We pointed out that Feb 5th, 2024, would be a decisive date for markets and crypto.

As it stands, we see a divergence between leading indicator BTC and our favorite crypto segment (Big Data & AI).

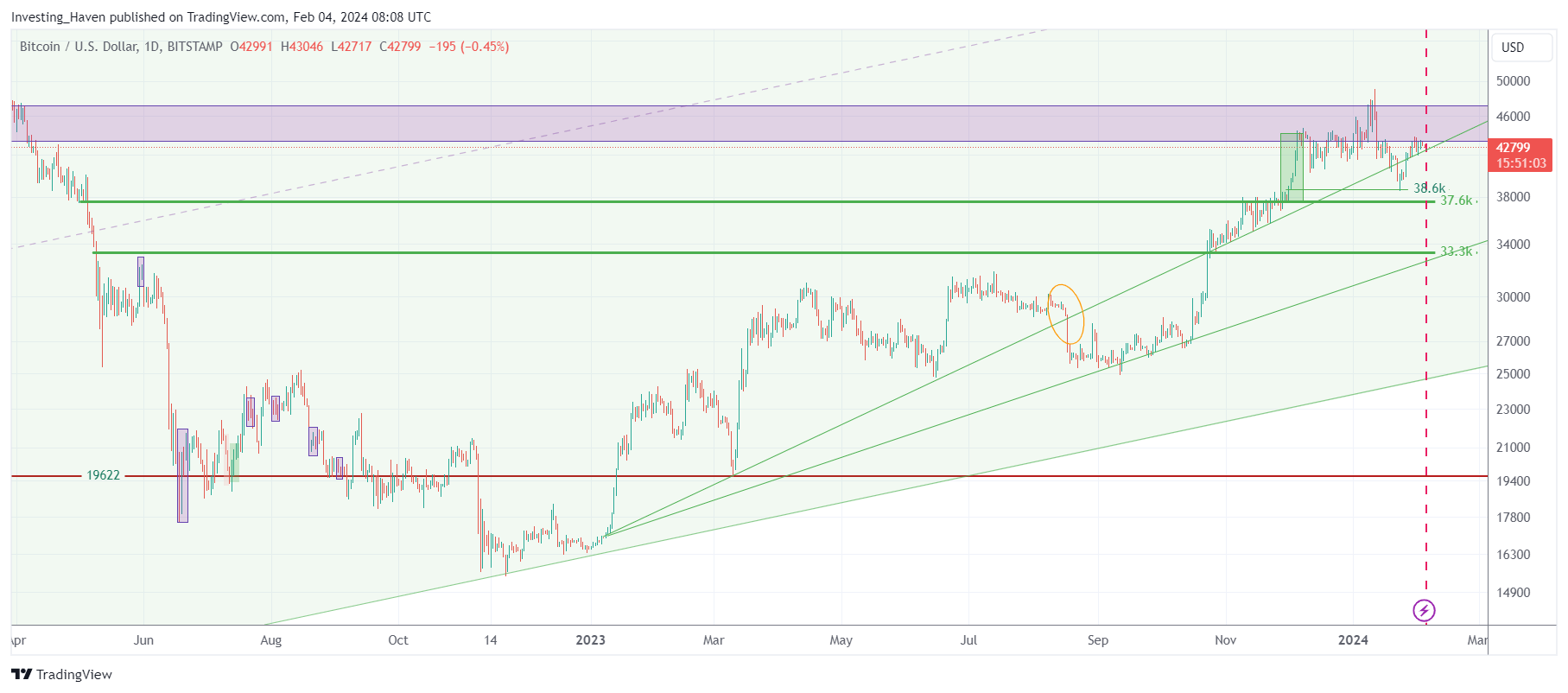

BTC found resistance at 43.3k, and is flirting again with a breakdown of one its rising trendlines. We believe there is a lower high on this chart which will make it tough to continue to climb in the very short term. On the other hand, we don’t think we can spot a very concerning secular bearish turning point.

Conclusion: slight bearish bias with the tendency to consolidate.

However, at the same time, there a handful of tokens that continue to improve, despite a hesitant BTC.

Remember, we have been forecasting a HIDDEN BULL MARKET in crypto in 2024 (read the public blog post in which we don’t mention our favorite segments nor favorite symbols as that’s research work that is intended for premium members), it probably is happening exactly as expected.

PYTH Network, which we tipped 2 weeks ago, is testing a breakout level. The real breakout is 0.495, contrary to what we said before. It is an oracle, playing in the same field as Chainlink (LINK). Currently, it is our favorite oracle, arguably favorite token.

