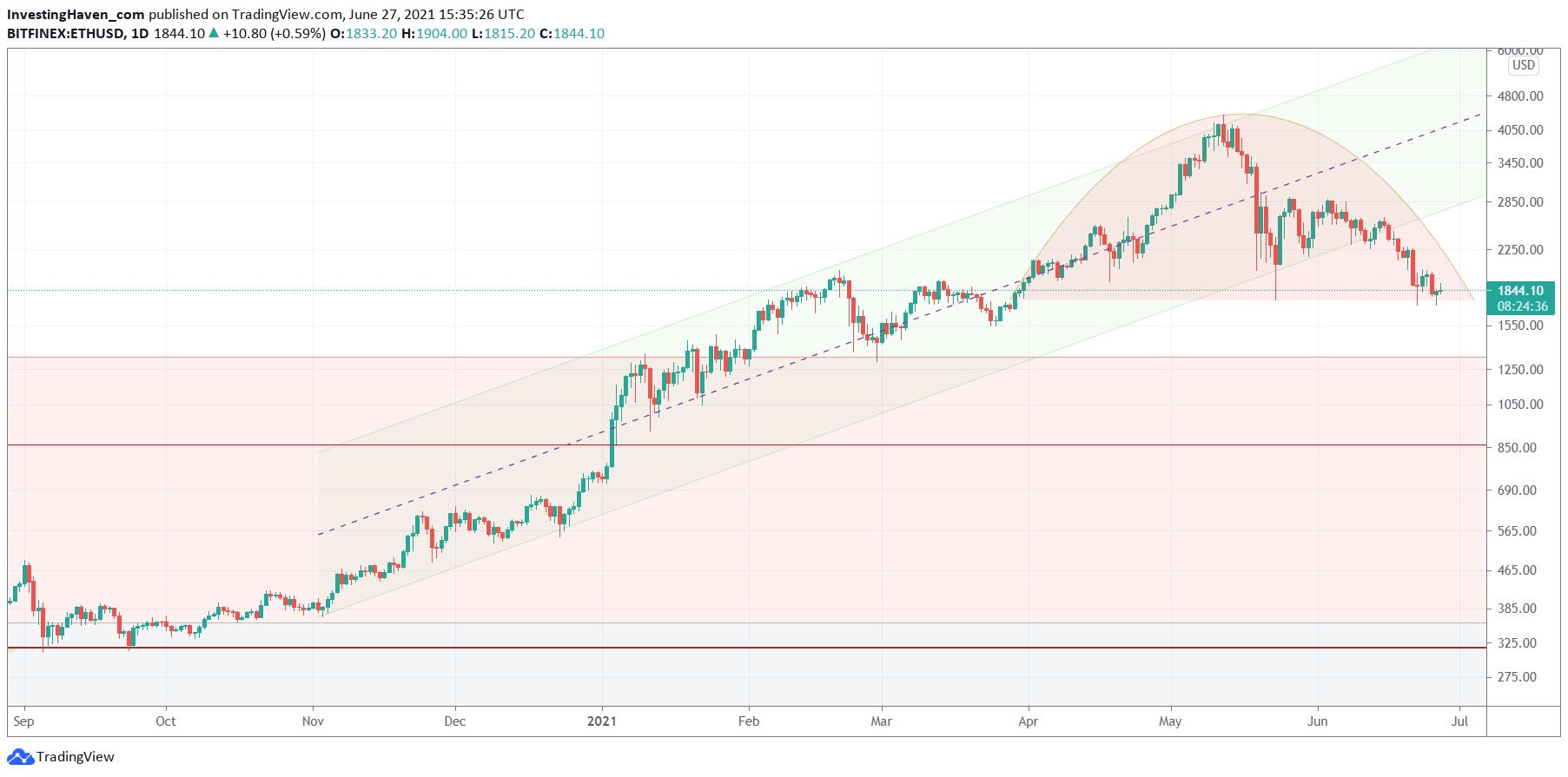

It is about to happen: a big make or break moment in Ethereum. When we say big, we mean big. Ethereum can move (strongly) up in the 2nd part of this year, or it will move (strongly) down. Interestingly, at this very point in time, it is a coin toss, literally. We are not even going to try to forecast any direction, at this point in time, certainly not after all our successful crypto 2021 forecasts and the massive successes we helped our crypto members realize in 2021. There are simply times in which it is not clear which direction a market will go, and no-action is the best action in those situations.

This is what we wrote exactly 10 days ago in Ethereum: Better Be Extremely Careful Here, and it was really spot-on and still highly relevant:

Ethereum is now below its 6 month rising trend channel, and is moving in a topping pattern, one that started in April and peaked right before the crash on May 18th, 2021.

You don’t need a PhD to understand that the current topping pattern is about to conclude at the end of this month. No coincidence, July 1st is when a new 3 month cycle starts in crypto markets, as per our cycle count.

Whatever happens in crypto markets and on Ethereum’s chart in the coming 2 weeks will be telling. One thing is clear though: this chart turned bearish, and will be bearish until proven otherwise.

We identified 1750 USD as a make or break level, and interestingly the rounded pattern is now nearly complete. More interestingly, Ethereum’s price fell to right above this 1750 USD level.

As said before, crypto investors will either be able to pick up Ethereum between 1000 and 1400 USD (most bearish target between 800 and 900 USD, not saying it’s a prediction just saying it’s a bearish target in case of a breakdown) OR Ethereum will rebound strongly from current levels.

What to do now?

Wait.

Do nothing.

And that’s hard, it’s very hard, for most investors. This is how most investors tend to operate:

- Thinking “not sure which direction this will go.”

- Acting “I’ll go look for information on the web, like crypto finance sites and Twitter.”

- Concluding “trying to come to a conclusion from all I read, I believe the market will go this or that direction.”

- Hoping that the market continues in that way, but needless to say a knee jerk selling reaction can come once it’s clear that the market decided to go the other way.

That’s how it mostly goes, not always, simply because (a) the wrong sources of information are used (b) investors cannot wait for direction confirmation (c) investors don’t realize that no position is also a position.

Over here, at InvestingHaven, running the first crypto investing service in the world, we have learnt that there are bullish momentum periods in which we go all in, bearish momentum periods in which we stay sidelined and do other things in life, and respect decision windows in which we are ultra-sharp but don’t take action. Today we find ourselves is a period of inaction, and it might resolve any moment from now. So yes, we are very sharp now!

Our premium crypto members will be the first ones to know when the crypto market turns bullish again. Between now and then we will ‘coach’ our premium crypto members in becoming better investors by ‘training’ them on discipline by being patient. At the same time we have one leading crypto chart that will set the direction of crypto markets, and we featured this every week since May. It’s this one chart with this one pattern that will determine whether it’s a good idea to initiate a new position or stay sidelined. You too can join us to receive our detailed crypto analysis.