Last week, we made the point, in a very factual and data-driven way, that gold’s leading indicator has among the most bullish readings in the last 10 years. This leading indicator turned even more bullish in the meantime. Gold is a must-have asset in any portfolio. What about gold stocks? We observe a bi-furcated gold stock market, with some gold stocks to avoid but a few that look very strong. This one gold stock has the strongest setup, in terms of risk/reward, and we believe it qualifies as a top gold stock to buy in October of 2023. This is why.

The gold stock market is bi-furcated: we see several gold stocks that sold off heavily, however there are some that have held up really well. Unfortunately, there is no red line in our findings. We could not find consistently stronger setups in groups like market cap (large caps vs. mid caps vs. small caps) or regions (Latin America vs. Northern America vs. Australia).

The only consistent observation was the chart structure, specifically relative strength as it relates to the 3-year consolidation structure.

Therefore, we will focus on the educational charting part in this public blog post.

Truth to be told, we could only find a few gold stocks that looked somehow better than the one featured in this article. In terms of risk/reward, this producing gold mine, in existence for many years, has the strongest setup.

Why? There are many reasons why we like this gold stock, and could comfortably recommend to buy this gold stock in October of 2023:

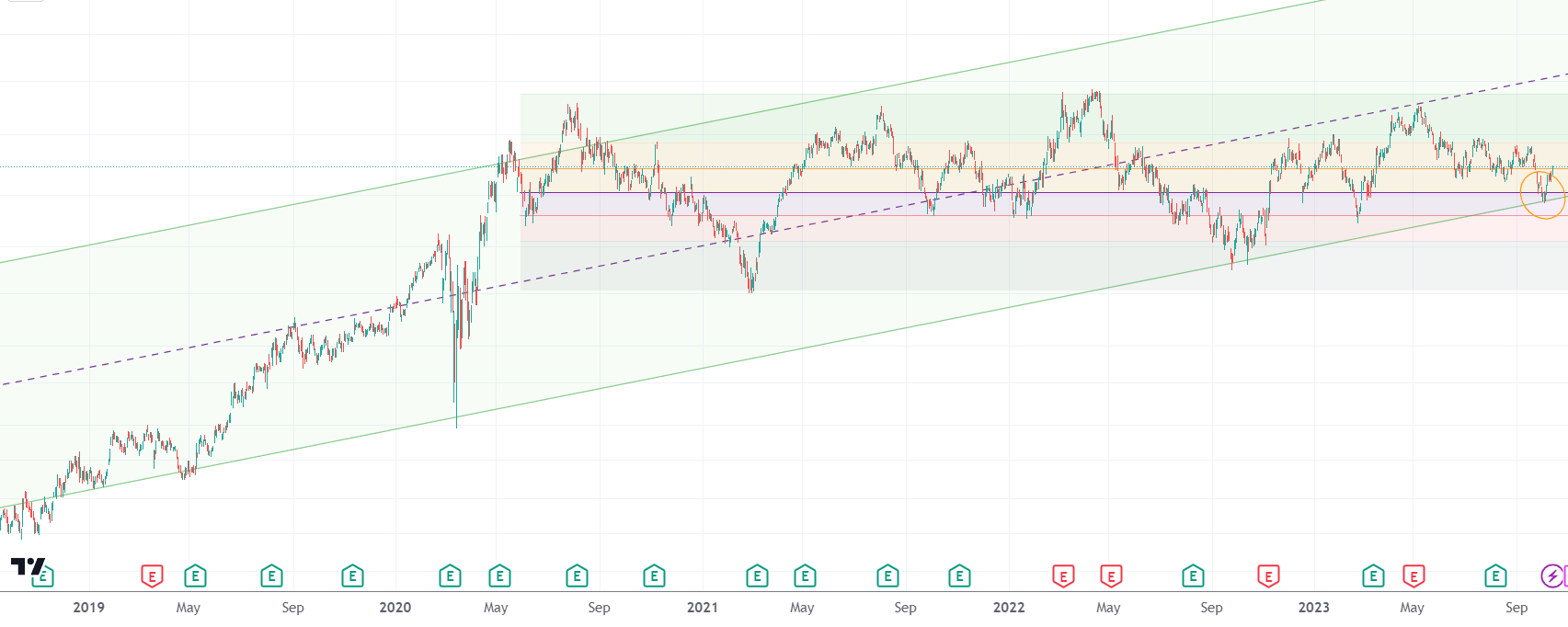

- A series of higher lows since summer of 2022, with a considerably higher low in October of 2023 against March of 2023.

- The recent drop, early October, touched two critical chart structures (a) the long-term rising channel (b) the 50% retracement level indicated by the fine purple line.

- Relative strength against other gold stocks.

Moreover, and equally important, financial ratios and metrics are really fine. This is a producer, it is generating revenue.

With bullish prospects of gold’s price, particularly one data point in gold’s CoT report which we mentioned to our premium members on Friday, we expect a strong rebound in both gold and silver prices. A safe bet, medium risk / high reward, is this gold stock shown below. We featured it on Friday, in the Momentum Investing piece Another ‘Crazy Friday’ For Silver – That’s Three In A Row (we featured one gold stock in that note). In today’s note, we will feature the entire selection of top gold stocks we like, also higher risk / higher reward ones.