Bittensor is set to move to all-time highs at $767 because of very strong on-chain metrics. The Bittensor (TAO) chart suggests all-time highs will be hit in the next 3 to 4 months.

READ – 15 Cryptocurrency Forecasts For 2025

Bittensor (TAO) has experienced substantial growth, particularly in 2024. The token’s most notable performance came in September, when it surged by 110%, making it the second-best performing cryptocurrency among the top 100, trailing only Sui (SUI), which saw a 115% rise.

TAO’s price has soared 276% since its lowest point in August, elevating its market capitalization to over $4.4 billion.

In this article, we explore the chances of Bittensor price reclaiming its all-time high as on-chain metrics and external factors point to a continuation of Bittensor’s bullish momentum.

The 2024 Bittensor price roller-coaster

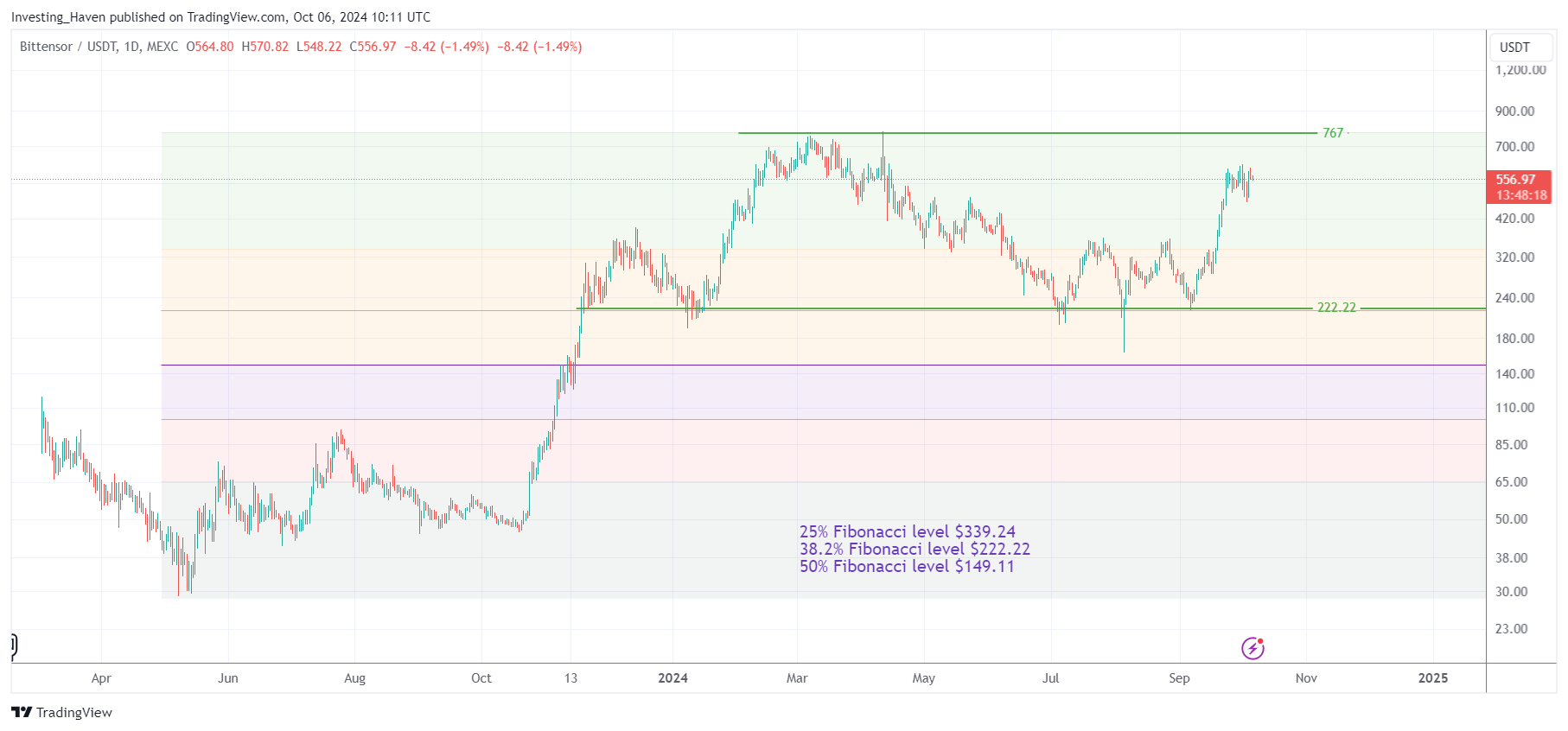

Bittensor’s journey began in March 2024 when it hit an all-time high of $767.68, completing a five-wave pattern. Following this peak, the token entered a downtrend, dropping 73% to $210 by July 5.

Despite this decline, the asset found support and formed a higher low on September 6, marking the start of a new potential bull cycle.

As of October 1, 2024, TAO was trading in a 24-hour range of between $563.56 and $615.35, with expectations of reaching new all-time highs by the end of 2024.

Key drivers for Bittensor to hit all-time highs

Several factors have contributed to Bittensor’s recent meteoric rise. Firstly, the platform’s decentralized AI framework is revolutionizing how AI blockchain networks operate.

Bittensor is a decentralized protocol that leverages artificial intelligence (AI) technology, and as AI continues to reshape industries, the protocol’s native token, TAO, has emerged as a standout asset within the crypto space, attracting both institutional interest and retail investor enthusiasm.

Moreover, Bittensor’s recent performance coincides with rebounds in major AI companies such as Nvidia, C3.ai, Alibaba, and Palantir. Notably, Alibaba’s decision to launch over 100 open-source AI models and OpenAI’s valuation surge from $100 billion to $150 billion further fueled enthusiasm for AI-related tokens, including Bittensor (TAO).

