Most crypto investors are impatient. They enter the crypto space, and want to be profitable immediately. That’s because the perception of crypto investing is one that has huge spikes. Crypto investors want to enter, and immediately hit these big pumps. However, more often than not, crypto investing is about waiting, eagerly waiting, sidelined with a big bag of cash, to enter at the right moment before pumps (not after). That’s what we continue to explain to premium members in our crypto investing research service, but it’s hard to be disciplined in the crypto space, as an investor, especially if as a newbie crypto investor.

One of our own favorite quotes that we often feature in our crypto investing research is this one:

We have to put these astonishing profits out of cryptocurrencies into perspective. And the big profits are realized in a few weeks.

It puts crypto investing in perspective.

The pumps that every crypto investor dreams of complete in a matter of weeks. In 2021 we saw most coins go up 3-fold in 2 to 3 weeks. Some 5-fold to 7-fold pumps took 3 to 6 weeks to complete.

It means that the real money making opportunities in crypto markets only occur the minority of the time. Talking about an extreme effect of the asymmetric success formula that characterizes financial market investing. Read more about this asymmetric effect in our 1/99 Investing Principles.

That said, at this very point in time, it is waiting that will make crypto investors more money than investing.

Let’s apply this principle to the current state of the crypto market. We take a few crypto charts from the detailed monthly update we published yesterday, and which is being shared with premium crypto members today.

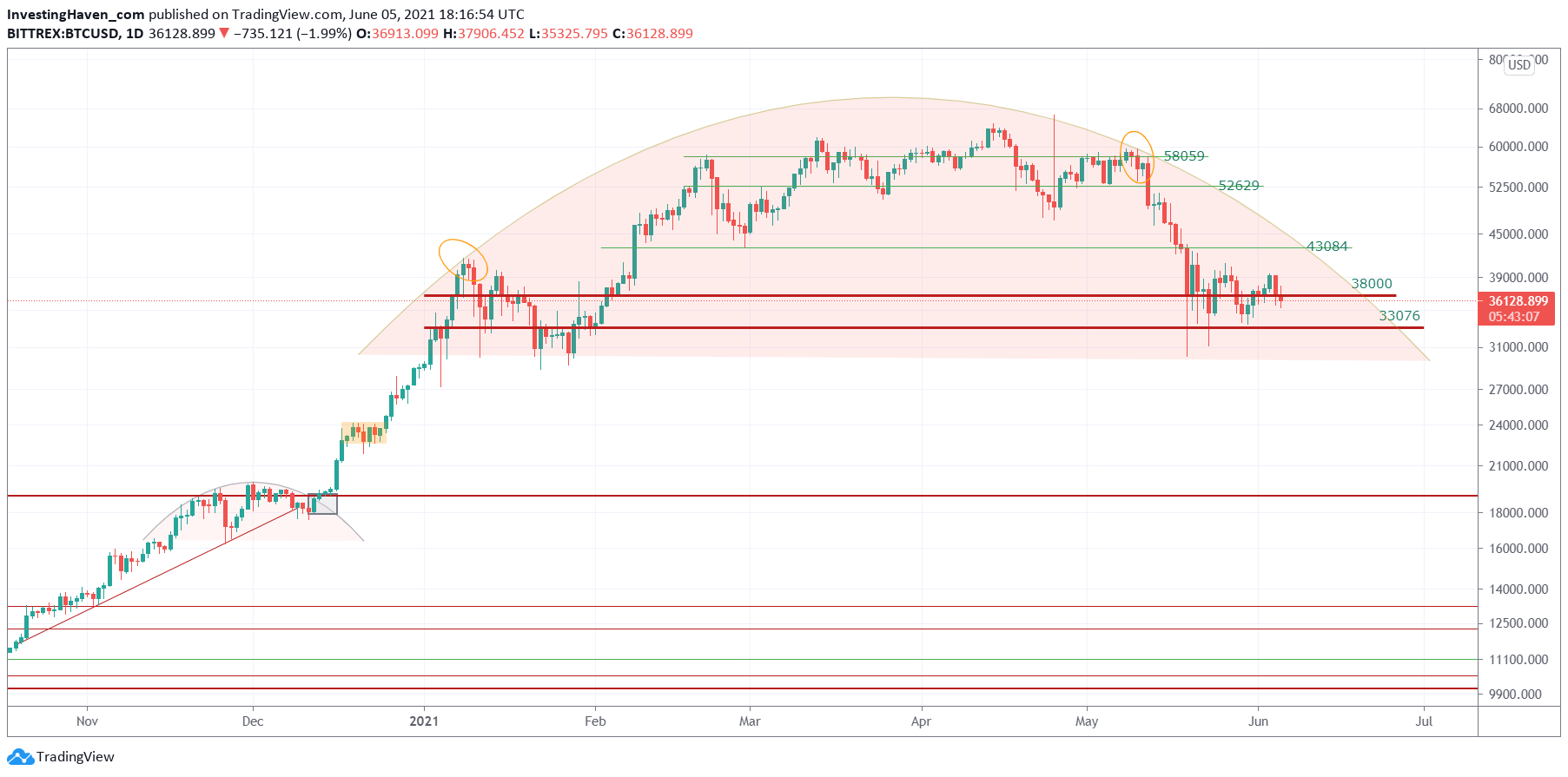

The longest timeframe of the BTC chart shows how BTC is now below its median line. BTC did not move below its median line since December of last year. This is telling, and it suggests there is more downside than upward pressure in crypto markets at the time of writing.

