The crypto market is beaten down. Many investors, particularly retail investors, have given up. That is what we read in the reports of crypto exchanges. Frankly, this is great for those investors who still believe in crypto. Less participants in a market (any market) implies less tension, which implies more upside potential, especially in a market that shows a long term bottoming formation. We remind readers that 2022 will be a year of hyper bi-furcation as per our 2022 crypto predictions so crypto investors have to look for relative strength as well as unicorns in intra-market trends.

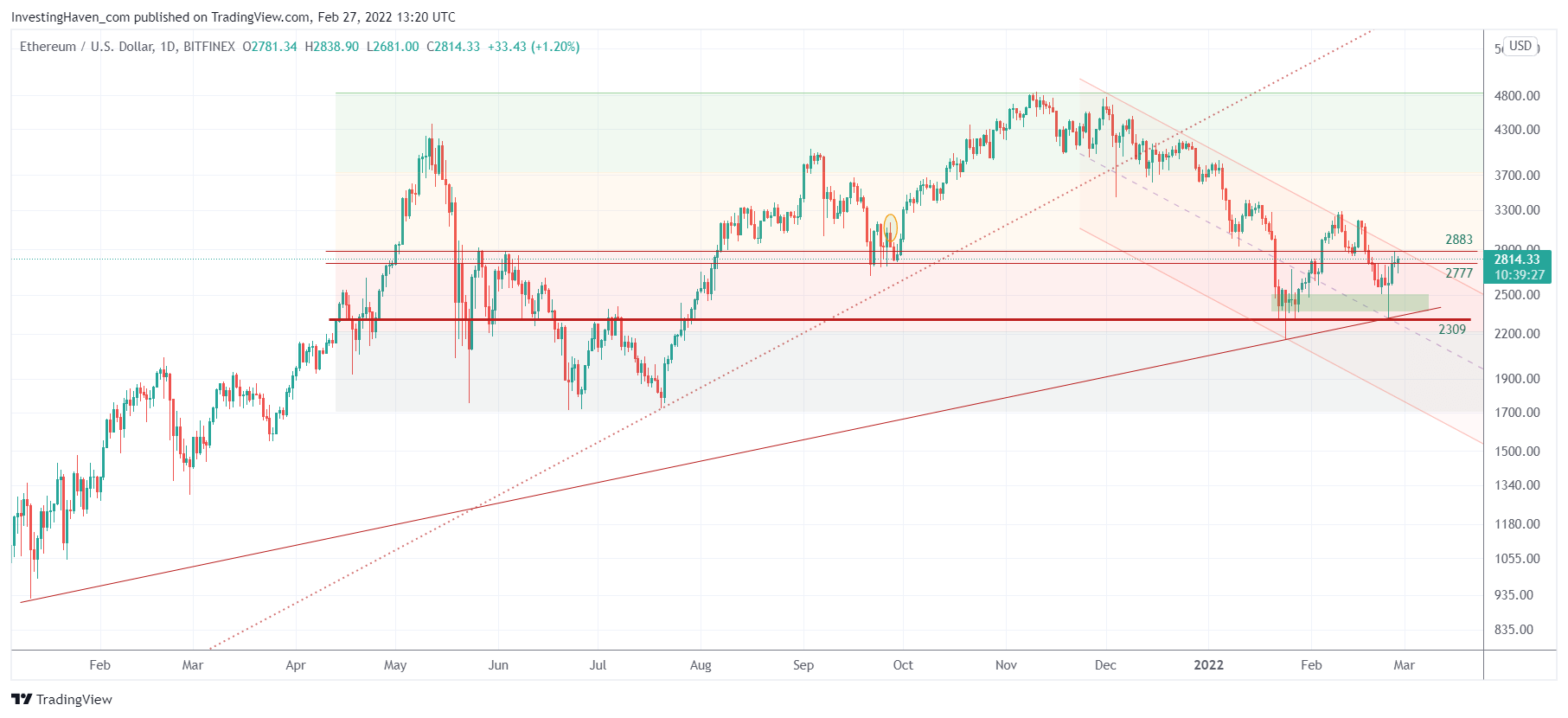

Last week, we wrote that an Ethereum reversal is underway. We also mentioned very clear pointers to understand whether it would become a bullish vs. a bearish reversal:

A double bottom on the ETH chart (support at 2300) and the ETHBTC chart (0.065) would confirm a strongly bullish reversal. If support breaks, we can reasonably expect a bearish reversal. We will know in about 2 weeks from now!

Today, one week later, we observe a nice rejection on the Ethereum (ETH) chart right at the 2300 USD level. It happened on the day of the Russian invasion into Ukraine.

Our time line assessment as per the above quote “we will know in about 2 weeks” is probably going to be spot-on. This coming week is going to be decisive, and we need a successful retest of last week’s lows, ideally a structurally higher low.

It is clear that a successful retest of 2300 would result in a bullish reversal pattern. It would be an interesting price point to consider adding to positions, but only after the triple sell-off confirmation within the typical 72h time window (all these concepts are explained in our crypto investing research).