In addition, the upcoming launch of the Bittensor Improvement Template (BIT001), which will tokenize each subnet within the Bittensor ecosystem, promises to further decentralize and enhance the network’s superintelligence capabilities. This development, coupled with the introduction of $TAOBOT, is expected to enhance the adoption of decentralized AI, further driving up the value of TAO.

🌍 Why is $TAO on the rise?

The upcoming arrival of BIT001 is a game changer for decentralized AI! Soon, subnets will evolve into their own individual tokens—like holding SN1 or SN2 tokens—fueling decentralized access to superintelligence. Powered by the Bittensor $TAO network,… pic.twitter.com/NUDwLIz8PK

— tao.bot (τ, τ) (@taodotbot) September 29, 2024

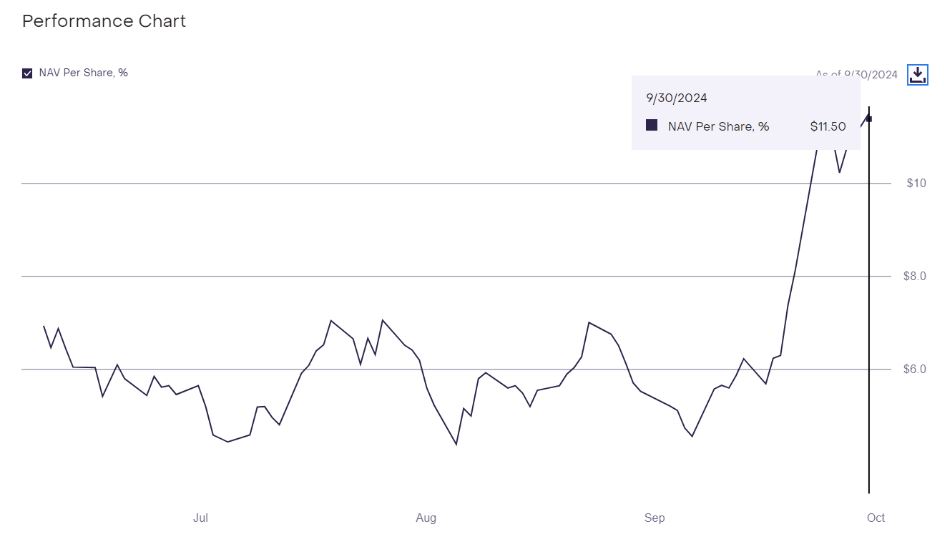

Grayscale’s endorsement of Bittensor has also played a crucial role in its rise. The launch of the Grayscale TAO fund has attracted over $4.1 million in assets, with trades occurring at a 5.6% premium to net assets.

The Grayscale Bittensor fund has seen performed extremely well since its launch with the Net Asset Value (NAV) per share percentage hitting $11.50 on September 30, 2024 morning. This shows the increased interest among investors which translates to a bullish case for TAO price.

Triple-bottom pattern followed by a golden cross

From a technical perspective, Bittensor’s price movements have shown strong bullish patterns as it recovers from the March 19, 2024, to July 8, 2024 plunge. The token formed a triple-bottom at $217 and broke its neckline at $365 in late July, achieving significant gains in August and September.

Furthermore, a golden cross pattern formed in September as the 50-day moving average crossed above the 200-day moving average, signaling further bullish momentum.

As of late September, Bittensor was approaching a critical resistance level at $600, representing a 23.6% Fibonacci retracement level. Analysts predict that if TAO breaks through this level, it could target $777, marking a 30% gain from its current price.

What on-chain metrics suggest about TAO new ATH

The bullish Bittensor price predictions are supported by several metrics both in the spot and derivatives market.

In the spot market, TAO liquidations data shows that a majority of the liquidated positions over the past three days were short positions signaling that bulls are still in control despite some investors anticipating a pullback following TAO’s meteoric rise.

Those who are betting on a TAO pullback are doing so on the precept of TAO having entered the overbought region seeing that the 14-day RSI is above 78.

In the derivatives market, the TAO futures open interest also portrays a bullish case for Bittensor seeing that the open interest is on the rise after a slight drop on September 29. An increase in open interest suggests new money entering the market, indicating a potential bullish trend.

Furthermore, TAO OI-Weighted Funding Rate and TAO Volume-Weighted Funding Rate have seen a significant uptick signaling a bullish case for Bittensor (TAO).

A high funding rate typically suggest that traders are bullish, expecting the price to rise.

When will Bittensor all-time highs be hit again?

The strong market demand, the imminent launch of BIT001, and key market metrics point to an increased bullish momentum for Bittensor (TAO).

We continue to caution against the short term TAO timeframes. The 1h TAO chart, for instance, is not the right timeframe. It creates a perception that $767 will be hit soon, very soon. We don’t think so simply because this analyst only focused on the triangle ignoring the equally important horizontal levels representing Fibonacci.

$TAO/usdt 1 hour

THERE. IT. GOES.

Told ya, we’re not playing this cycle …. $640 is next https://t.co/ZlVM19lF4r pic.twitter.com/GA8yX99V5b

— Satoshi Flipper (@SatoshiFlipper) September 29, 2024

Looking at our own TAO chart, we observe the bullish reversal created at/above $222.22. While we are not saying TAO will drop again to TAO, we also cannot exclude a drop to the 25% Fibonacci level at $339.24 before a big run to $767 starts.

Conclusion – we see $767 hit sooner or later, but not in the very short term. We see the need for a micro-reversal to be created, hitting one of the key Fibonacci levels, before TAO can stage a run to $767, most likely in a few months from now.

Needless to say, $767 is not going to be an end point for TAO, TAO is expected to set new ATH in 2025.