Our chart research shows that next week will be crucial for Bitcoin, and because of this for the entire crypto market. In case of a bullish outcome our Cryptocurrency Predictions for 2021 might get crushed. We aren’t there yet, and Bitcoin has presumably one last chance to prove that it is able to continue its bull market. This is what crypto enthusiasts should watch.

Last week we wrote Bitcoin’s Cup And Handle Points … HIGHER

Since then, something very interesting happened. This is what we wrote:

- The 72h cycles show a breakout in the cycle starting 03.13.

- The very long term chart says BTC is eager to move to 100k, if not higher (160k). It will only succeed if it stays above 60k for 3 consecutive days (open + closing prices), but preferably also 3 consecutive weeks (open + closing prices).

- The chart makes the point: the current rising trend is accelerating, and it is happening exactly in one of our 72h decision windows: the current 72h decision window has to confirm this ‘break up’.

Bitcoin decided to move lower, and our ultra-bullish thesis did invalidate … for now.

But did it invalidate for once and forever? Not yet!

Our research shows two things.

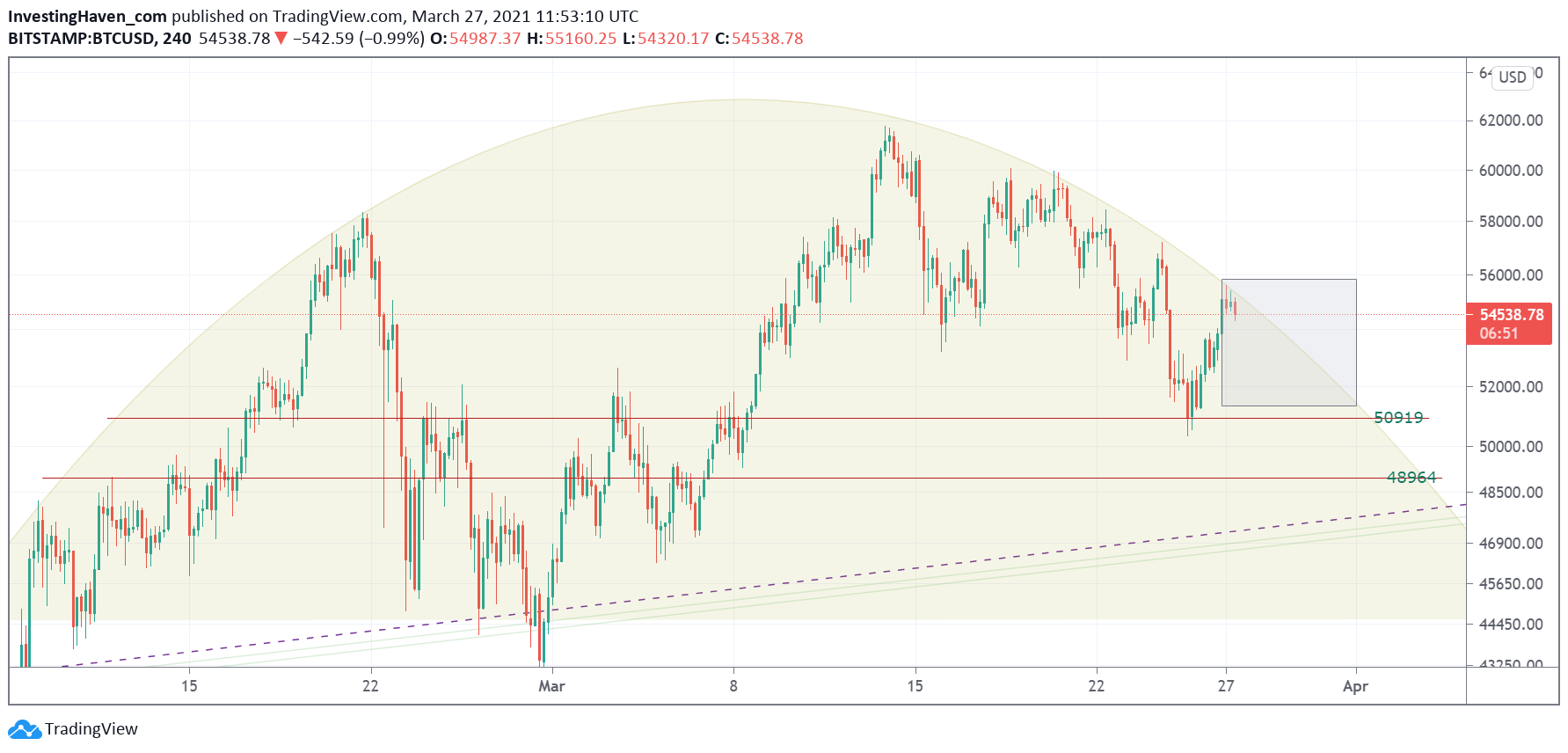

First, the ‘invalidation’ scenario which we outlined last week (see above, underlined) happened exactly at the same level as the breakout on 03.07. In other words, that price level now has an above average importance. The price level is 55,550 USD. Whatever happens going forward, 55.5k in BTC is one of those few crucial levels. We have to watch unusual price action like a large green candle (or price rejection) at 55.5k, the next week but also later in time.

Second, our refined BTC chart now has a decision window, and the decision window is particularly relevant early to mid next week.

From our crypto research to our premium members (only a snippet from the materials we share with members):

- The 46-48K level is THE most important level for a confirmation of a bearish breakdown, and that’s a short term concern with long term impact in case a breakdown takes place.

- The downside is now what we have to focus on: BTC wants to move (a bit) lower, it’s clear. It is entering an area with good support, but it’s a rather wide area: 45k to 51k.

- This short term support area 45-51k is not only important in the short term, but even more important for the long term. That’s because this red rounded pattern shown on the chart is a bearish topping pattern.

- Only if BTC succeeds in moving above it, and staying above it, will it invalidate a bearish scenario.

That’s also what we see on the chart. The potential topping pattern has to invalidate in order for the bullish scenario to play out. The grey window is the decision window: if BTC succeeds in moving ABOVE this rounded area it will mark a big moment.

The opposite is true as well: if BTC fails in moving higher, this rounded topping pattern might either morph into a flat pattern (which would be unusual for a hyper-volatile asset like BTC) OR it will mark a longer term top (a bearish cycle would start in April).

It will be a very important week for crypto markets, very important!

In the meantime please stay focused on price action as they relate to patterns. Reading crap crypto articles like these ones here is financial suicide, only designed to make you fearful.

We flashed several coin tips, and noted that all bullish crypto calls that follow are based on the assumption that Bitcoin will continue to be bullish. If so these coin tips will do amazingly well. If not …