In other words by waiting you will be able to buy lower, at least that the highest probability outcome. This is not a forecast that prices will go lower, it is a probability based outcome that informs an investing decision.

The opposite is true as well: impatient crypto investors that want to (re-)enter at current levels might see prices move lower in which they case they will be forced to sell with a loss during a panic sell-off moment or they will miss the opportunity to buy lower. In both scenarios it is less profitable than waiting.

Source: crypto investing research service, published June 5th to premium crypto members.

The daily BTC chart suggests that the topping pattern will resolve in a few weeks. It also tells us that this formation is not the one that makes us FOMO’ed, on the contrary. Waiting seems the best option, especially because IF the 33k level is violated there is no support whatsoever until the lower 20ies.

Again, the highest probability is that investors will be able to buy lower. Yes, you can make money by being sidelined. It is all relative.

Source: crypto investing research service, published June 5th to premium crypto members.

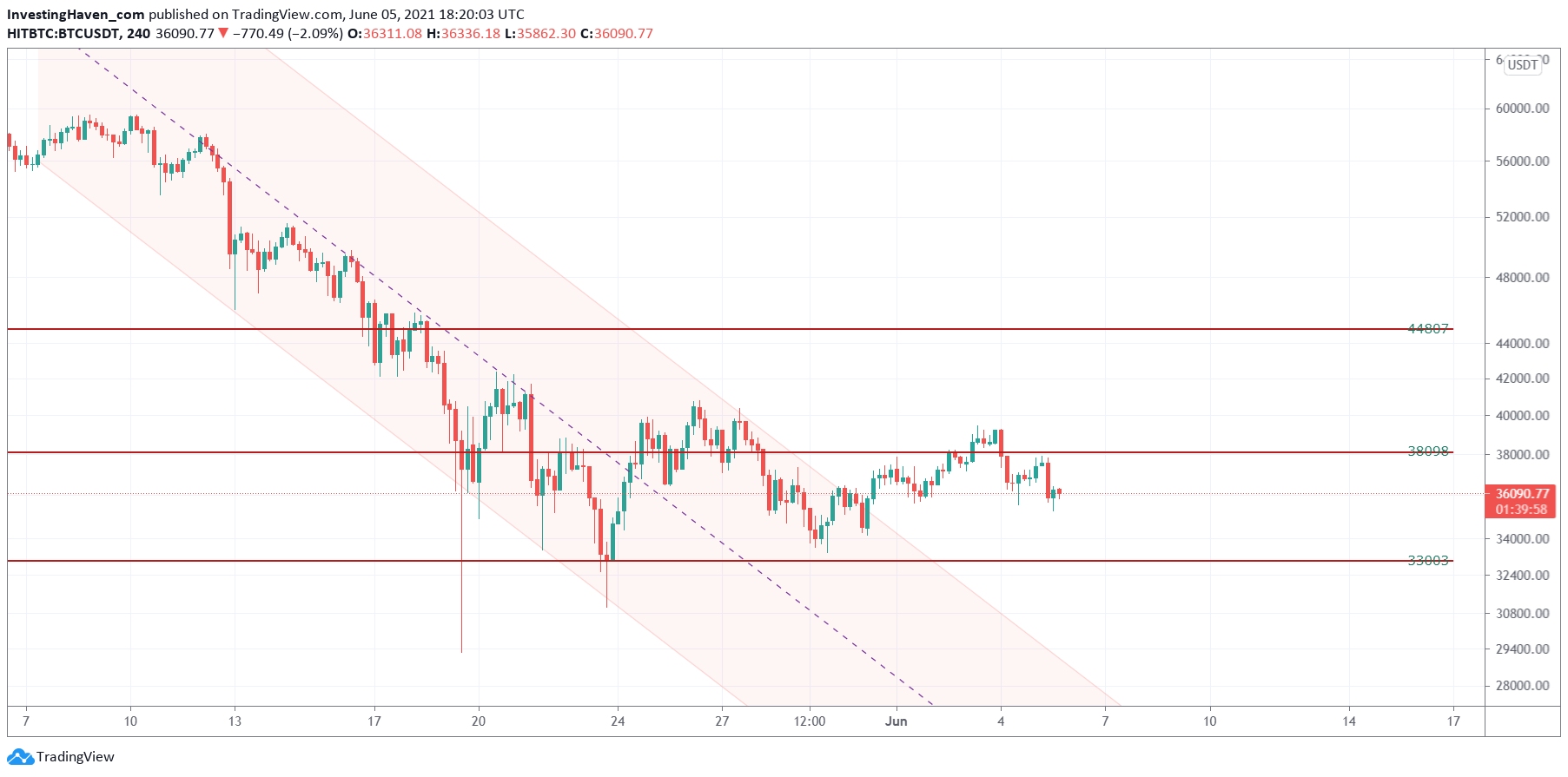

The shortest timeframe, the 4h chart, is now printing a consolidation. This may or may not hold. It may be the basis of the next trend higher. But there is much, much more work that this market requires before getting somehow excited.

Source: crypto investing research service, published June 5th to premium crypto members.

By comparing ‘doing nothing’ as an investor in crypto markets with ‘acting now’ it is clear that the highest probability to make money is being sidelined. Cash will offer you the opportunity to buy lower, presumably.