The new Ripple Outlook Report is out. And what an insightful report. InvestingHaven we were keen to get the confirmation on THE single most important trend for 2019: institutional money entering the crypto space. Hardly anyone got this point, hardly anyone is talking about this, but what stands out for us is the 154.74% growth of institutional investing capital year-on-year. It is one of the crucial points in our 5 cryptocurrency predictions for 2019 which lead us to our XRP forecast 2019 and the conclusion that XRP is on its path to become the largest cryptocurrency.

Many have analyzed the quarterly report published by Ripple. It contained certainly some interesting insights like this one:

“In Q4, we saw an overall settling of XRP (XRP) volatility compared to quarters’ past. XRP’s volatility of daily returns was 5 percent – the lowest quarterly average since Q4 2016. Conversely, we saw the average daily volume for XRP increase substantially. The average XRP daily volume was $595.7M – the highest quarterly average since Q1 2018.”

Ripple Confirms Institutional Investors Entering Crypto Market

However, by far the most important data points, according to us, were related to institutional investors. This is what Ripple wrote in their report.

- The market continued to mature in Q4. First, we saw an increase in enforcement actions against questionable crypto projects, including ICOs. By weeding out these projects, the market will naturally contract as legitimate projects thrive and experiments or scams disappear.

- In addition, we saw reputable financial institutions both in the U.S. and abroad continue to push ahead with their digital asset or blockchain plans.

They backed this up by some news items which underpin this finding related to increased institutional interest in Q4:

- OTC desks continue to grow as volume moves to institutions published by Bloomberg

- Increasing number of institutional custody solutions appeared on Coindesk

- Large entrants in crypto space starting to look beyond just BTC and ETH noted by Coindesk

Ripple’s XRP Institutional Investors Growth Rate Is 154.74 Pct Annually

It is not only a market trend but it is more so XRP specific. Institutional investors showed increased interest in XRP.

Interestingly, some analysts focused on the the quarter-on-quarter changes of institutional investors. They obviously missed the point entirely.

The really important point is the annual growth rate, not a quarter-on-quarter change. Related to this, knowing that 2018 was a catastrophic year for cryptocurrencies Ripple sold directly to institutional investors 154.74% more XRP than during the most bullish year ever (2017).

- Calendar Year 2017: $67,400M

- Calendar Year 2018: $171,680M

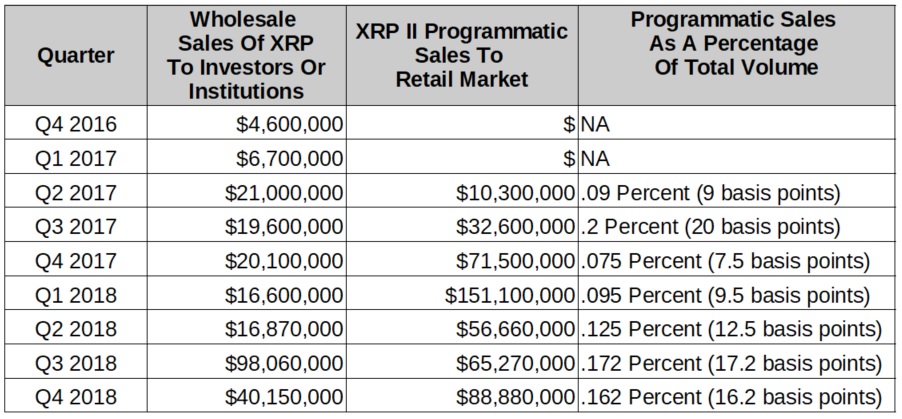

A big shout-out to the XRP community for compiling the following table which we used to derive the growth rate mentioned below.

It is the annual growth in institutional money entering the crypto space that matters. Remember how XRP has held up remarkably well, for sure compared to the crypt leader Bitcoin, as shown in Ripple: Relative Strength Suggests Ripple Investors Will Be Richly Rewarded.

Our thesis remains that institutional money will help drive the next big run of XRP, regardless of when exactly it will start. The data points are on our side, so far, until proven otherwise!