The predicted range for the Dow Jones in 2025 is approximately 38,000 to 44,000 points. This Dow Jones forecast 2025 assumes a continuation of the primary market trend in which market caps assume a leadership role.

RELATED – S&P 500 Forecast for 2025

In this article, we focus on the large cap heavyweight index Dow Jones.

We consider the following data points:

- Fundamental drivers.

- Primary market trend.

- Secular chart dynamics.

These inputs allow to publish a Dow Jones forecast for 2025 which, visibly, is based on a bullish outlook for the Dow Jones index. New all-time highs in the Dow Jones are expected.

Last update – January 4th, 2025.

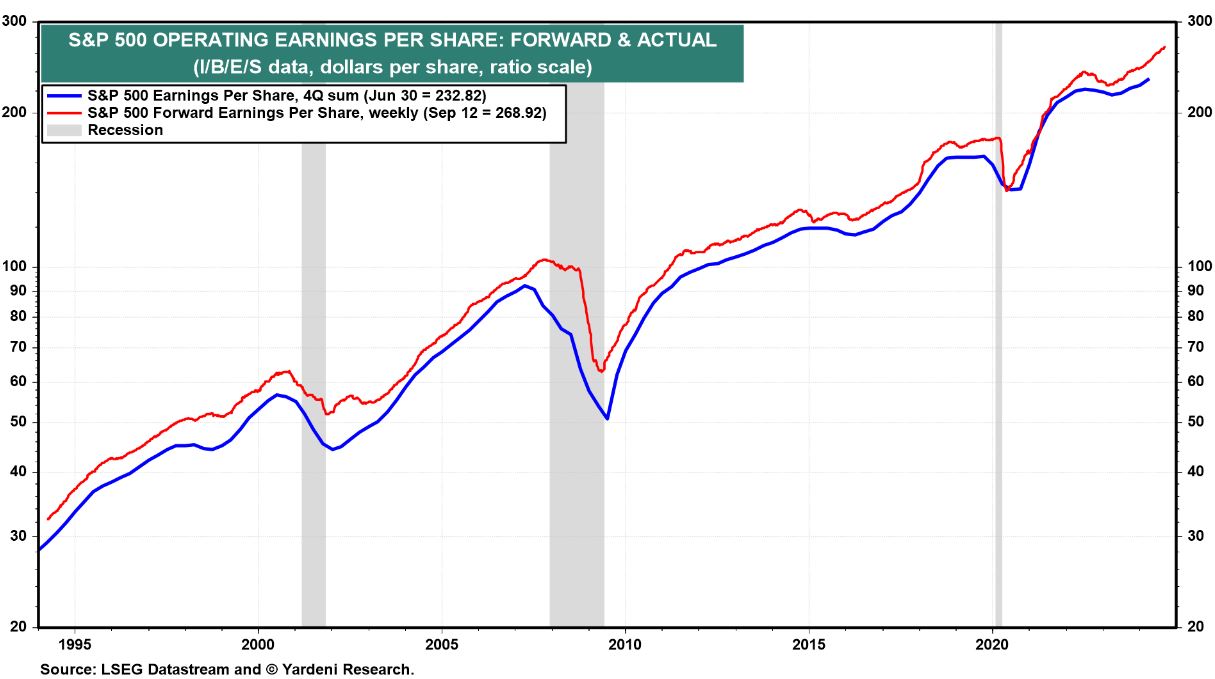

Fundamental driver: Dow Jones future earnings

The Dow Jones Industrial Average is in a prime position to capitalize on the ongoing upward trend in corporate earnings. This provides fundamental support to a bullish Dow Jones outlook 2025.

Dow Jones future earnings – chart

As we head into 2025, large-cap companies—many of which have weathered economic turbulence over the last few years—are set to experience accelerated earnings growth, especially if the Federal Reserve pivots toward a more dovish monetary policy.

Historically, large-cap companies, particularly those in the Dow, have outperformed during periods of economic stabilization and growth due to their established market positions, robust cash flows, and operational efficiency.

In 2025, as inflationary pressures ease and consumer demand strengthens, Dow constituents in sectors such as industrials, consumer staples, and healthcare are likely to lead the charge in forward earnings growth.

Companies like Caterpillar, Procter & Gamble, and UnitedHealth Group have shown resilience, and they stand to benefit significantly from improved profit margins driven by higher productivity and lower input costs.

Chart by Yardeni – Large-cap earnings growth to drive Dow Jones gains in 2025 based on the S&P 500 large cap trend:

Dow Jones future earnings – fundamental observations

Despite a period of monetary tightening in 2023 and 2024, the economy has continued to grow at a steady pace. This resilience underscores the strength of large-cap companies that are better equipped to tackle challenging environments.

