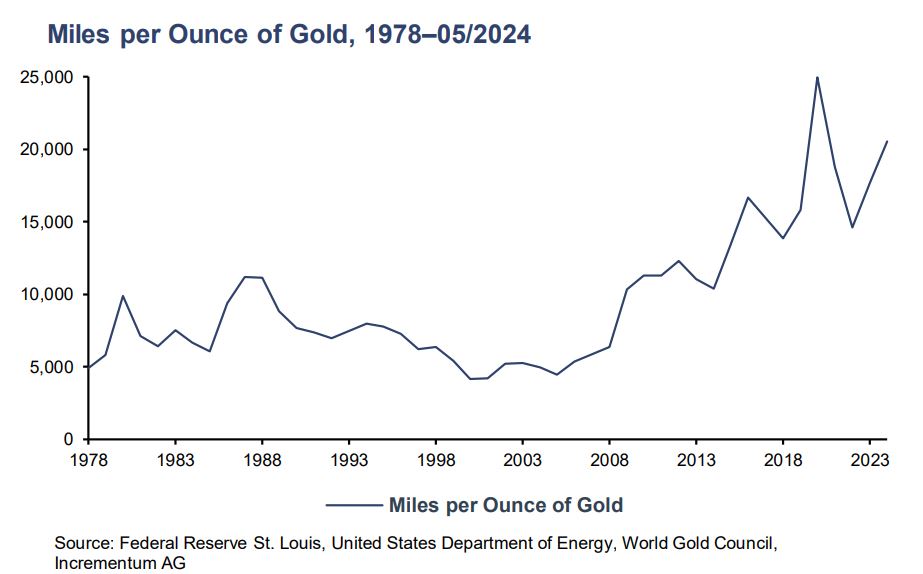

The miles per ounce of gold is close to hitting all-time highs in 2024. There is one take-away from this: gold is a hedge against rising prices, including gasoline.

Over the past several years, the price of unleaded regular gasoline has nearly doubled, prompting many to reconsider their travel plans.

The gold-to-gas ratio, a measure of how much gasoline can be bought with an ounce of gold, has been steadily climbing, reaching significant highs in 2024. This phenomenon underscores gold’s enduring role as a hedge against inflation and its practical benefits in mitigating the impact of rising fuel costs.

In this article, we feature insights shared by the latest edition of In Gold We Trust.

The Rising Cost of Gasoline

The cost of gasoline keeps on rising, this is its long term impact:

Since Independence Day 2016, the price of gasoline in the United States has surged from just over $2 to approximately $3.80 per gallon. This dramatic increase is part of a broader trend that has seen gas prices quadruple since the turn of the millennium.

Even though prices have eased slightly from their record highs in mid-2022, the cost of fueling up remains a significant burden.

This persistent upward trend in gasoline prices can be attributed to various factors, including geopolitical tensions, supply chain disruptions, and fluctuating crude oil prices.

Did you know that gold investors have not been feeling the pain of increased gasoline prices?

In fact, when compared to 4, 889 miles in 1978, an ounce of gold would allow you to travel 20,522 miles today. pic.twitter.com/NjymMEnMoK

— In Gold We Trust (@IGWTreport) July 3, 2024

Gold as an Inflation Hedge

Amidst the volatility of fuel prices, gold has long been regarded as a stable store of value.

Historically, gold has served as a reliable hedge against inflation, preserving purchasing power when fiat currencies falter.

The gold-to-gas ratio exemplifies this principle by illustrating how the purchasing power of gold has outpaced the rise in gasoline prices over time.

- In May 2023, an ounce of gold could purchase 16% more gasoline than it did the previous year.

- Comparing this to the pre-COVID-19 pandemic era, gold’s purchasing power increased by an impressive 41% by the end of May.

This trend becomes even more remarkable when viewed in a broader historical context. At the peak of the gold rally in the late 1970s, an ounce of gold could buy 925 gallons of gasoline. Although this high was short-lived, it highlighted gold’s potential to maintain its value amidst economic upheavals.

A Historical Perspective on the Gold-to-Gas Ratio

The gold-to-gas ratio has experienced significant fluctuations over the past few decades.

- After reaching its highest point in the 1970s, the purchasing power of gold in terms of gasoline plummeted, hitting a low of 247 gallons per ounce in March 1984.

- This was followed by a brief resurgence in the mid-1980s before entering a prolonged downward trend that persisted until the mid-2000s.

- In September 2005, the ratio bottomed out at just 156 gallons per ounce of gold. However, the subsequent years have seen a remarkable recovery, with the ratio climbing steadily.

- By December 2023, gold investors could purchase over 600 gallons of gasoline per ounce, and in May 2024, this figure stood at 626 gallons. This upward trend underscores the resilience of gold as a store of value and its effectiveness as an inflation hedge.

- The all-time high of over 900 gallons per ounce, achieved in May 2020, was largely theoretical due to travel restrictions imposed during the COVID-19 pandemic.

Despite this, the long-term trajectory of the gold-to-gas ratio remains upward, reflecting gold’s robust purchasing power in the face of economic uncertainties.

Gold to Gasoline ratio: Key takeaways

In recent quarters, the price of gasoline has come back from its record high in 2022, but it is still at a high level by historical standards.

The price of gasoline may be hitting households, but it is hardly affecting long term gold investors.

The takeaways as described in the special edition of In Gold We Trust 2024:

- The situation is completely different for gold investors. One ounce of gold currently buys more than 600 gallons of gasoline. This is 16.0% more than in May 2023 and more than 40% more than in May 2019. In September 2005, the historic low point of gold’s purchasing power, this number was only 156 gallons. Since then, the price of gasoline has roughly doubled, but the purchasing power of gold has quadrupled.

- The extremely positive trend in the purchasing power of gold is also evident when you consider significantly improved fuel efficiency, which has roughly doubled since the end of the 1970s. As a result, current vehicle models can travel around 20,5000 miles for an ounce of gold, whereas in 1978 the average was below 5,000 miles. Gold has therefore proved to be the ideal fuel.

Download the special edition here.

Follow In Gold We Trust on X or Linkedin.