In our attempt to understand the different ways to invest in NFTs, now and in the future, we gave up. It is so confusing, there are so many options and so many opinions. As we run the first blockchain investing research service in the world with a large following we decided to solve the question “how to invest in NFTs” in a different way.

This is what we did: we opened a Telegram group, exclusive to members of our premium crypto investing service, we announced it in one of our mid-week crypto alerts, and saw more than 200 members sign up in the first week.

The group conversations revealed the depth and breadth of NFT investing. After a few weeks it became clear that we can find 12 distinct ways to invest in NFTs in 2022 and beyond.

NFT Investing: from hype to reality

In the first week of March of 2021 there was so much hype around NFT. Suddenly, the entire world was talking about NFT investing. Prices of everything NFT related went through the roof.

Bloomberg, among many other financial media outlets, explained that NFT investing was for real. Interestingly, since then, they hardly provided any coverage.

That’s how it goes: the herd is interested when media makes an investment ‘hot’. Over here at InvestingHaven we research until we find the right entry point for an investment particularly when ‘nobody is paying attention’. That’s how we accumulated profits over time, big profits.

Among the few articles that appeared since then on Bloomberg is this one featuring one of the NFT collectors.

The most popular way to invest in NFTs

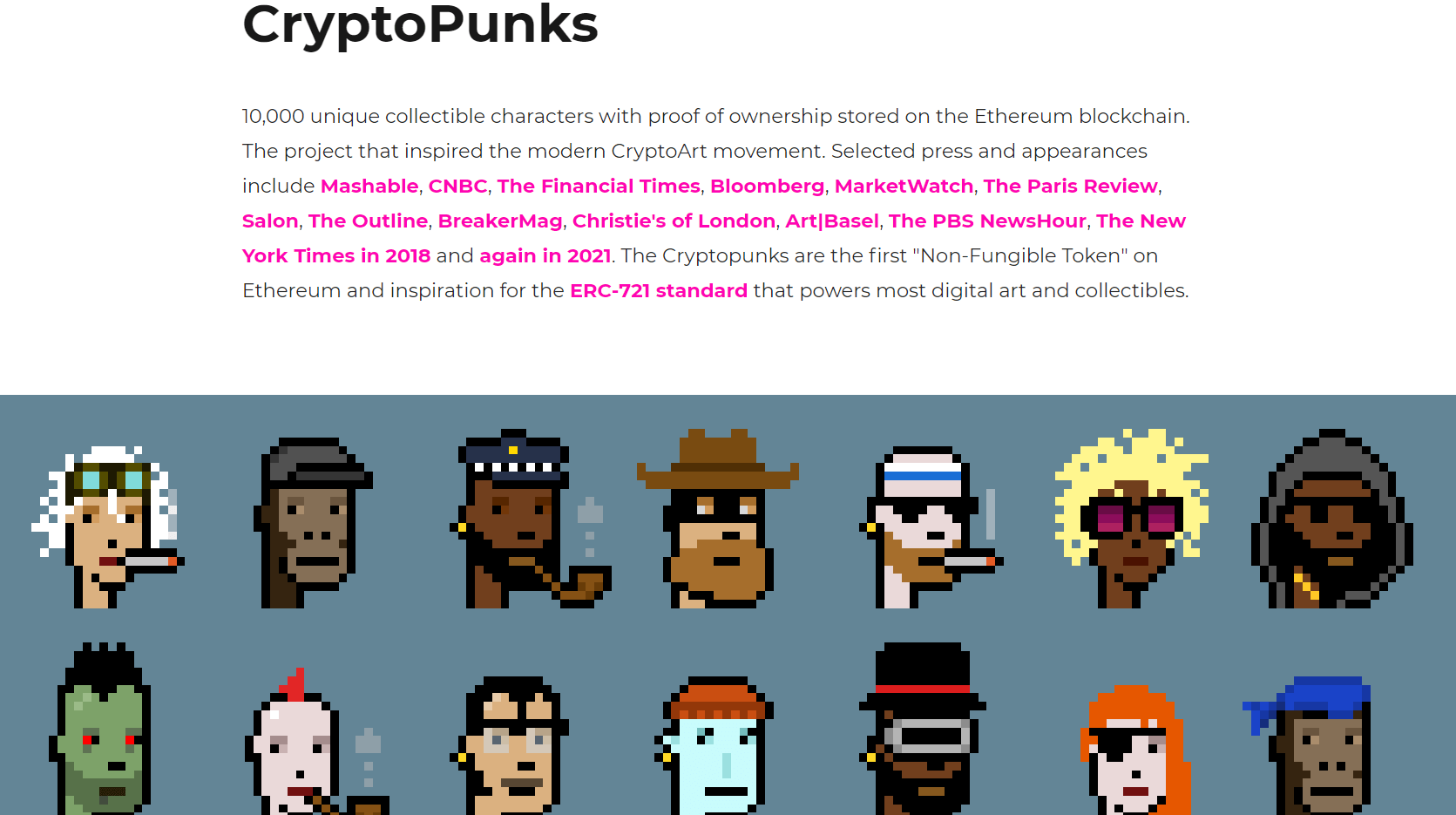

One of the most popular ways to invest in NFTs in buying cryptopunks. This requires to pay in Ethereum, and there are 2 components that determine value of these cryptopunks: the price of Ethereum and demand for cryptopunks. Needless to say, there are dynamics in this market that drive the price (also demand) of cryptopunks.

We are not going to expand on what NFTs are. We’ll simply copy what already was written before (source):

NFT stands for non-fungible token. In economics, a fungible asset is something with units that can be readily interchanged – like money. With money, you can swap a £10 note for two £5 notes and it will have the same value.

However, if something is non-fungible, this is impossible – it means it has unique properties so it cannot be interchanged with something else. It could be a house, or a painting such as the Mona Lisa, which is one of a kind. You can take a photo of the painting or buy a print but there will only ever be the one original painting.

NFTs are “one-of-a-kind” assets in the digital world that can be bought and sold like any other piece of property, but they have no tangible form of their own. The digital tokens can be thought of as certificates of ownership for virtual or physical assets.

Without further ado we want to present our readers with this short overview of the 12 ways they can invest in NFTs. Note that much more detail is available in our research area (NFT investing in the restricted research area).

