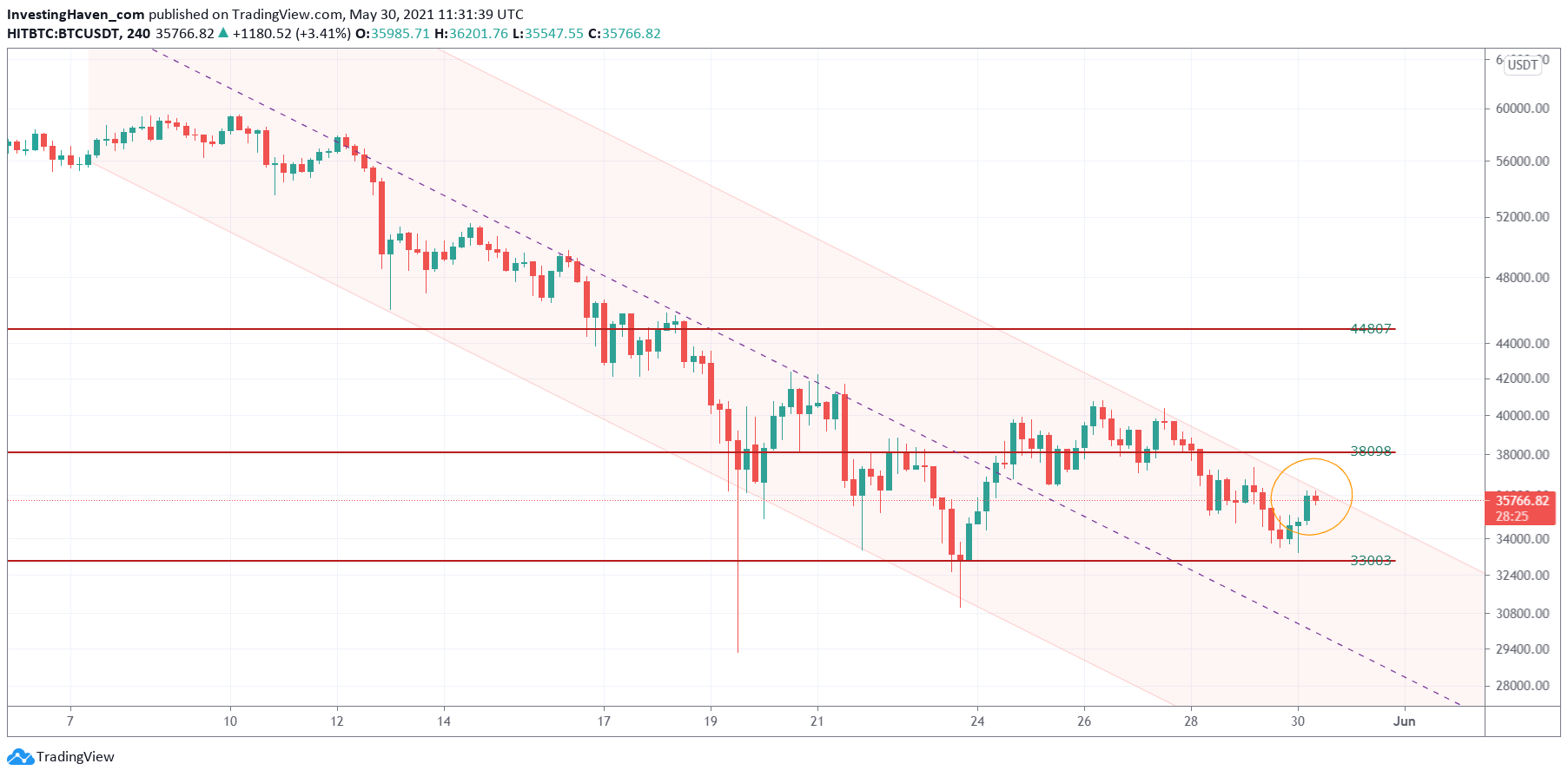

So far Bitcoin’s sell off. For 3 full weeks we got heavy selling pressure in Bitcoin. This dragged the entire crypto market down. In our premium crypto investing research we started getting defensive on BTC a while ago, and gave clear guidance to our members on critical levels that had to be respected. We mentioned that the failure of 47k to hold would open the door for (much) more selling, and it happened exactly as expected. Right now BTC is trapped between 33k and 44k, and it will be trapped until it decides to move below 33k.

One common mistake investors tend to make is to measure the % decline, and take it for granted that a wave of selling is over because a certain % got hit.

The truth is that whatever goes down, can continue to go down.

The only way to assess opportunity vs. risk is thorough chart analysis combined with cycle analysis.

In terms of the cycles this is what we observe:

- Bullish BTC cycle from October till December.

- A continuation of the bullish BTC cycle from January till March 2021.

- A bearish cycle from April till June of 2021.

Don’t be too fast initiating positions in a bearish cycle. While it might be that selling is over, for now, there is no guarantee that selling won’t continue in June.

The short to medium term BTC chart which is the ONE AND ONLY leading indicator for cryptocurrencies has this falling channel. We want to see a break above this channel to know that risk is fading. And only above 39k will be start getting excited.

For now it looks like the BTC chart says that 33k to 44k is the new sideways range. We don’t see BTC move above 44k for 3 consecutive days, and believe that the probability of it to fall below 33k should not be discounted.

Do you enjoy our crypto investing research work? Why don’t you become a premium crypto member? We send several crypto alerts per week with to-the-point crypto market analysis.