Whether gold can hit $10,000 an Ounce by 2030 is depends on how macro trends develop in the next 5 years. In this article, we look at the conditions for gold to rise to $10,000. Can gold hit $10,000? Yes, potentially.

RELATED – A Gold Price Prediction for 2025 till 2030 | InvestingHaven.com

As inflation rises steadily, geopolitical tensions escalate, and fiat currencies face growing scrutiny, a new question emerges: Can gold hit $10,000 an ounce?

While some may view this gold price target as impossible to achieve, the argument for gold moving towards $10,000 is not as far-fetched as it seems.

In this article, our team over here at InvestingHaven.com explores two scenarios:

- A base case scenario: gold reaches $5,000 by 2030.

- An exceptional case: extreme conditions push the price of gold to $10,000 an ounce.

We explore the exceptional case in more detail. In doing so, we highlight which conditions should be in place for gold to hit $10,000 by 2030. For each catalyst we indicate if there is an emerging trends visible in the data.

Base Case: Gold Moving to $5,000 by 2030

1. Inflation and Currency Devaluation

One of the key factors driving gold prices higher is inflation.

As central banks continue to print money to stimulate economies, particularly in the aftermath of the COVID-19 pandemic, the value of fiat currencies declines. Gold, known for maintaining its purchasing power, tends to rise in periods of inflationary pressure.

In the base case, where inflation is moderate but persistent over this current decade, gold prices are likely to trend upwards, potentially reaching $5,000 by 2030.

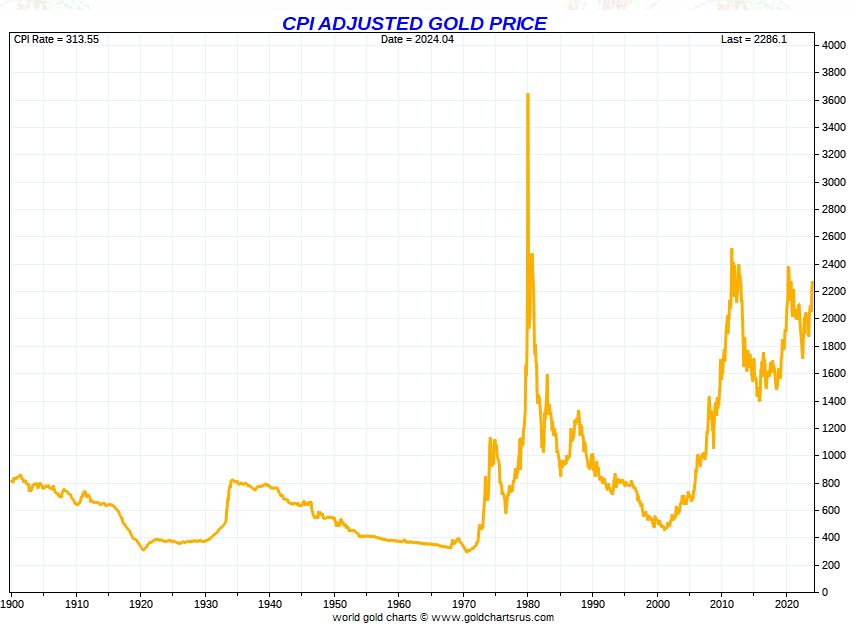

Historical correlations between inflation and gold prices suggest that gold benefits significantly when real interest rates remain low or negative. Investors looking to protect against devaluing currencies could push gold prices higher. This one of the many long term gold charts released from our own blog InvestingHaven.com:

