As we head into the 2024, several compelling trends emerge in crypto, shaping the future of digital assets. In this article, we look at 5 cryptocurrency predictions that could define the crypto space in 2024 and 2025. From our crypto charts, we derive 5 trends that will shape the future of digital assets, beyond our XRP forecast 2024 and $10 XRP forecast.

In recent years, we published our cryptocurrency forecast, each and every year right before year-end. If anything, it can be said that most, if not all, of our cryptocurrency predictions came true. Only our 2022 cryptocurrency predictions were somehow postponed, but eventually were achieved in 2023 or are close to be achieved in 2024.

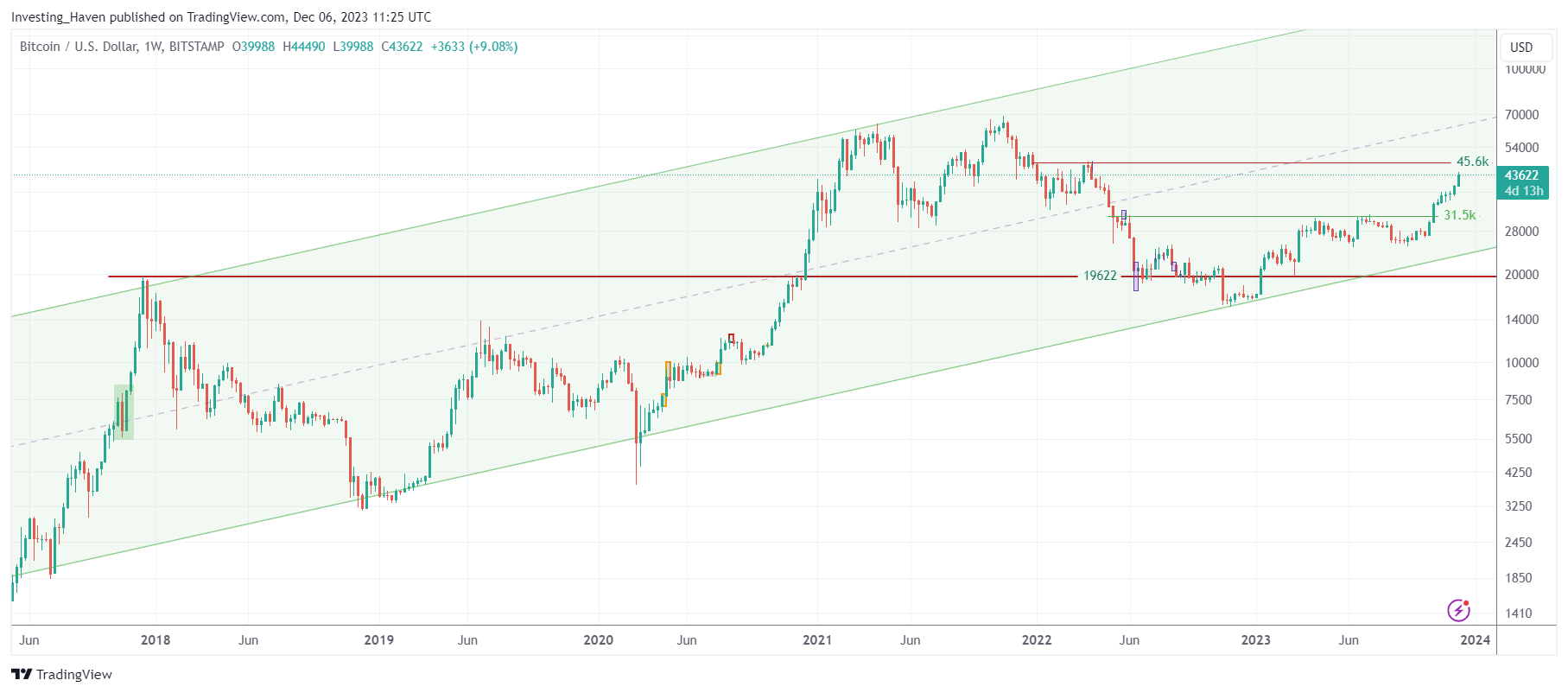

Crypto Prediction #1. Bitcoin’s Ascension to All-Time Highs

Bitcoin, the pioneer of cryptocurrencies, along with Ethereum, is poised for a remarkable journey in 2024. We explained our viewpoint, in great detail, in the following articles, cryptocurrency predictions published a while ago but highly accurate based on the current path of Bitcoin:

A Bitcoin Price Forecast For 2024

How High Can Bitcoin Go In 2024?

Will Bitcoin go to $100,000 in 2024, 2025 or 2026?

Our compass is the seven-year rising channel etched on its weekly chart, guiding us towards the anticipation of Bitcoin revisiting its previous all-time highs. As the market dynamics continue to evolve, Bitcoin’s resilience remains a cornerstone, offering investors a reliable pathway in the crypto universe.

