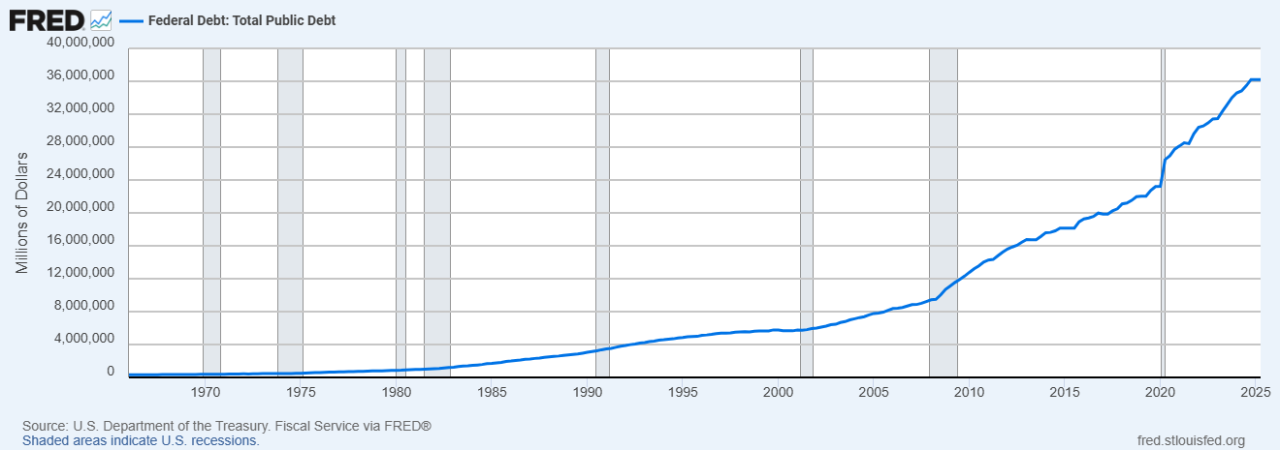

Rising government debt and funding pressure are reshaping global capital flows. Bitcoin and stablecoins are becoming popular alternatives as investors question the stability of traditional finance.

Governments are borrowing heavily, and repeated debt ceiling disputes are creating uncertainty in financial markets.

When confidence in public debt weakens, investors start looking for assets that hold value outside the traditional system. This shift is already visible.

Standard Chartered estimates that up to $1 trillion could move from emerging market bank deposits into stablecoins within three years. Bitcoin’s recent record highs also show how fiscal worries can lift interest in digital assets.

RELATED: How Shifting Debt Levels Are Driving Gold and Silver Prices

How Debt Pressure Shifts Capital To Crypto

Rising borrowing costs and large debt auctions make investors nervous about future inflation and currency value.

To protect their capital, some turn to Bitcoin as a store of value or to dollar stablecoins as a safer form of liquidity.

Institutional activity reinforces this trend. In early October, US Bitcoin ETFs attracted about $3.2B in inflows in a single week.

At the same time, emerging markets are seeing weaker portfolio inflows and heavier sovereign issuance, adding more strain to local banking systems and encouraging alternative savings options.

RECOMMENDED: What Will $1,000 in Bitcoin Be Worth in Five Years?

From Bank Deposits To ETFs

Stablecoins now make it easier to move money globally without relying on banks. Analysts expect the stablecoin market to reach about $2T by 2028 if this pace continues.

That growth comes with risks. Sudden regulatory changes or liquidity shortages could affect prices sharply, and crypto markets can still move with broader risk sentiment.

Even so, Bitcoin’s latest highs show how fast investor demand reacts when fiscal or monetary pressure builds.

RECOMMENDED: Former CFTC Chairman: Stablecoins Will Replace Failed Currencies

Conclusion

Debt stress is pushing investors to rethink where they keep their money. ETF inflows, stablecoin growth, and rising sovereign yields all point to one trend: when confidence in government debt wavers, digital assets increasingly become a place to park value.

The easiest way to buy Cryptocurrencies is through a trusted crypto exchange like Moonpay, Coinbase, or Uphold. These platforms allow users to purchase and trade crypto instantly from any device, including smartphones, tablets, and computers.

Buy Crypto NowCrypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)