Bitcoin’s recent sell-off was pretty violent. However, it also came with opportunities provided yesterday’s lows hold. Two things are crystal clear. First, the major rejection when BTC hit 43k. Not bad, but much more work is required for this market to turn bullish. Second, this crypto market is getting even more bi-furcated than ever before. It’s what we wrote in one of our 3 Cryptocurrency Predictions for 2022. It’s already happening.

This is what we wrote in our research note to premium crypto members this morning:

In other words, yesterday’s sell-off might be a process in which BTC dominance is decreasing in favor of some other coins that are (a) among the highest market cap coins (b) in the ETH ecosystem.

We continued:

Coin selection will be key, and more important than ever before. And while it is getting clear which coins will do well we cannot be 100% sure about all successful tokens in 2022. So we need data ‘on the go’ as 2022 progresses to find out the 2022 perls.

There are 3 incredibly important crypto charts which we featured in today’s research note to our premium members, easily accessible after signing up.

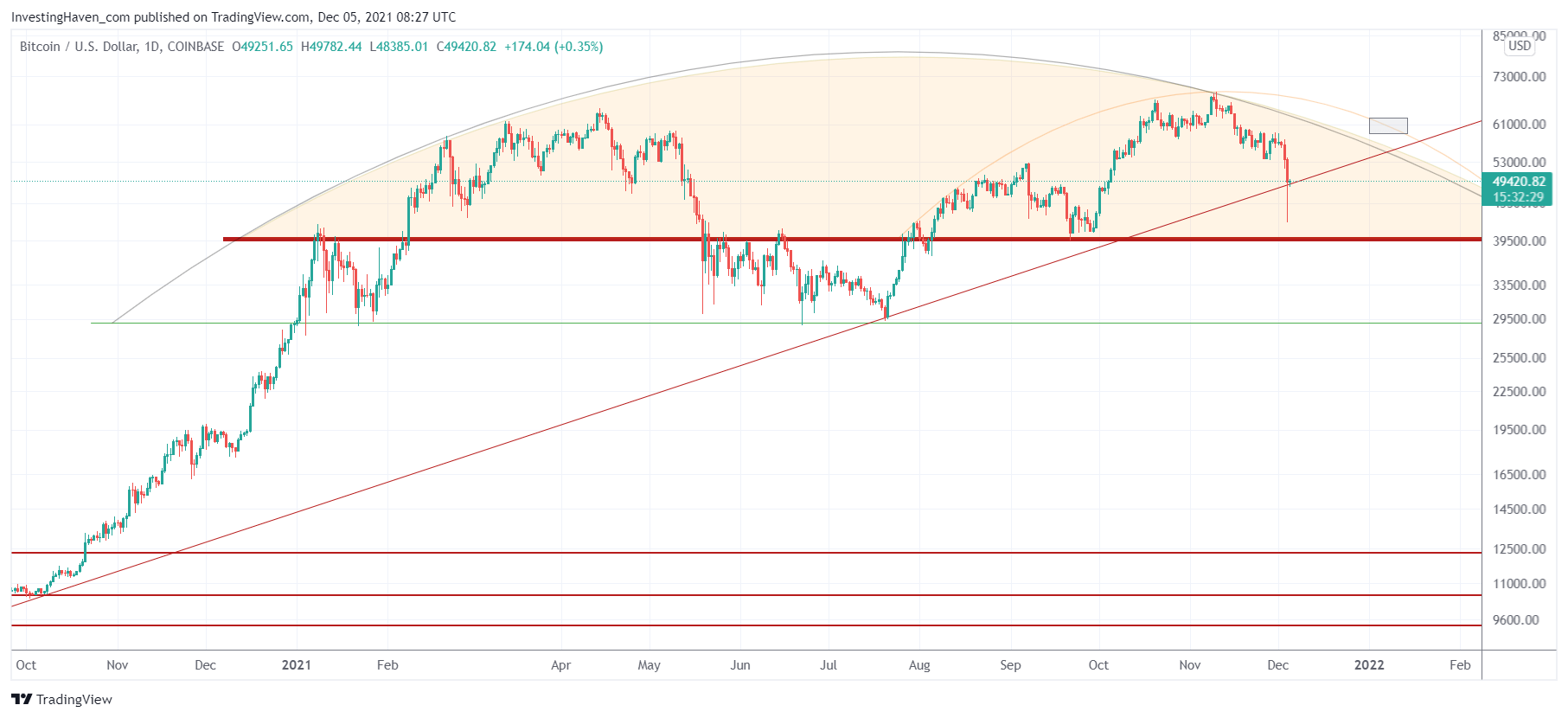

In the meantime, what we do see on the BTC daily chart is a giant topping pattern. This must be broken to the upside in order for BTC to continue its bull market. In essence, 2021 is characterized by one giant consolidation pattern. This may become a hugely bearish M-pattern OR a bullish W reversal.

The latter case requires a bullish ‘break up’ of this pattern, and based on our calculations January 6th might be when this could happen (see small grey box on below chart).

Our premium members get multiple updates per week which features many crypto charts. Also, with sell-off events like yesterday we flash special alerts, almost real-time analysis and charting, to ensure our members have a full understanding of the market, risks, opportunities, threats. More about our premium service >>