If the Federal Reserve lowers interest rates in 2025, large caps in the Dow Jones are expected to accelerate their earnings growth, setting new record highs in forward earnings. This scenario would create a strong tailwind for the index, boosting sectors like industrials, technology, and healthcare, which are well-represented in the Dow.

Large caps typically thrive in a low-rate environment, as cheaper borrowing costs fuel capital investments and expansions. Additionally, Dow Jones constituents, with their global footprints, will benefit from stronger demand in both domestic and international markets, bolstering revenue streams and enhancing their competitive edge.

Takeaway: The Dow Jones is set for a strong 2025 as large caps lead forward earnings growth, making the index a key beneficiary of improving economic conditions and a dovish Fed stance.

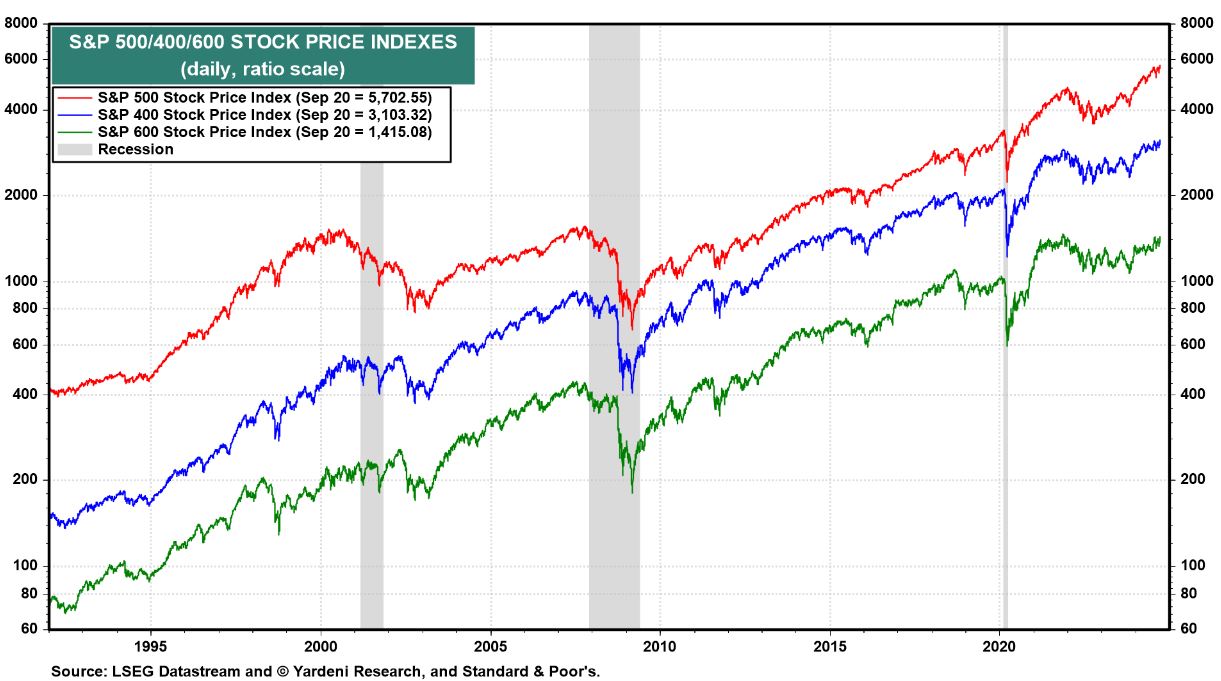

Dominant market force: Large caps leadership

One of the most encouraging signals heading into 2025 is the improving breadth across the stock market. While this may benefit small and mid-caps, it will certainly underpin the outlook for large caps. This confirms a bullish Dow Jones forecast for 2025.

Large cap leadership – the chart

While large-cap stocks, particularly those in the Dow Jones, have led the market in recent years, there are signs that small- and mid-cap stocks are beginning to recover. However, large caps are expected to maintain their leadership position, with the Dow Jones at the forefront of this rally.

Large-cap stocks often dominate during periods of market uncertainty because they offer stability, predictable earnings, and strong balance sheets. Companies within the Dow Jones are no exception. As small caps start to rebound, large caps will continue to lead the broader market due to their established business models, brand recognition, and access to capital. The large-cap dominance seen in the Dow is further strengthened by their ability to innovate and expand efficiently in a shifting global economy.