In our crypto investing research we flashed what we called ‘sell-off guidance’: very accurate readings to ‘buy the dip’ in a risk managed way. As per below Ethereum chart, the green shaded area was a perfect ‘buy the dip’ area, is what we wrote 48h before the sell-off took place.

Whether retail investors have been buying the dip or institutions is unclear to us. According to the WSJ there is a strong interest by institutions in crypto investing.

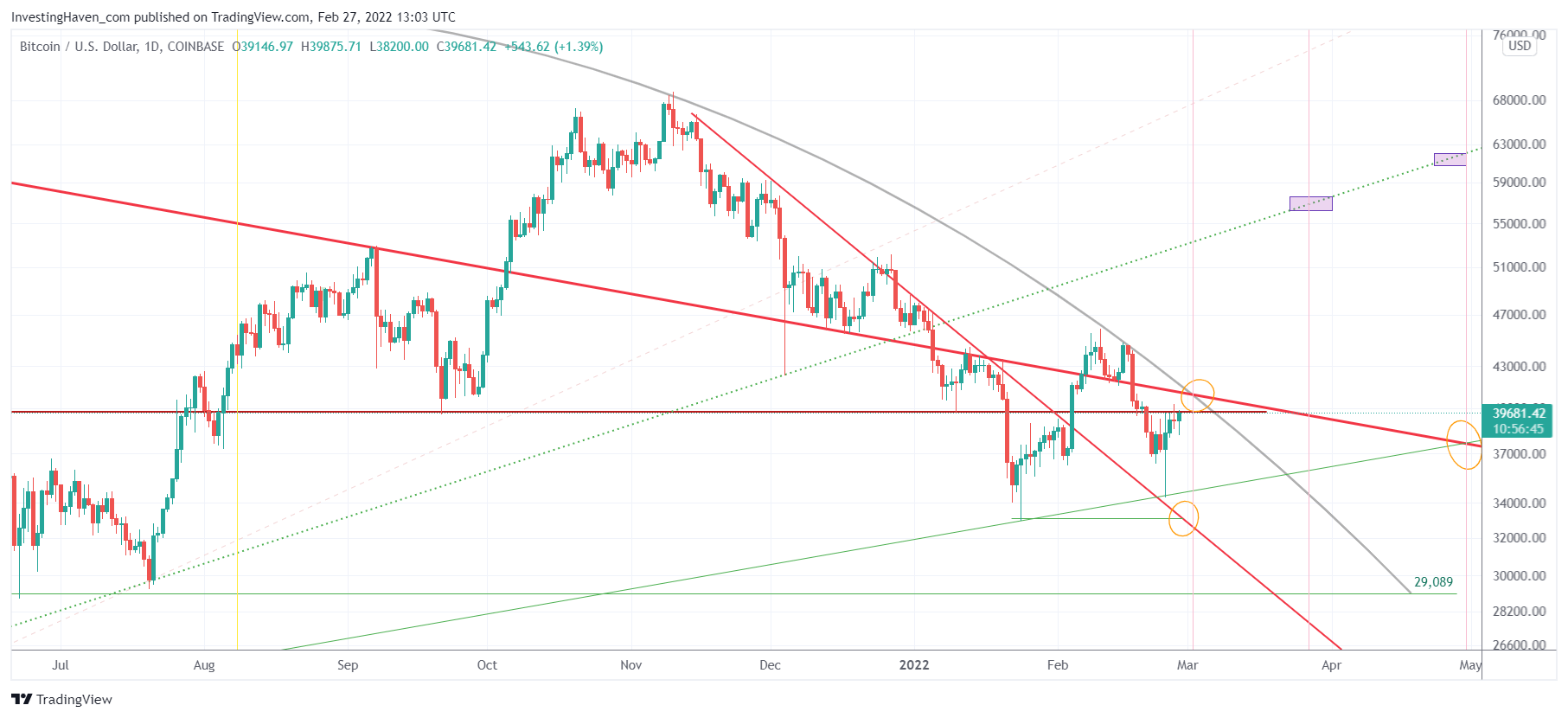

In the meantime we see that Bitcoin (BTC) is very close to testing a 14 month rounded pattern on its chart. What this really means is that once BTC clears 41.5k, on a 3 day closing basis, that we can consider it a ‘breakout.’

In the meantime we see that Bitcoin (BTC) is very close to testing a 14 month rounded pattern on its chart. What this really means is that once BTC clears 41.5k, on a 3 day closing basis, that we can consider it a ‘breakout.’

BTC will only break out if broad markets will start a recovery from here. We do agree with the findings of Forbes that crypto is, in the end, a play on tech stocks. That’s because of the strong correlation between BTC and the Nasdaq. We would re-phrase it in this way: “crypto is a leveraged play on tech stocks, and being able to successfully identify the ‘unicorns’ in crypto land is going to be an extremely rewarding activity, particularly in 2022.”

In our premium crypto service we did flash ‘buy the dip’ guidance. Moreover, we are about to share on Sunday evening our top altcoin selection to consider when BTC breaks out.

This article originally appeared on InvestingHaven.com: Ethereum’s Decisive Week Is Here.