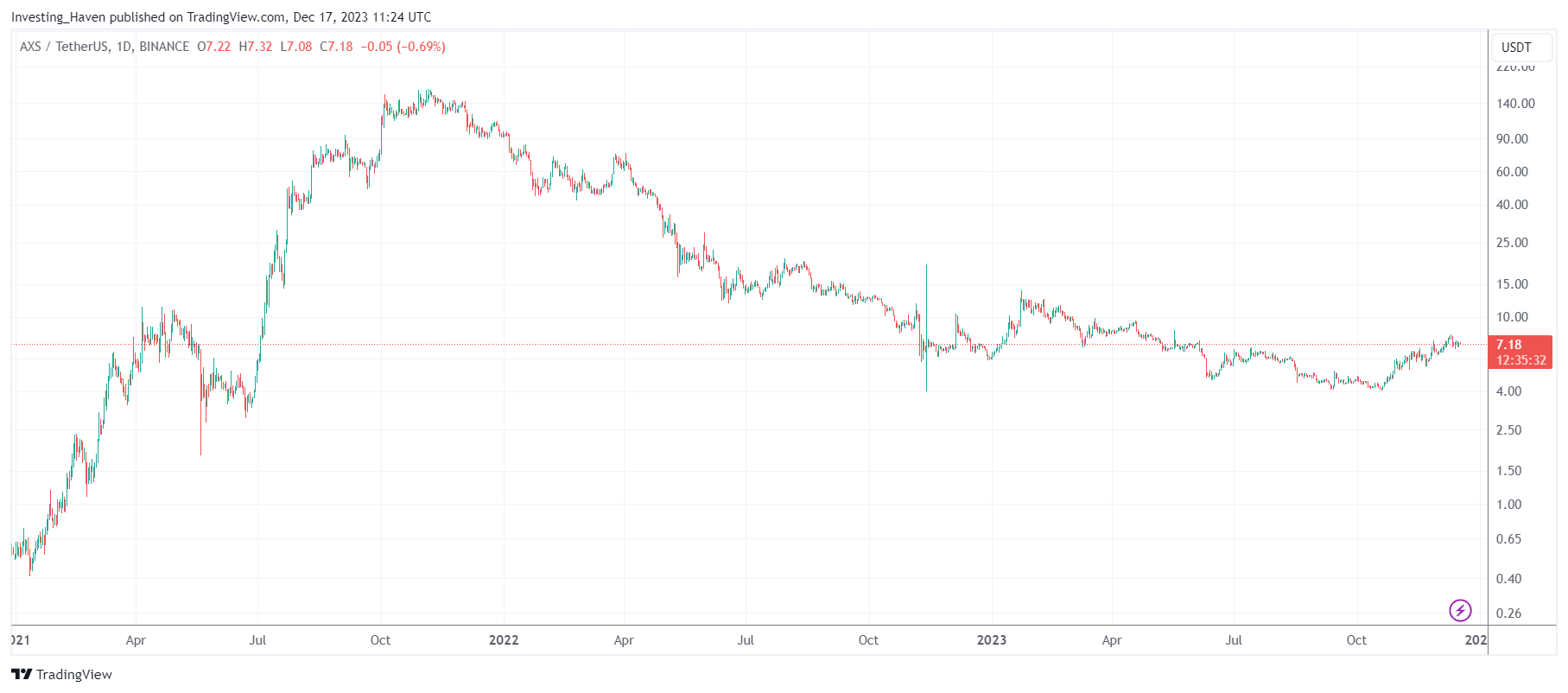

Crypto Prediction #2. Game-Fi Resurgence

In the ‘beaten down’ area of blockchain gaming, Game-Fi is set to reclaim the spotlight. Axie Infinity, a trailblazer in the sector, serves as our North Star, pointing to a resurgence of interest and activity.

The vast majority of investors will look at the chart of Axie Infinity, with a lot of disinterest, and run for the hills because it’s not hot. Over here, at InvestingHaven, we get unusually excited from Axie Infinity, simply because we see the bullish reversal that is clearly, visibly, certainly going to resolve to the upside. We believe that AXS will move to 40 USD, it will start in 2024 and might be complete late 2024 or in 2025. We stay focused on the future direction of this chart, not the current ‘lack of momentum’. In fact, we see momentum coming, it makes us unusually excited.

As blockchain gaming ecosystems mature, expect Game-Fi to captivate audiences anew, presenting exciting opportunities for both gamers and investors. For those that want to spot the best opportunities in Game-Fi, we recommend following our crypto investing research service because we will not feature the best Game-Fi tokens in the public domain.

Crypto Prediction #3. Real-World Applications, Tokenization and NFTs in Focus

The crypto sphere is on the cusp of integrating with the tangible world. Real-life applications, whether in tokenizing physical assets or expanding the horizons of non-fungible tokens (NFTs), are becoming a reality. 2024 could witness a transformative phase where blockchain technology steps out of the digital realm and makes a tangible impact on the real world.

Crypto Prediction #4. Micro Caps’ Meteoric Rise