12 ways to invest in NFTs in 2022 and beyond

- NFT Collectibles: investing in NFT collectibles like CryptoPunks (also fine-art), BoredApe Yacht Club, and many others. This is very popular, comes with risks but also has best practices.

- NFT Fine-art pieces: think of Sold on SuperRare as the most popular platform. It is crucial to pick the right artist, while many artists should be avoided.

- NFT Gaming: Punkscomic launched a comic which you can keep or burn the NFT for currency which will entitle you to stake in the IP of the comic book world they are building. Picking the right time horizon is crucial.

- Sports-centric NFTs: among the platforms we identified it looks like Zed Run is the most popular.

- NFT Funds: our NFT fund suggestions include Piedao, Metaverse Index, FTX, The Whale Token, Flamingo DAO.

- NFT/social token: Pak e.g. Sotheby. You can now burn his art for $ASH tokens which can be used for buy exclusive NFTs.

- Designer products: www.lukso.network allows you to track the source of a designed product, eg Armani. Adoption is lacking, as far as we can see, so watch out buying the cool idea without adoption. However, Bloomberg featured an article about this, suggesting there is traction (which we cannot verify).

- Designer products/NFT token: VET, VeChain Foundation.

- NFT tokens: Theta, Flow, Enjin, etc. Running a Theta node creates TFuel, wcich eventually may be exchanged for specialty items/NFTs. Note that these NFTs tokens are 100% correlated to the Bitcoin price trend.

- Metaverse Tokens: Mana (Decentraland Token), Sand (Sandbox). Specific do’s and don’ts apply to investing in these tokens.

- Collectibles/NFT tokens: ECOMI has VeVe digital collectibles woth the OMI token. There are many more though, but best practices apply.

- NFT stocks on Nasdaq: We found 7 stocks that run a business based on NFTs.

NFT investing is very different from crypto investing. It has characteristics of investing in art, so both the timeframe and the selection criteria for an NFT investment are really specific.

Moreover, NFTs mostly don’t have charts to discover trends and patterns, something that is crucially important in crypto investing.

Last but not least, one of the BBC reports described the process of purchasing an NFT. So be prepared for a not-so-classic-and-user-friendly journey when buying an NFT. It’s not your regular checkout process in an online store.

Unless you’re prepared to spend a lot of money and time learning the market – it is hard to imagine making money from NFTs. Even though I am a technology journalist (albeit not a crypto-expert), I was baffled by how complicated the process was, and realised I wasn’t alone.

Do you want to know more about NFT investing? Interested to know the do’s and don’ts about the 12 ways to invest in NFTs? Eager to exchange thoughts with our crypto investing community? Simply sign up here, look for the NFT investing overview page where you’ll find a link to join our Telegram group instantly.