As with any breakout attempt, a breakout can fail after which a quick drop typically occurs. We believe that this setup is strong enough to find follow through, if not next week then the week(s) after. It’s worth holding even if the breakout fails, is what we are saying.

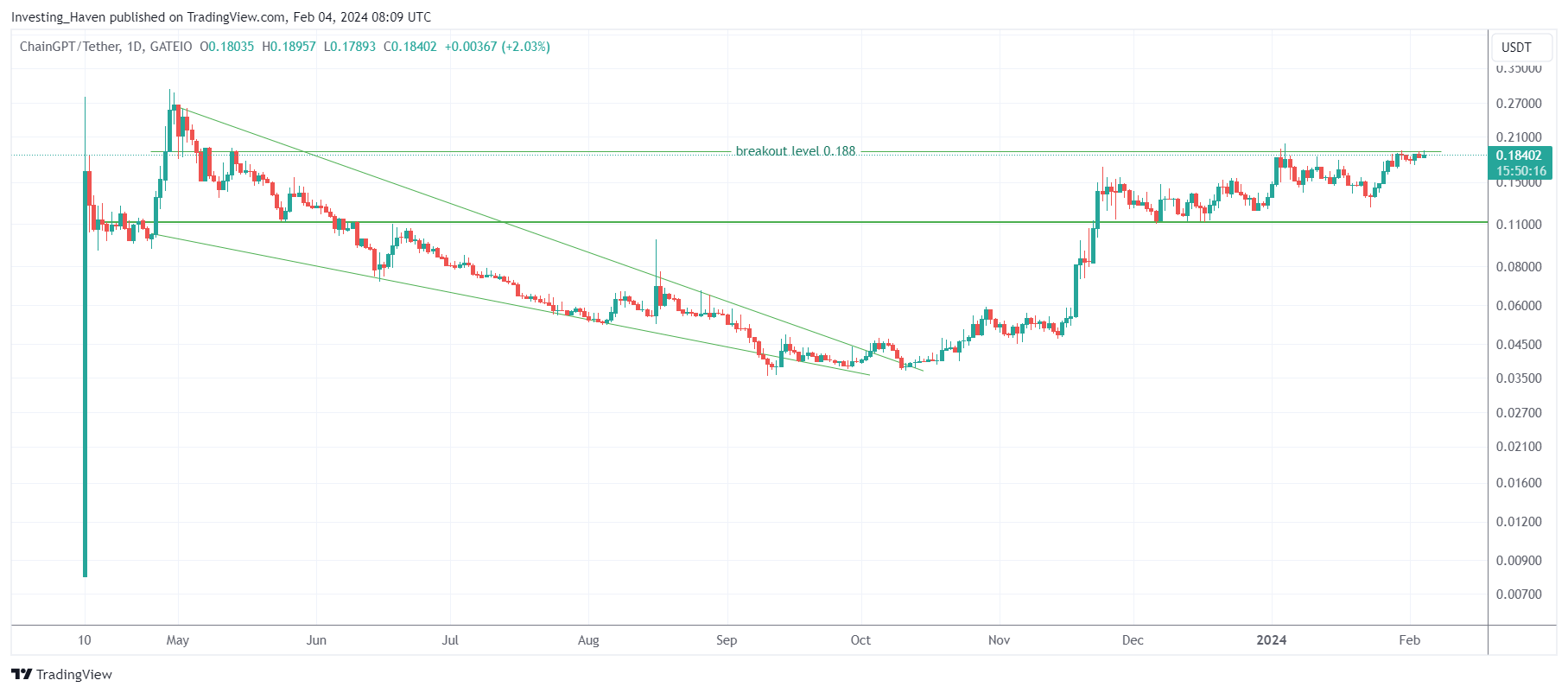

Also in the AI & Big Data space, we found another top tip we shared a few weeks ago: ChainGPT (CGPT). A breakout is looming. Same story as PYTH: the breakout may invalidate, after which a quick drop may occur.

This cup and handle formation is bullish, so we believe it will eventually resolve higher, irrespective of choppy price behavior around its breakout level at 0.188.

