As of December 2024, gold premiums in China are on the rise again. They dipped significantly over the summer. What could this mean?

RELATED – A Gold Price Prediction for 2025 2026 till 2030

In terms of gold demand, Asia is a world leader. Changes to purchasing behavior in this region has a significant impact on the gold price which is why precious metal analysts monitor Asian data for clues as to how developments may shape gold buying. China is the world’s largest single consumer of gold and has its own gold exchange, the Shanghai Gold Exchange.

Much has been said about gold’s repricing and how Asian gold prices will soon be the true price of gold. The World Gold Council monitors and reports the spread between international gold prices and the price that gold is trading at in the Chinese market. The premium or discount on the Shanghai Gold Exchange compared to international prices provide a valuable insight into what the world’s single largest market is doing in terms of gold buying.

A late-2024 return to premium

2024 has been a tale of two-halves for the Chinese market which is unsurprising given that the gold price has rallied 30% during the calendar year.

This has had a significant impact on Chinese premiums as the beginning of the year saw Chinese prices trading higher than world prices, yet the mid-point of the year saw a reversal of this, leading the Chinese gold price to trade at a discount.

Data from early December 2024 shows signs of the premium coming back into the Chinese market with gold prices in China surpassing global benchmarks by $4.4/oz on December 20 2024, following months of discounts as deep as $40.6/oz in October.

This shift marks the first significant premium since mid-August 2024 and signals strengthening domestic demand as the recent gold price stabilization has given buyers more confidence to enter the market again.

Early 2024: Strong premiums

The first quarter of 2024 saw the Chinese gold market consistently trading at a premium.

The Chinese price rose as much as $85.6/oz over international prices on April 1 which signaled strong domestic demand, something that was probably linked to seasonal factors such as the Lunar New Year.

A sluggish summer for gold demand

- The steep premiums seen early in the year began to wane by the summer.

- The market shifted into discount territory by late July which continued into August until reaching lows of -$23.0/oz on August 20.

- This trend likely stemmed from rising prices as well as the loss of any demand from Chinese New Year.

Deep discounts in Autumn

- From September to November, the Chinese gold market experienced sustained discounts, hitting a low of -$40.6/oz on October 9.

- This occurred at a time when gold was making new record highs in most established currencies.

This shows evidence that Chinese buyers are extremely price sensitive and that the rising prices were causing buyers to be cautious in case of a price correction.

A glimmer of resurgence in December

Recently the Chinese gold price has flipped to trade at a premium again, signaling a recovery in demand. The rebound in buying is likely to be due to a small dip in prices from record highs as well as early seasonal buying ahead of the Chinese New Year.

Factors driving the recent premium recovery

Seasonal demand: With the Chinese New Year on 29 January 2025, it provides buyers with a small window to make their purchases. It is possible that Chinese investors are seeing the recent dip in prices as ‘less risky’ time to buy. As demand recovers, so does the price premium.

Economic sentiment: Speculators could be increasing their gold holdings in China as they brace for Donald Trump’s presidency in the US. Trump has a history of applying tariffs on Chinese imports and has been vocal about his intentions to use these again in his upcoming term. Whilst this will not impact the flows of gold into China, it increases the uncertainty of the Chinese economy going forward which will naturally cause some to want more exposure to the safe haven asset.

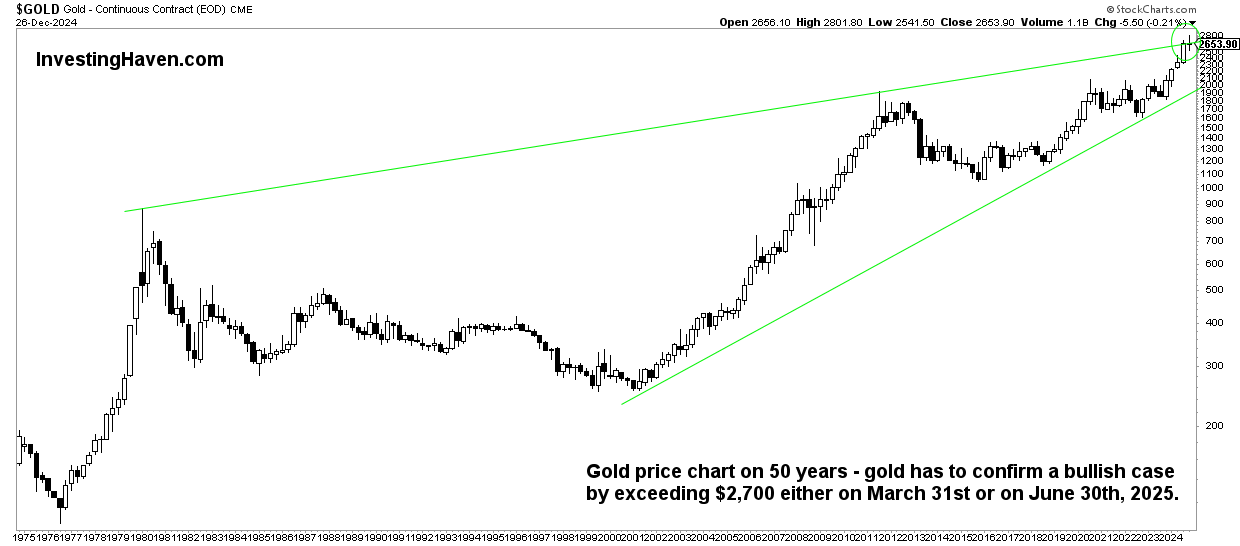

The gold chart

Now, what’s interesting, looking at the long term gold price chart, is the number of consecutive ‘green’ candles (represented in white on below quarterly candlestick chart).

To be more precise, gold experienced 4 consecutive quarters with ‘profits’. The Chinese dip came right at the top of the long term rising wedge which is a potential bearish pattern (it’s not confirmed yet, and it’s easy that it invalidates as explained in the commentary on the chart).

Moreover, the dip in Chinese demand (with falling gold premiums in China) occurred right at the highs of the previous quarterly candle (highs in Sept/Oct), when hitting $2,700 which is a crucial gold price level.

Implications for the global gold market

The return of Chinese gold premiums is a bullish signal for the global gold market.

Rising Chinese premiums could indicate a recovery in demand, supporting higher global gold prices in the near term.

Chinese investors are thought of as shrewd buyers and so if they are seeing the recent dip in gold prices as a buying opportunity, this may become a wider trend in the global economy which provides fundamental justification for our long-term bullish view on the precious metal.

Written by Levi Donohoe.