Bitcoin is hitting resistance, short term. While a pullback is the most logic next step, it remains to be seen how deep Bitcoin will retrace. Our best guess is that it will be a regular pullback to create an even more bullish structure on the BTC chart. We remain firmly convinced about our prediction for an upward trajectory of Bitcoin and crypto, in 2023, despite short term pullbacks.

Even though we see a pullback coming, in BTC and other cryptocurrencies, we also remain focused on the big picture. We said so a few weeks ago as well: Bitcoin And Ethereum Preparing A Correction In A Secular Uptrend.

Talking about the secular uptrend, we decided to update the secular BTC chart. Members that are signed up to our premium crypto investing research service received this, along with many other charts, in our last update: “BTC currently sandwiched, what does it mean” (available in the restricted area).

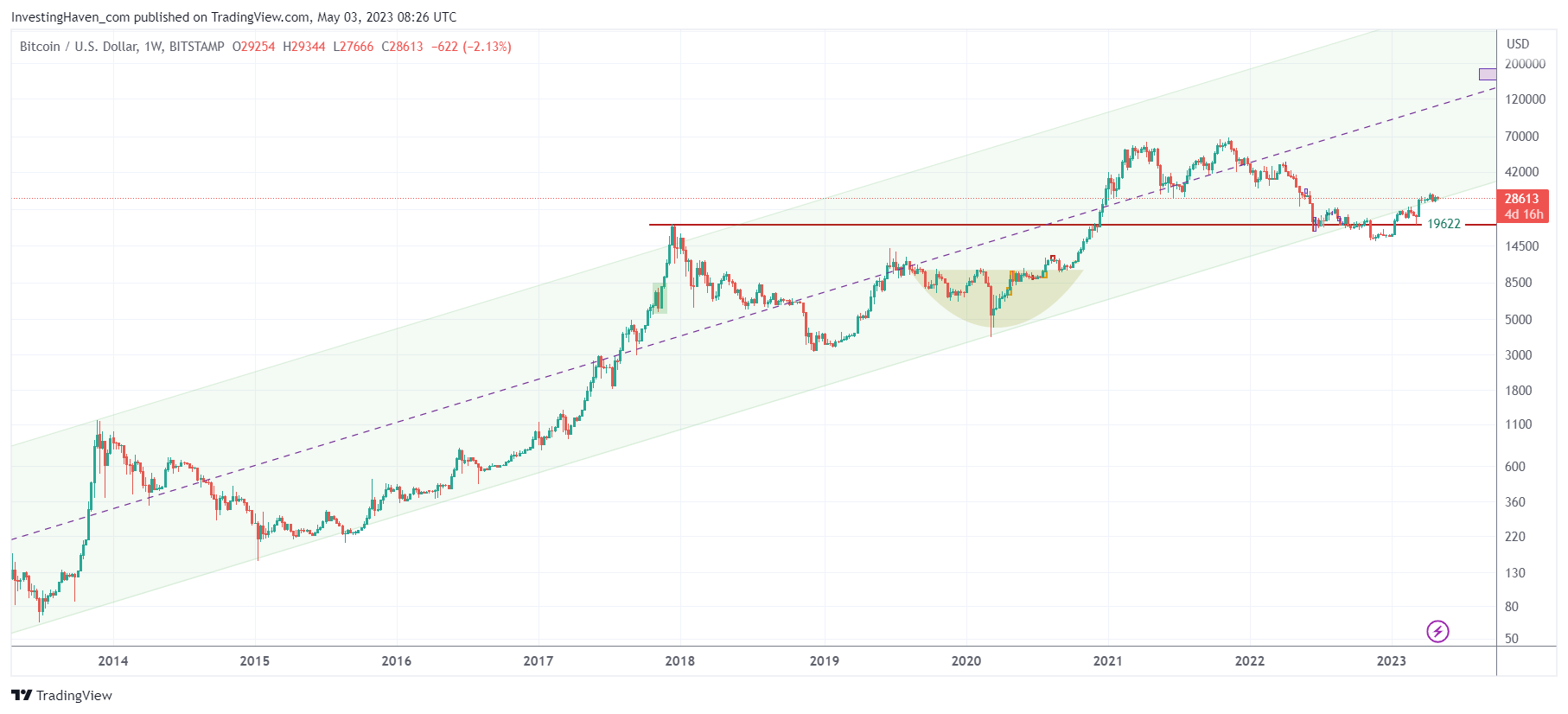

Below is the secular BTC chart, the weekly timeframe. This is just one quote from our premium crypto alert:

On the 10 year chart we observe an attempt of BTC to climb support of its channel. It is succeeding for now, it can fall below the channel for 3 to 5 consecutive weeks (it did so for 8 weeks back in Nov/Dec and recovered). Momentum in broad markets is fading which will prevent BTC to moving decisively higher, say to 40k, and be in the safe area when it comes to trending higher on its 10 year channel.

The short term timeframe give much more information, but there is the catch: ultimately, if BTC continues to trade within this long term channel, we can really see how our ultimate price target will be hit, the tiny purple box at the right top of the channel. That’s not in 2023, but we will be watching if the base is being created in 2023 for this ultimate target to be hit in the next 3 years.

Again, crypto investing will deliver insane results only when investing with a long term timeframe in mind. That’s the spirit of our premium crypto investing service.