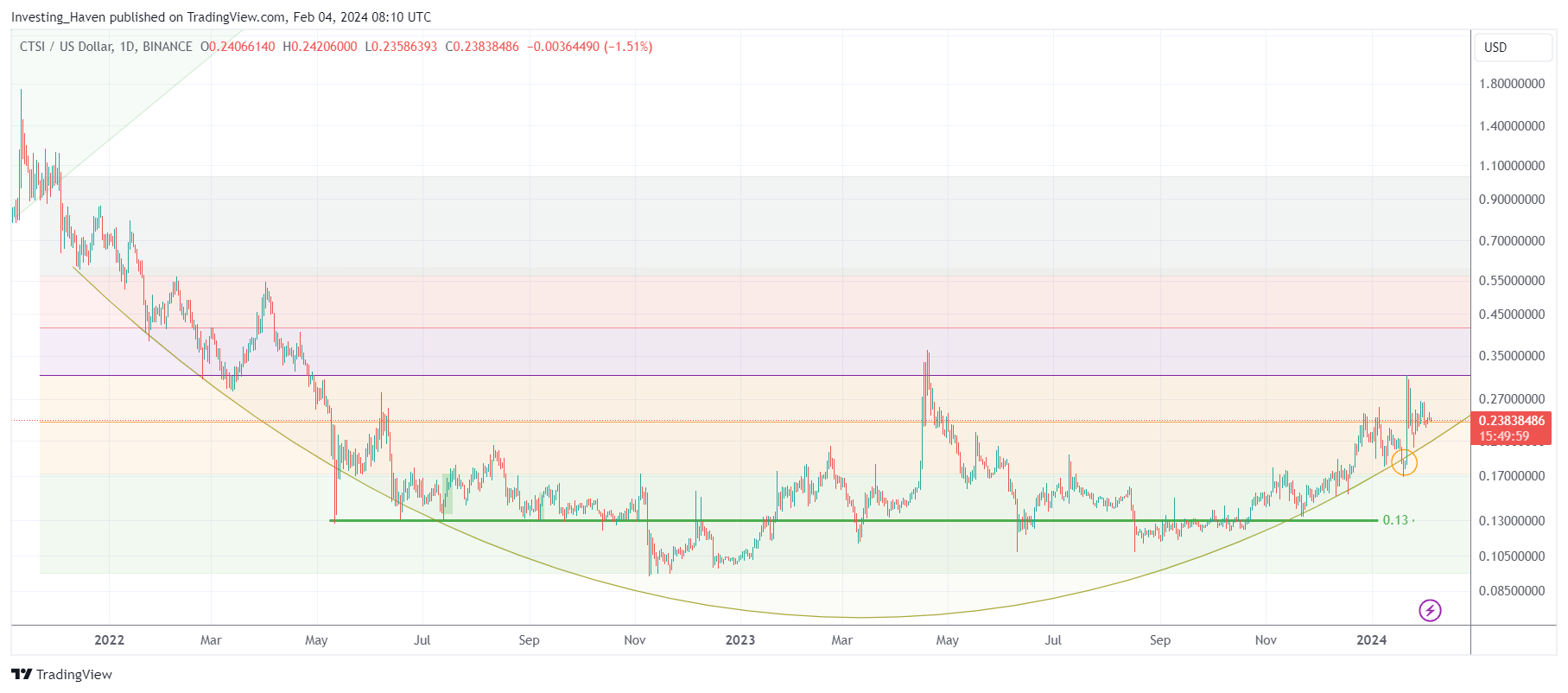

Cartesi, a Layer-2 that is enabling AI services, has an absolutely phenomenal long term setup. The breakout is 0.3, the rounded pattern is reliable, the upside potential is 4x.

For those that are into the technology part of blockchain, you certainly must read this article which explains how Cartesi facilitates ChainGPT.

We add one more candidate to this list of Big Data & AI group of momentum plays, flirting with a breakout.