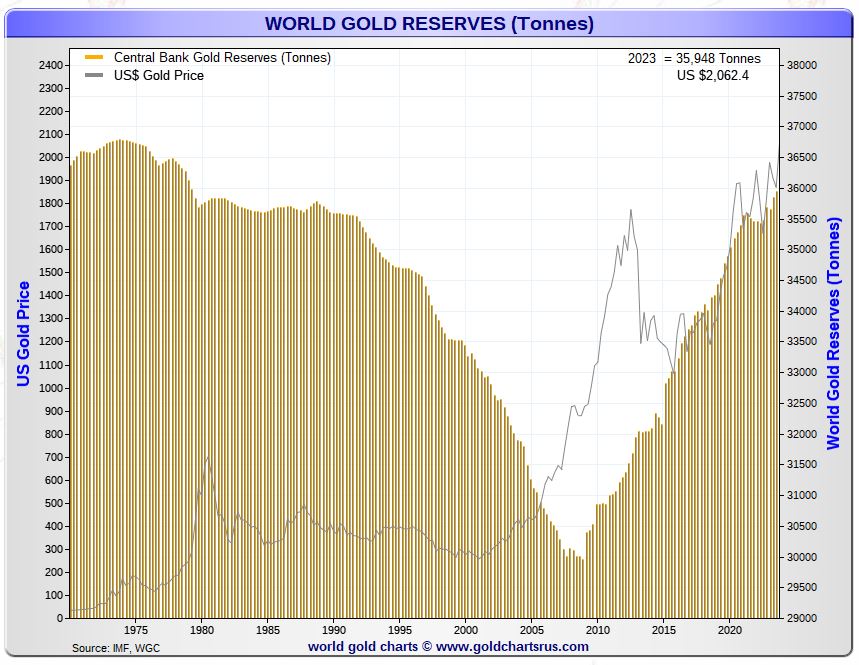

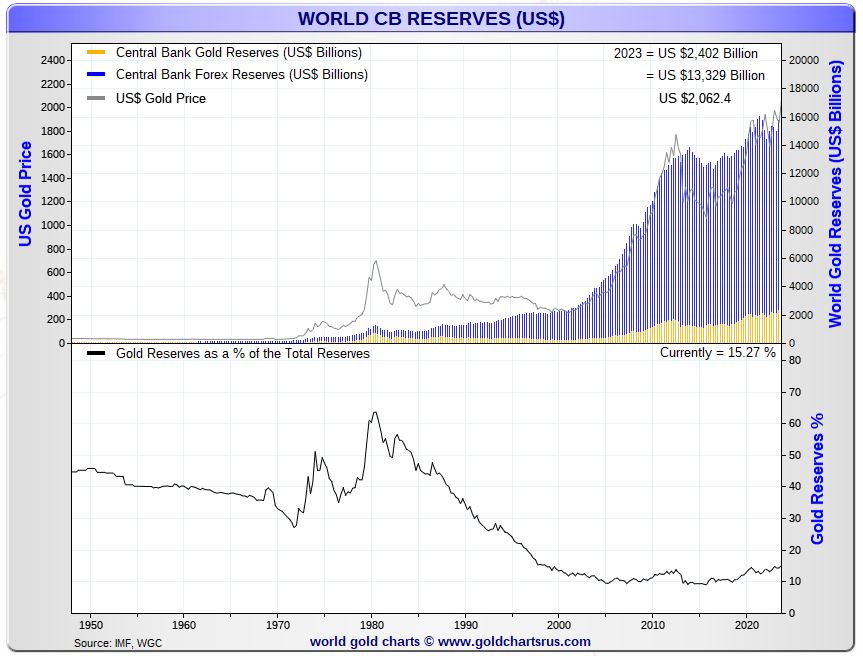

2. Central Bank Accumulation of Gold

Central banks have been steadily increasing their gold reserves, a trend that has been visible in countries like China, Russia, and India. These nations are looking to diversify their holdings away from the U.S. dollar, which has been the global reserve currency for decades.

In the base case, this steady accumulation of gold by central banks continues over this current next decade, providing consistent demand and supporting the gradual rise in gold prices.

With geopolitical tensions unlikely to fade, gold’s role as a key reserve asset could push it toward $5,000.

3. Slow but Steady De-Dollarization

While a full-scale de-dollarization is unlikely in the short term, there is growing momentum among nations looking for alternatives to the U.S. dollar.

Countries like Russia and China have already begun conducting more trade in their own currencies, and efforts to reduce reliance on the dollar are increasing globally.

In this base case scenario, a gradual shift away from the U.S. dollar fuels incremental gold demand as countries seek to diversify their reserves. This slow de-dollarization would provide a steady tailwind for gold prices, making $5,000 by 2030 an achievable target.

4. Supply Constraints Due to Mining Challenges

The supply side also plays a crucial role in supporting higher gold prices. Gold mining is becoming increasingly difficult, with fewer large discoveries and rising costs for extraction.

As supply tightens and demand grows, the fundamental imbalance could steadily lift gold prices.

In this scenario, supply constraints combine with inflation and central bank demand to push gold gradually toward $5,000.

Base Case vs. the Exceptional Case

While the base case for gold moving to $5,000 is based on current trends, what happens if more extreme conditions emerge? Gold could surge far beyond $5,000, potentially reaching $10,000 in case of:

- Runaway inflation;

- accelerated de-dollarization;

- or major geopolitical upheavals.

The following sections explore the catalysts that could lead to this exceptional scenario.

