It was really nasty in cryptocurrencies earlier this week. One week ago everything looked like an amazingly strong bullish setup, with a rather explosive outcome as a result. We documented all those charts in our monthly crypto charts update for premium crypto investing members. The small sell off on Thursday might not have been a big thing in historical terms (Bitcoin has seen moves of 20 to 40 pct per day in the past). However, there was some damage created which caused the rising trend to slow down.

We wrote last week: Last Chance To Get In On Some Top Coins.

While everything we wrote was correctly backed up by accurate charts it was Thursday September 3d, 2020 that decided to soften the ongoing uptrend.

Interestingly, 4 out of the 6 top coins we track in our shortlist did not have damage on their uptrends. Two others are in a so-so situation.

We have many dozens of top coins in our longlist, and they all broke down this week.

So in relative terms our selection of top coins is largely outperforming the rest of the crypto market!

That said, what we shared with our premium crypto members is a deep analysis with lots of charts on the damage that was created last week, and how lasting this might be. Our conclusion:

We are not too concerned at this point in time. In the bigger scheme of things crypto markets are very bullish. A slowdown was not in the cards until Wednesday, but we cannot deny the continuously growing relationship between broad markets and crypto markets. Let’s give crypto the time it needs.

We consider this to be a must-read crypto market update. After signing up to our crypto research you will have instant access to read this crypto update.

There is one more crucial conclusion we can share, to give a preview of the type of research and insights we share with our members:

We will get really concerned once BTC moves above 9163 USD for a few consecutive days. That’s when something much bigger will be underway. Very unlikely to happen, but we always need to know when exactly to push the red button and certainly when not.

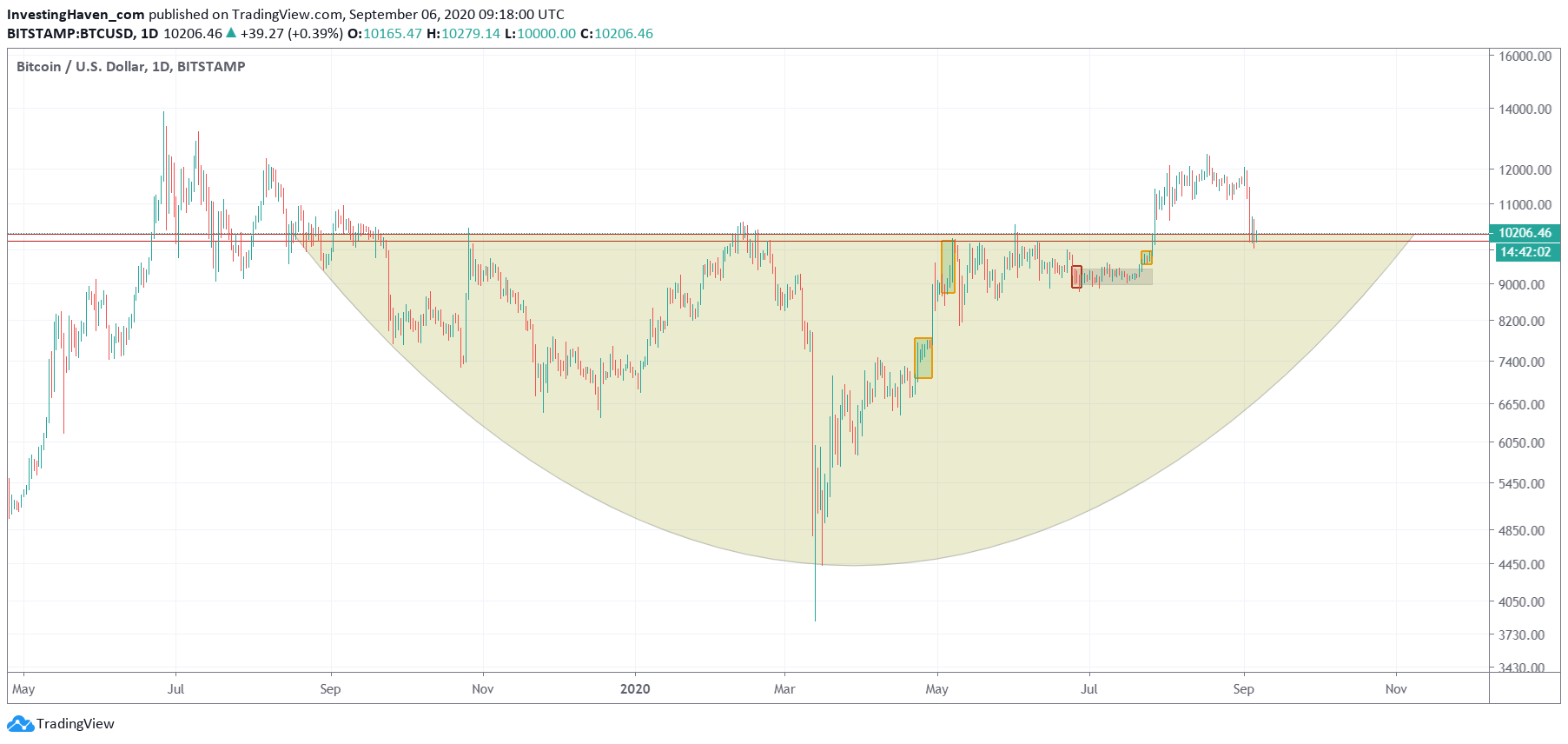

If we look at the 18 month Bitcoin chart (with our annotations) it becomes clear what the point is in crypto markets: this bull market is really different, and a giant reversal over 12 months shows the unusual complexity of the crypto market.

This chart also shows the inability of Bitcoin to say goodbye to its 12 month reversal.

Very, very unusual.

Not a market for starters, on the contrary.

Sudden, unexpected trend changes take place in a way we have never seen before in Bitcoin.

It requires a heavy effort with advanced charting skills to understand trends, and align on them.

The short answer to the question asked in the title of this post: another consolidation + a new reality, both is what we see since this week.

Yesterday evening, our premium crypto members received another update with detailed crypto investing insights and crypto charts which anyone can access instantly after signing up here >>