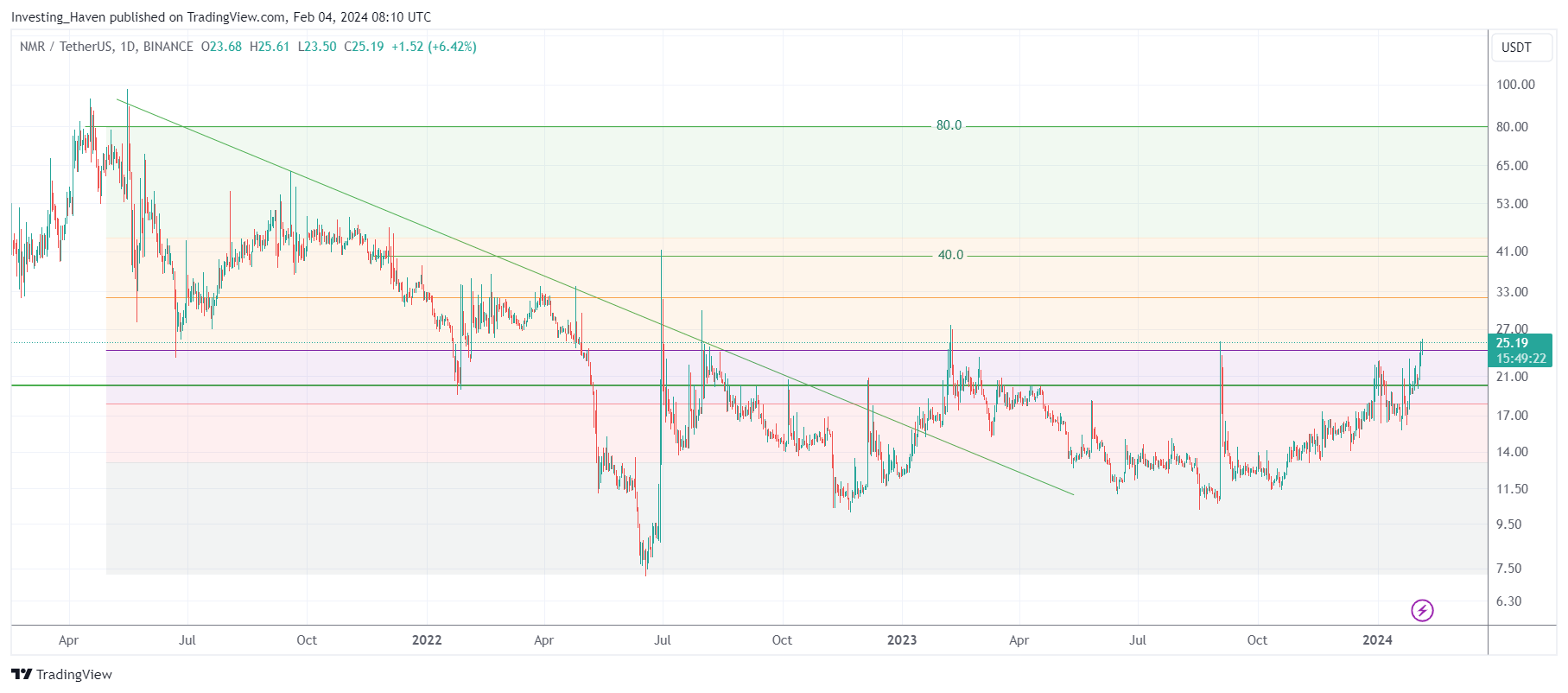

Numerai (NMR) is testing a breakout level. A quick run to 40 may occur in February, eventually it should touch 80. It may happen any time, NMR is a very volatile token, only do this if you can stomach volatility and enjoy big swings. We believe NMR is ready for prime time, big swings, in two directions, but eventually it should higher, it may start any time, it should happen somewhere in February.

Numerai is a predictive stock market crypto project which has not done a lot in recent years, bringing AI to the blockchain with stock market forecasting as the use case. However, with renewed interest in Big Data, facilitated by AI, it seems like the perfect token to benefit from this new trend, especially as the chart of NMR is very bullish.

Now, finally, we are able to explain why Flare token is doing so well. Its oracle characteristic is benefiting from the overall interest in Big Data tokens.

We believe that Feb 5th, 2024, a window of 72-hours to be precise, might be the official start of the hidden bull market in crypto. While BTC may struggle, a handful of tokens in the Big Data & AI space may start a breakout.

We will follow up late next week.

For now, be prepared for volatility to pick up.

Legal notes

No financial advice

Our crypto alerts and tracking list are no financial advice. We follow a methodology which is based on advanced inter-market and intra-market analysis, advanced chart analysis. Our alerts simply reflect the bullish and bearish trends, also the expected trends that we derive from our methodology. For investors interested to buy or sell tokens they may have to seek advise with a financial advisor as prescribed by autorities.

A look-over-the-shoulder method

All our alerts explain how our methodology functions. They are no recommendations to buy, hold, or sell tokens, or to engage in any trading strategy, or that an investment strategy is suitable for any specific person. Such recommendations may only be made by a personal advisor or broker you select. InvestingHaven’s Crypto Investing service is a look-over-the-shoulder service to understand the specifics of the methodology. It is designed for educational purposes as explained in the T&C.