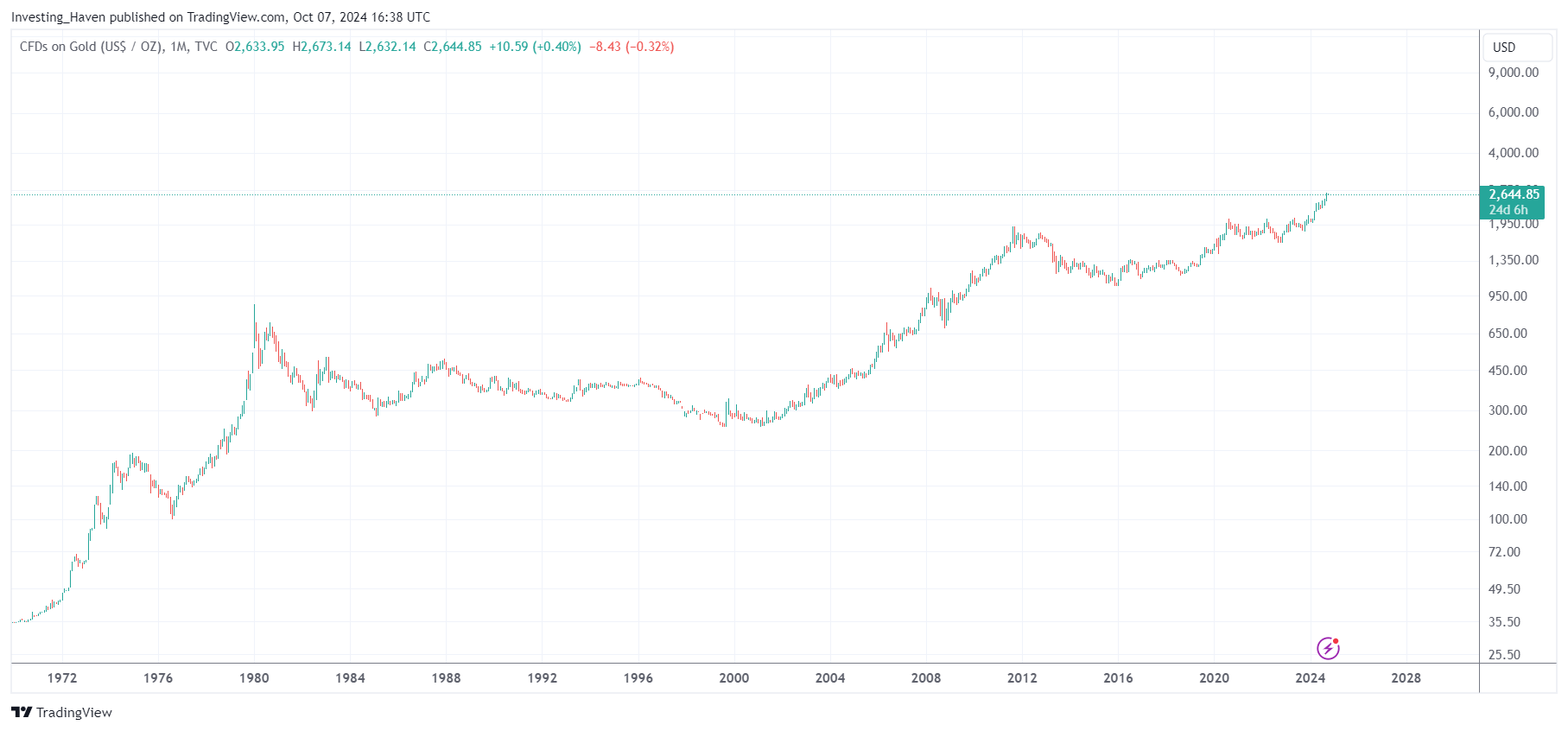

Before looking at each of the catalysts that might drive the price of gold to $10,000, we should visualize what gold at $10k looks like. Below is the monthly gold price chart over 60 years (1970 – 2030).

If gold were to hit $10,000 by 2030, it would move to the top right of this chart. Purely from a chart perspective, it not impossible but certainly a stretched scenario, also not a sustained scenario but more of a blow off top scenario.

Exceptional Case: Gold Surges to $10,000

1. Runaway Inflation or Hyperinflation

In the exceptional case, inflation spirals out of control, leading to a scenario similar to what we’ve seen in countries like Venezuela or Zimbabwe.

If the U.S. or other major economies experience runaway inflation, gold prices could skyrocket as investors flee collapsing fiat currencies.

Runaway inflation would amplify the demand for hard assets, and gold as the ultimate inflation hedge would be in extremely high demand

Under these conditions, gold could quickly rise past $5,000 and potentially hit $10,000 as investors seek safety.

2. Rapid De-Dollarization

While the base case assumes a slow de-dollarization process, the exceptional case envisions a more dramatic shift.

If a global economic crisis or political realignment leads countries to abandon the U.S. dollar ‘en masse‘, demand for gold as a reserve asset could surge.

This rapid de-dollarization would see central banks, especially in emerging markets, rushing to accumulate gold as a safe alternative to the dollar. Such a scenario could send gold prices soaring toward $10,000 as confidence in fiat currencies diminishes.

