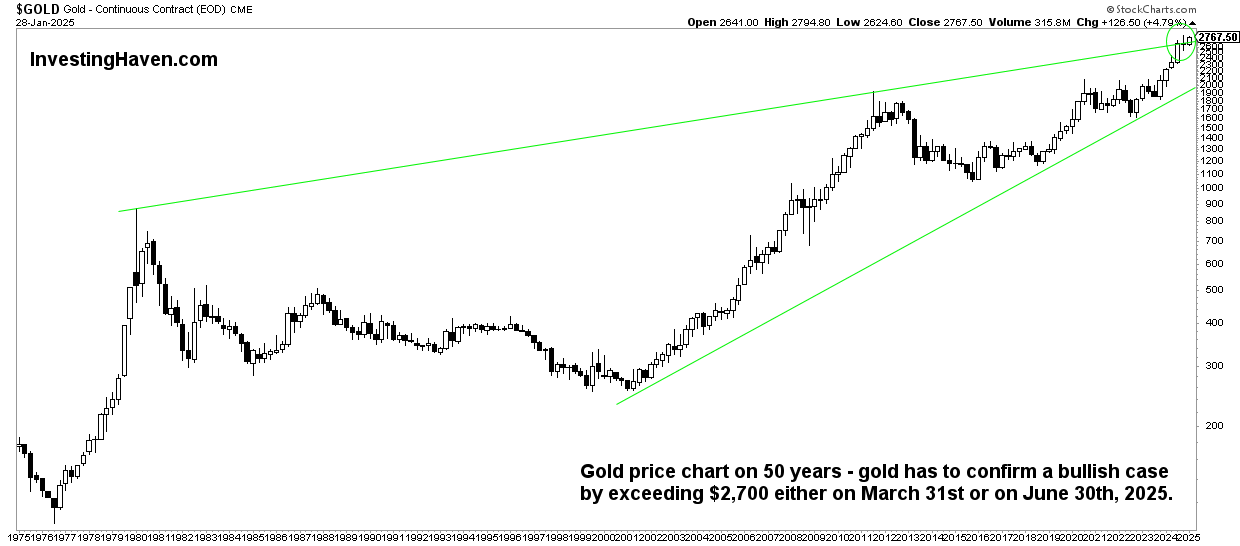

On the quarterly gold price chart, we observe a gold secular breakout. For now, it qualifies as an attempt. Confirming is pending, and a decisive date will be March 31st, 2025.

RELATED – Gold prediction 2025

There is a lot of chatter about gold’s test of ATH.

What goes unnoticed is gold’s attempt to invalidate a secular bearish chart structure.

Gold’s ATH is not a secular breakout

There is a tremendous supply of financial content related to gold.

However, financial and social media are very short term oriented.

Take the focus on gold’s ATH (here and here for instance). Gold’s test of ATH is attracting a lot of attention.

Why?

Because it’s easy to create content.

Investors are left with the perception that exceeding ATH is the most important thing.

We don’t think so, as there is a much more important ‘chart event’ to watch in the gold market.

Gold’s real secular breakout

The really important news comes from gold’s longest timeframe.

That’s not the daily gold price chart but rather the quarterly gold chart. Below is the 50-year gold chart.

As seen below, a true gold secular breakout is in progress now. And the secular breakout on gold’s chart coincides with the invalidation of the rising wedge which, by default, is a bearish structure.

What we are saying is that the only thing holding gold back, currently, is the potential rising wedge.

Conversely, once this rising wedge is cleared, gold is invalidating any potential bearish dynamics. By exclusion, that’s very (very) bullish.

Gold’s moment to shine: the end of this & next quarter

When exactly will we know for sure that gold will confirm a secular breakout?

That’s going to be on the next 2 dates:

- March 31st, 2025.

- June 31st, 2025.

On both dates, gold will close a quarterly candlestick.

If this current quarterly candlestick as well as the next quarterly candlestick will close above the rising wedge, above $2,700 an Ounce, it will be the ultimate confirmation of a secular breakout in the gold market.

Follow our premium gold price alerts for weekly coverage of the gold & silver trend >>