Dollar Rise (and Top) Concurrently?

That said, if we look at the commodities space we see a few candidates to survive and thrive.

No, it’s certainly NOT crude oil. We strongly recommend readers to check our Momentum Investing alert sent on June 12th to members of the research service: How To Know When The Inflation Monster Is Priced In? The turning points that were printed in the first half of 2022 are telling. The bull market in crude oil is over, is what these turning points are telling us.

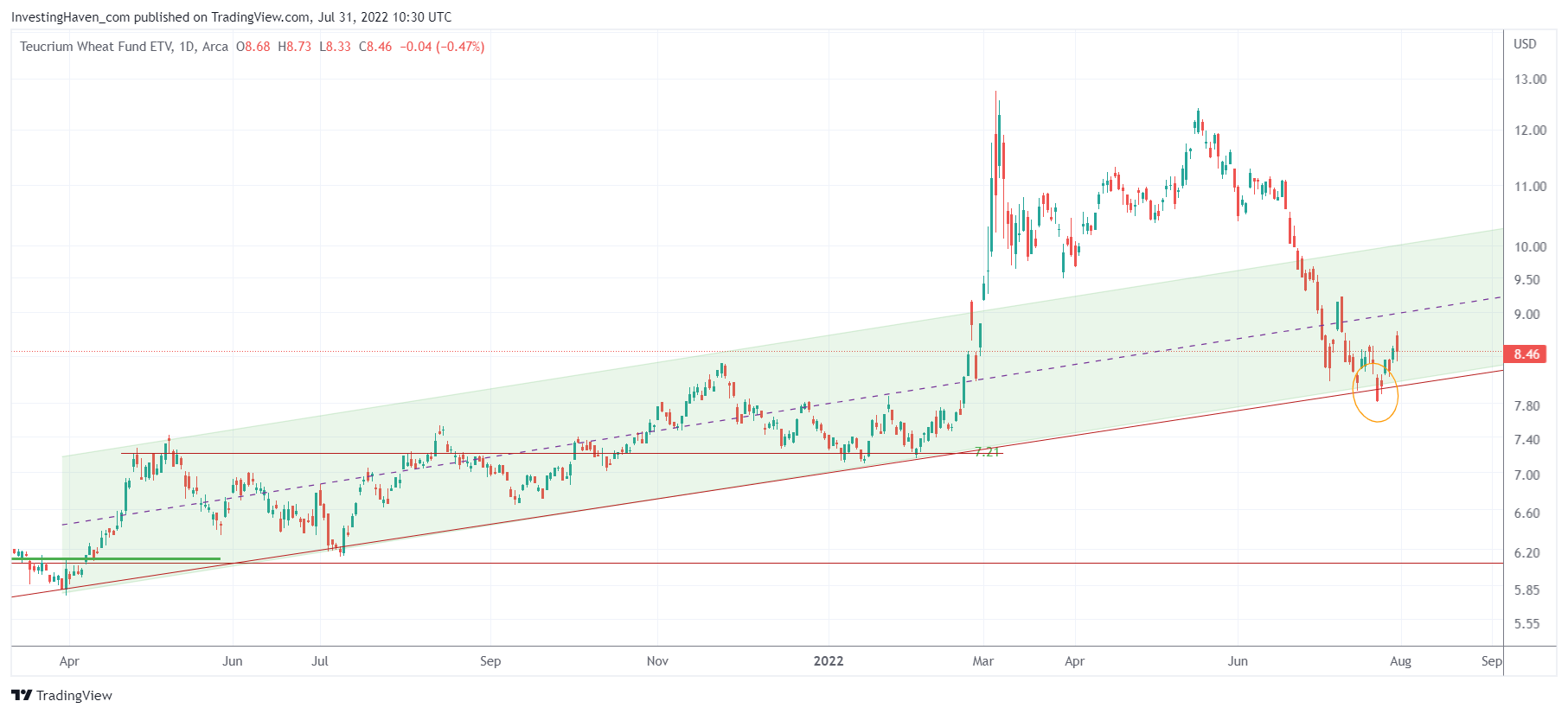

Wheat, unexpectedly, respected support.

In fact, wheat respected multi-year support.

It could not have been more clear, the long term chart of wheat is really juicy.

8 USD in WEAT, the Wheat ETF, was horizontal and rising support. It did hold, and it’s remarkable.

There are different ways to play wheat, the most obvious is holding an ETF like WEAT. Even a 2x leveraged ETF like LWEA or 3X ETF like 3WHL as valid candidates to play the wheat trend. We do not recommend playing stocks that have business activities in the wheat sector.

While we believe that the uptrend in wheat can continue, we are more convinced that a much stronger secular trend is about to resume. We describe this in great detail in today Momentum Investing alert, a must read for investors that want to capitalize on the biggest trend of this decade and that want the market to work for them (not the other way around).