The price of Uniswap (UNI) is breaking out. It is happening on a major announcement. How does this development affect Uniswap (UNI) price analysis for October 2024?

RELATED – 15 Cryptocurrency Forecasts For 2025

Let’s look at the UNI chart, and map their latest technology announcement to chart dynamics.

Uniswap major announcement

Today’s announcement was a confirmation of what was announced a few years ago: Uniswap confirmed their Layer-2 functionality.

This is a major development, from a technological point of view, because of many reasons. If anything, Uniswap will not be functioning faster, cheaper and in a more reliable way than ever before.

Arguably, this also implies that Uniswap can enable institutions to enter the DeFi space (which is important given this 2025 narrative).

From X:

Uniswap just announced their own L2, Unichain.

– DeFi focused network with 250ms block times

– Cross chain interoperability

– Sequencer revenue to $UNI stakers

– Would be the #1 ETH L2 by activity$UNI is bumping up on the $8 resistance level now but interesting to look at the… pic.twitter.com/pLTLvC9nDt

— Austin Barack (@AustinBarack) October 10, 2024

Uniswap (UNI) bullish breakout ongoing

In order to understand what this implies for the price of UNI, we really need to zoom out.

We realize that most social media posts are focused on the short time frame. That’s not good, it introduces noise for an investor because it does not allow to see the big picture.

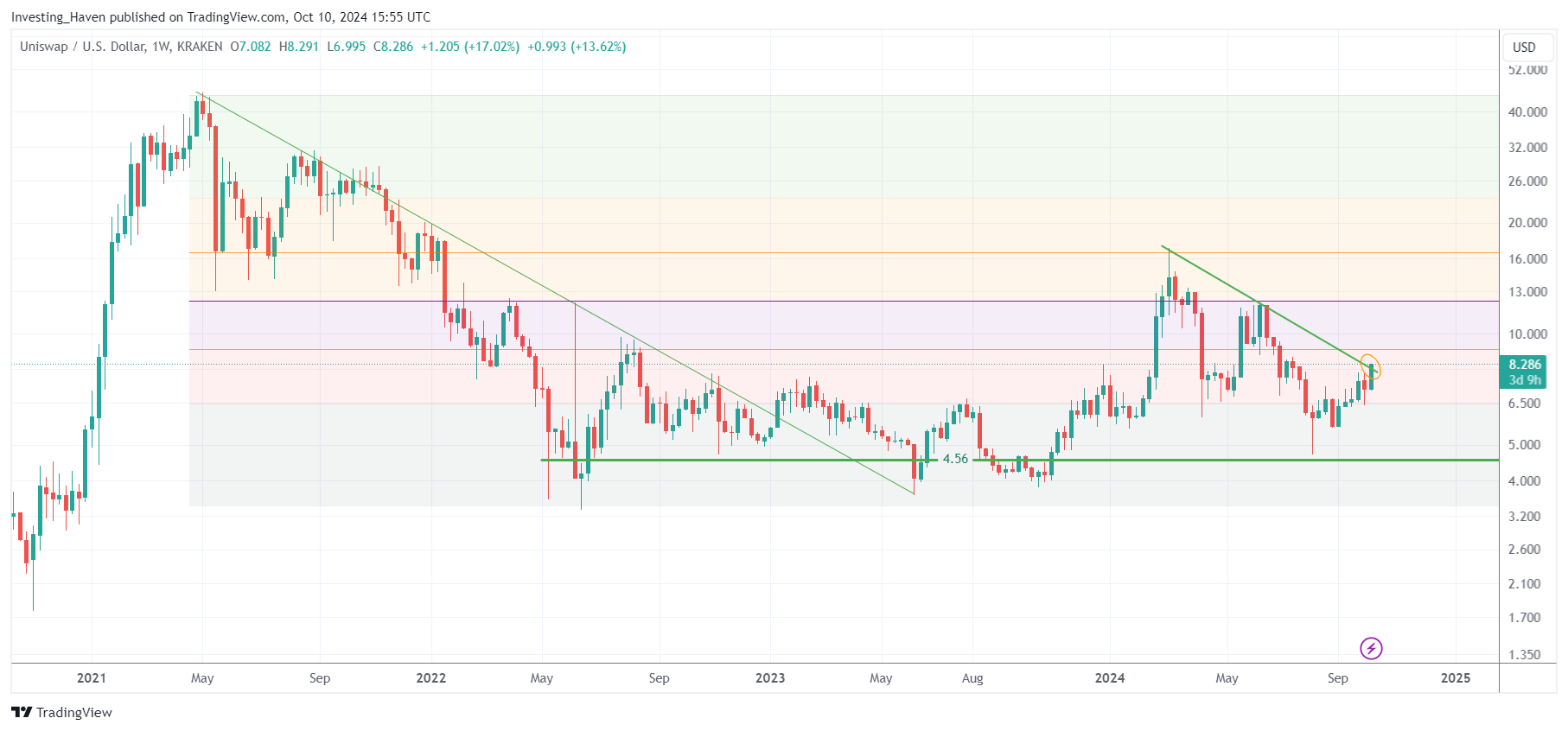

Below is the weekly UNI chart with our annotations:

- The long term chart is a bullish reversal, arguably a wildly bullish reversal.

- The higher lows in 2024 against 2023. What is equally important is the orderly structure (bottoming formation) in 2023.

- The 2024 downtrend is now being tested. This is the 2nd touch, potentially UNI might need a 3d touch (or not) before moving decisively higher.

- Key Fibonacci levels are respected – readers should pay attention to the purple and red shaded areas which represent the 50% and 61.8% Fibonacci levels.

This is a rule of thumb when charting out a cryptocurrency like UNI – the more chart structures (incl. Fibonacci levels) are respected, the more reliable the chart pattern. In this case, the long term bullish reversal seems to be very reliable, hence powerful in terms of outcome.

Below is an illustration of a short timeframe – it’s impossible to get the same level of detail and conclusions out of this short term oriented chart compared the longer timeframe shown above. No offense whatsoever to the content creator of this post, just emphasizing the difference between the timeframes and the level of detail as well as significance of the output.

$UNI appears to be poised for a significant run in the coming weeks IMO.

One of the best ecosystem, which is rapidly expanding and has the potential to rank among the top five this cycle.

LFG @Uniswap! ✍️ pic.twitter.com/BIPFjkrs23

— Lucky (@LLuciano_BTC) October 9, 2024

Uniswap (UNI) wildly bullish long term reversal

The long term bullish reversal is pretty powerful:

- Reliability of the chart pattern.

- Length of the pattern.

- Shape of the pattern.

They all contribute to the high level confidence of a bullish resolution, if not in 2024 then for sure in 2025!

Our premium members were notified about this opportunity before our public blog post. We are preparing several buy the dip alerts for the last week of October. You might want to join our premium crypto service as well.