Gold stands firm near record highs as rate-cut bets loom. Silver gains under tight supply while Platinum outpaces peers with a stunning 50% H1 rally.

Markets in mid-August 2025 highlight a sharp turn toward scarce, valuable metals. Safe-haven demand, expectations for Federal Reserve policy easing, and structural supply gaps keep metal prices on high alert.

Gold now trades around $3,340–$3,360 per ounce following weakening dollar and elevated rate-cut expectations, while silver and platinum chart robust gains so far this year.

Let’s look at the best-performing precious metals to watch August 2025

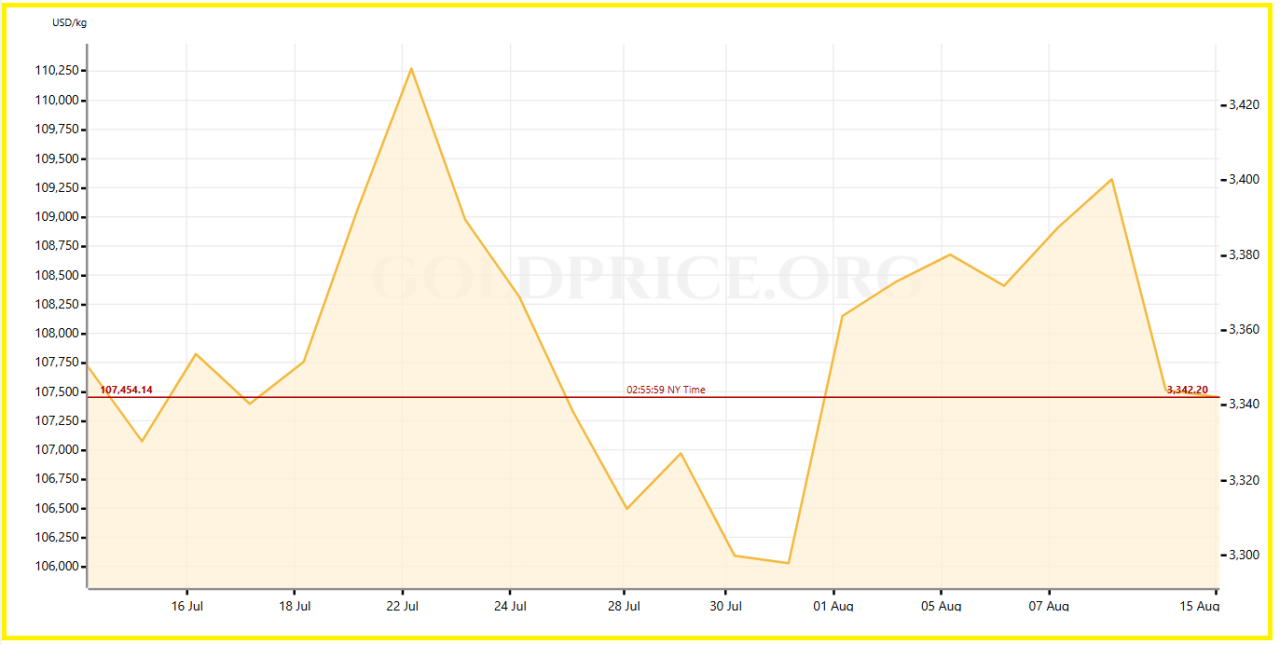

1. Gold – Safe Haven on the Rise

Gold rose modestly to $3,351.46/oz after U.S. consumer prices climbed only 0.2% in July, showing investor confidence in a September rate cut.

At the same time, the dollar slipped and rate-cut odds soared, making gold more affordable and attractive. Technical signals show that holding above $3,400 could unlock further upside.

