Ethereum’s resilience will be tested, and it will be happening in the next few days. The 20 month bull market is at stake. If Ethereum’s bull market trend gives it might be bad news or neutral. If anything, we keep on saying that our most important 2022 crypto forecast is a hyper bi-furcated market: while crypto momentum can be expected a few times in a year it will be a select few coins only that will go up significantly in 2022.

The daily Ethereum is getting pretty spectacular, in a way also scary.

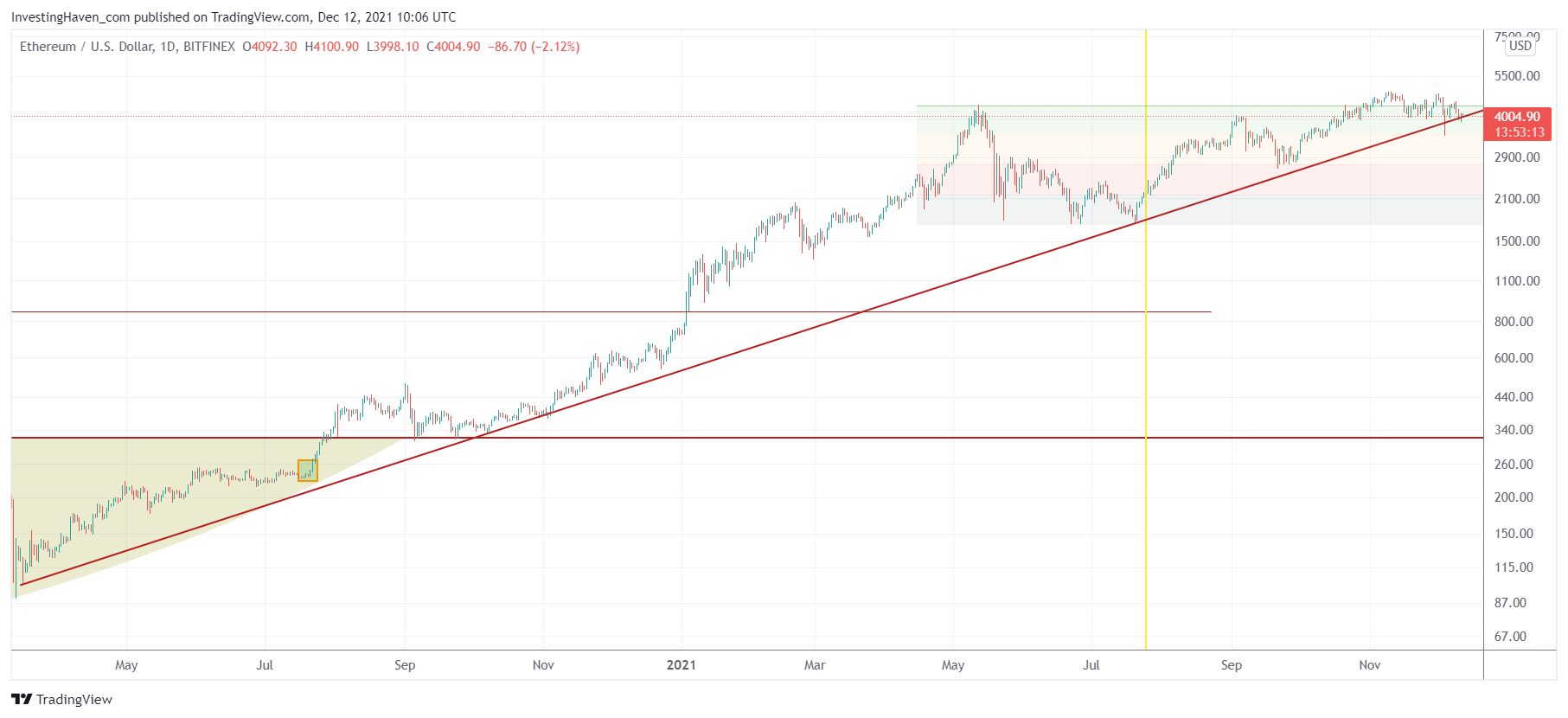

Below is the 20 month view on Ethereum with the starting point coinciding with the bull run that started right at the depth of the Corona crash.

The red rising line is the trendline that connects multiple touches since then. Every time Ethereum touched the trendline it was a great BUY opportunity.

Will this time be different?

What stands out is the hesitation we currently see, right at the May 2021 highs. While the current toppish looking is scary it is not confirmed.

Ethereum is at a decision point now, and it will have to admit strength or weakness. In case of a breakdown it might imply a flat period is about to start because we see some good support in the area till 2990 USD. On the other hand, a breakdown will make Ethereum really vulnerable.

Can we expect an outright crash? Probably not immediately, but continued weakness might lead to bigger selling.

For now, full focus on the 3900-4000 area. It has to hold in order for ETH to have a constructive 2022.

In our crypto research service we announced an accelerated rollout of our automated crypto trading. Moreover, the market is making it really clear that our service should be centered around finding the unicorns in 2022.