Chart by Yardeni – Fed easing and large-cap dominance to sustain bull market leadership based on S&P index data:

Large cap leadership – foundations

As we look ahead to 2025, a combination of improving economic growth, easing inflation, and a potential shift to a more accommodative Fed policy will likely extend the dominance of large caps.

For the Dow Jones, this means that its components, which include some of the world’s largest and most stable companies, are well-positioned to outperform. Even as small- and mid-cap stocks play catch-up, large caps will remain the engine driving overall market growth.

The sectors leading the Dow—industrials, healthcare, financials, and consumer staples—are all positioned to benefit from a robust economic outlook. For instance, Boeing and Goldman Sachs are poised to capitalize on renewed investment in infrastructure and financial services, while companies like Apple and Microsoft stand to gain from technological innovation and global expansion.

Takeaway: The leadership of large caps, particularly those within the Dow, will continue to drive the market forward in 2025. While smaller stocks may join the rally, large-cap dominance will remain central to market performance.

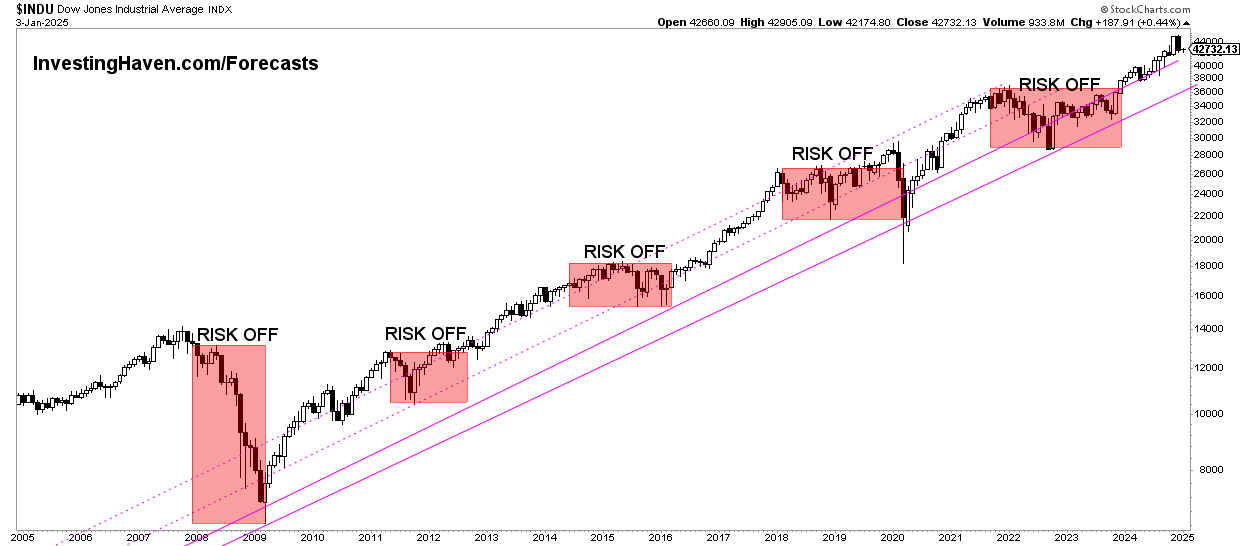

Dow Jones outlook directionally bullish in 2025

With all of the above data in mind, in particular fundamental drivers and primary market trends, we turn our attention to the long term Dow Jones chart. This, once again, confirms a bullish outlook for the Dow Jones in 2025.

RELATED – Dow Jones Historical Chart On 100 Years (fascinating chart analysis)

The secular Dow Jones chart features a clear and clean pattern:

- A series of ‘risk on’ and ‘risk off’ periods.

- The ‘risk off’ periods tend to last roughly 12 to 18 months.

- The ‘risk on’ periods tend to last longer, say 18 to 24 months.

We consider that the Dow Jones started a bullish cycle somewhere in the second half of 2023. If history is a reliable guide, the Dow Jones is set to continue rising, at least directionally, in 2025.

Takeaway: a bullish Dow Jones outlook for 2025 is justified (source: 20-year Dow Jones chart).