RELATED: 5 Reasons to Buy Gold in 2025

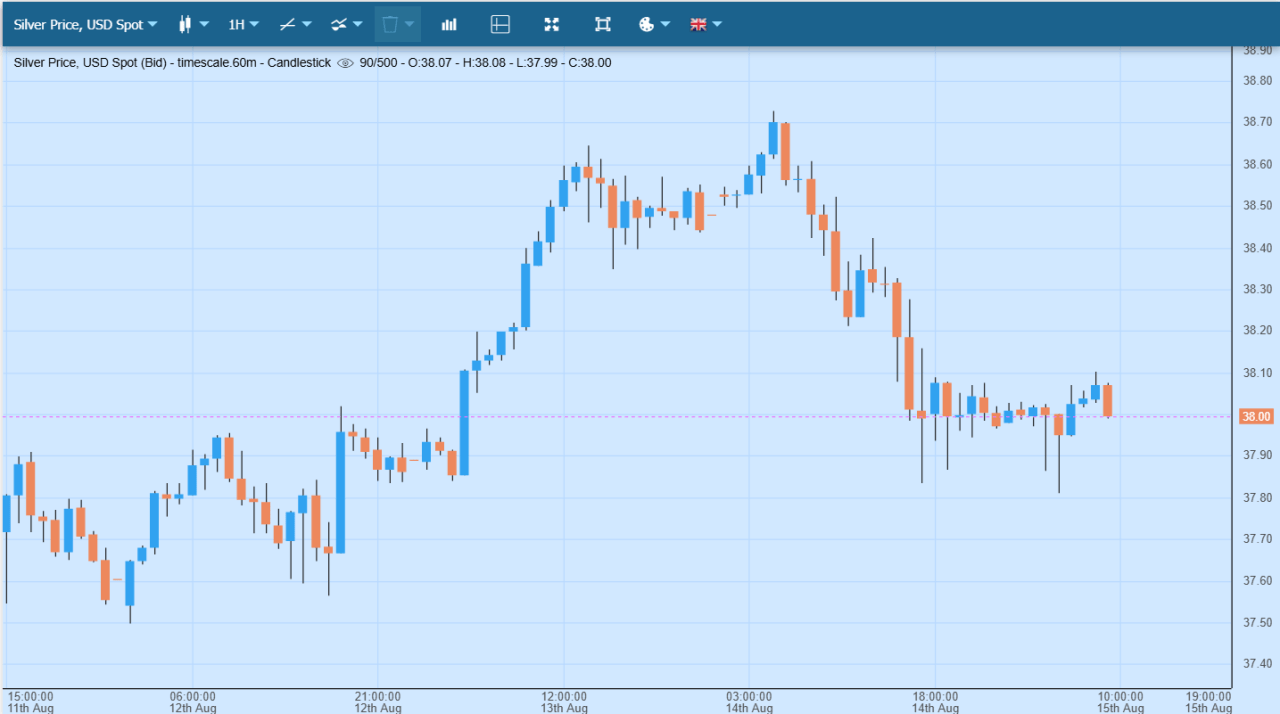

2. Silver – Tight Supply and Renewed Demand

Silver edges upward, trading above $38/oz again, with HSBC raising its average forecast to $35.14 for this year from $30.28, while projecting a massive 206 million-ounce silver supply deficit in 2025.

This sizable shortfall supports prices in the year ahead and adds weight to silver’s appeal amid persistent demand.

RELATED: Is Silver A Good Investment Right Now?