In 2023, officials came out stating that BRICS countries are preparing a gold backed currency:

It’s Official

RT (Russia sponsored TV) says the new BRICS-currency will be gold backed pic.twitter.com/YIjKwPTiTw

— Willem Middelkoop (@wmiddelkoop) July 7, 2023

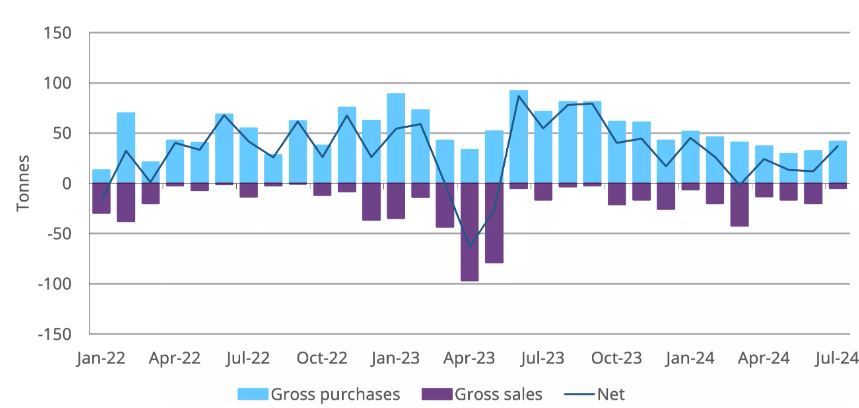

Note that central banks are currently already hoarding

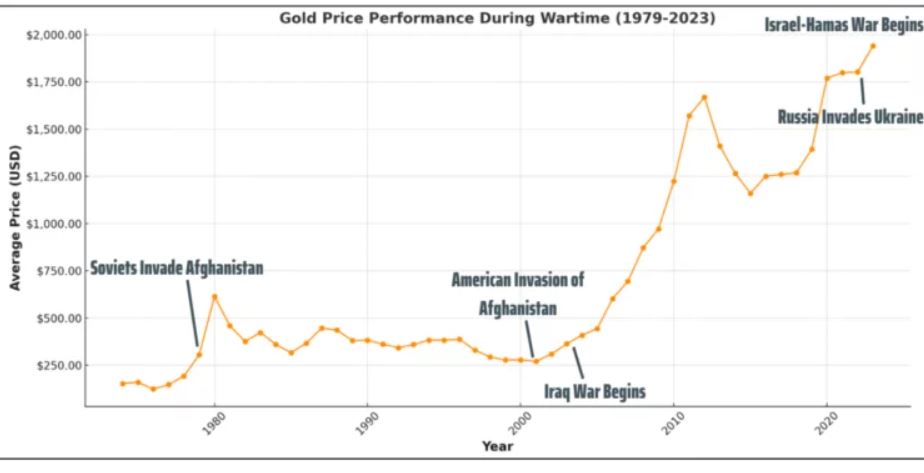

3. A Global Geopolitical or Economic Crisis

Gold has always thrived during periods of global instability. In an exceptional scenario, a large-scale war or another severe crisis could trigger unprecedented demand for gold.

In that scenario, investors but also the retail public, fearing the worst, would buy gold as the ultimate store of value.

Such a crisis could easily send gold prices into the $10,000 range. That’s because global markets could collapse and currencies devalue in response to extreme geopolitical risks.

4. Large-Scale Central Bank Buying

If central banks across the globe dramatically accelerate their gold purchases, the demand for gold could outstrip supply. This, in turn, would push the price of gold sharply higher.

This coordinated increase in gold reserves would signal a massive vote of no confidence in fiat currencies. It would trigger a rush toward gold that could drive it toward $10,000.

In a way, central bank gold buying is a strong trend since 2009. For gold to hit $10,000, this trend should accelerate.

5. [speculative] Rise of Tokenized Gold

While speculative, blockchain technology and the digitization of assets, including gold, could lead to increased liquidity and accessibility.

In an exceptional case, tokenized gold assets could become mainstream. This would allow investors from around the world to easily purchase and trade fractional shares of gold.

RELATED – The Future of Tokenized Gold: Bridging Tradition and Innovation

This rise of tokenized gold could lead to massive demand, further increasing prices and pushing gold toward $10,000.

Conclusion: Is $10,000 Gold Possible?

Gold reaching $10,000 an ounce may seem unlikely in the current environment, but exceptional conditions could make it a reality.

The base case of $5,000 by 2030 is more achievable based on current inflation.

However, gold might rise to $10,000 in case any or many of these conditions were to occur:

- Extreme central bank demand.

- Gold supply constraints.

- Runaway inflation.

- De-dollarization.

- A global crisis.

Whether it’s inflation, currency devaluation, or a digital gold revolution, the path to $10,000 gold is worth considering. However, it’s not the base case so don’t bet on it.