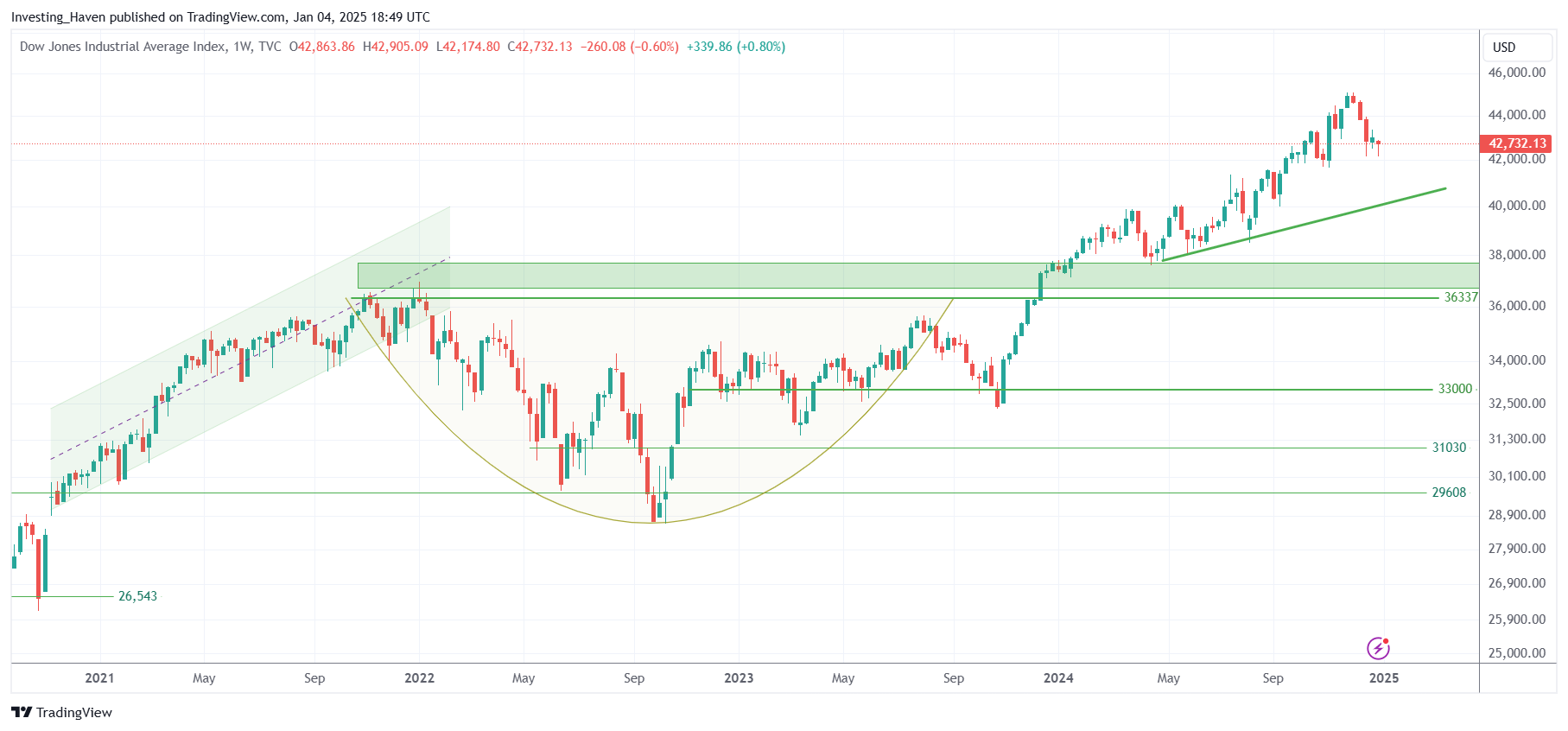

Dow Jones forecast 2025

In our attempt to do a specific Dow Jones forecast for 2025, we need a shorter timeframe to complement the secular timeframe shown above.

- The direction is up, although in a soft uptrend.

- Very important support comes in around 37k.

- We can reasonably expect a round number to work as resistance. While not scientifically backed up, we believe the 44k area is a reasonable number.

Our Dow Jones forecast 2025: a trading range with forecasted lows of 38,000 and highs of 46,000.

Dow Jones forecast – conclusions

The Dow Jones Industrial Average is well-positioned to benefit from a favorable economic environment in 2025, with large-cap companies continuing to lead the market.

- As forward earnings growth accelerates and monetary policy becomes more supportive, large-cap stocks will thrive, reinforcing the Dow’s leadership position in the broader stock market.

- While smaller companies are starting to recover, the Dow’s large-cap components have the scale, resources, and market presence to maintain their dominance.

- With key sectors like industrials, technology, healthcare, and consumer staples driving earnings growth, the Dow Jones is set for a bullish year ahead.

Our Dow Jones forecast 2025 predicts a trading range between 38,000 and 46,000.

January 4th – We would like to remember readers that exceptional rotation is a dominant dynamic in markets nowadays. This will not change. Presumably, there may be times of underperformance of large caps relative to small and mid-caps. This is part of the current bull market dynamics.