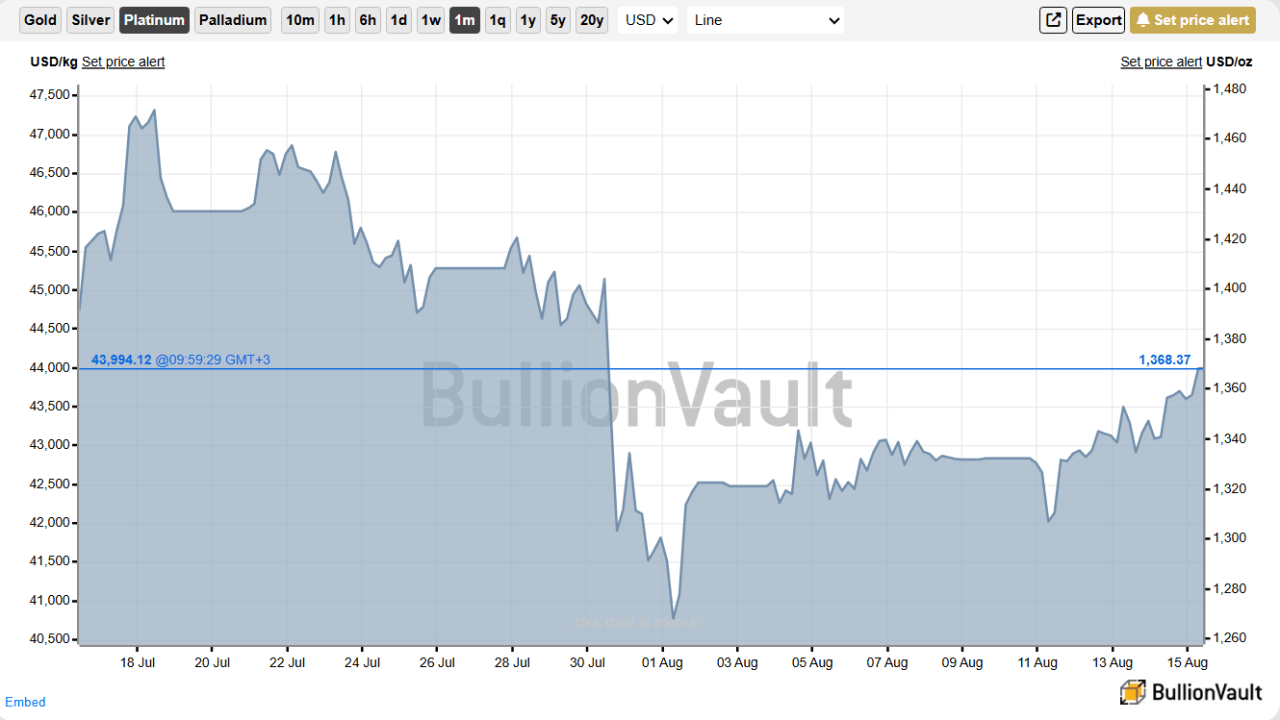

3. Platinum – Undervalued Powerhouse in Supply Crisis

Platinum jumped nearly 50% in the first half of 2025, rising from just over $900 in January to around $1,360 by June.

Supply remains constrained as output lags despite elevated prices, while demand grows across auto, jewelry, and green hydrogen sector.

Analysts call this sustained tightness a structural boon for continued gains.

RELATED: A Platinum Price Prediction For 2025

Conclusion

Gold stays attractive as a steady safe-haven given rate-cut anticipation. Silver earns upside from sharp supply gaps and positive outlook revisions.

Platinum shines as the year’s star, leaning on fundamental imbalances and emerging industrial applications. These three metals offer a blend of stability, momentum, and long-term value.

Stay Ahead of the Market – Get Premium Alerts Instantly

Join the original market-timing research service — delivering premium insights since 2017. Our alerts are powered by a proprietary 15‑indicator system refined over 15+ years of hands-on market experience. This is the same service that accurately guided investors through stock market corrections and precious metals rallies.

Act now and discover why thousands rely on us for timely, actionable signals — before the market makes its move.

Here’s how we’re guiding our premium members (log in required):

- Silver – Speculators Keep Exiting The Long Side. What Does It Mean?(Aug 16)

- Must-See Secular Charts: Precious Metals Mining Breakout & More (Aug 9)

- The Monthly Silver Chart Looks Good + A Special Harmonic Setup On The EURUSD (Aug 2)

- A Trendless Summer for Precious Metals? (July 26)

- Spot Silver in EUR Closes at Highest Weekly Level Ever (July 19)