The crypto market isn’t just about the giants; hidden gems in the form of small and micro-cap coins are poised for a spectacular ascent. A multitude of charts reveals bullish reversals, quietly biding their time for the opportune moment to explode. Throughout 2024, keep an eye on these underdogs, as they have the potential to surge a hundredfold, rewriting the narrative of crypto investments.

One of the illustrations of what we are saying is the token shown below. We are, on purpose, not showing the symbol, simply to avoid a misunderstanding (some readers might take it as a ‘buy recommendation’ which it isn’t). We use this chart as an illustration of the tremendous upside potential in some, not all, micro caps and nano caps.

Case in point: the token shown below had a market cap of 1.5m in October, it went up 20x in a matter of 3 weeks, after which it retraced. We are 100% sure that many more micro caps and nano caps will follow the same path. Note that the token shown below has another 20x upside potential.

Crypto Prediction #5. Meme Token Surprises, Beyond the Expected Names

Meme tokens, often characterized by unpredictability, are set to surprise. However, the stars of this show might not be the familiar names. Buckle up for an unpredictable ride, as a select few meme tokens, hitherto under the radar, could undergo a staggering tenfold increase. In the crypto world, expect the unexpected.

Our top meme pick was featured in our latest premium crypto alert, with very specific entry and exit areas, along with a strategy to multiple the tokens over a period of 2 years without doing anything. We recommend signing up to find out which meme token we are talking about, and read our strategy: Crypto – Time For Some Partial Exits And Free Tokens.

Conclusion

As we step into 2024, the cryptocurrency space promises excitement, innovation, and unforeseen opportunities. While the future is inherently uncertain, these five predictions offer a glimpse into the potential trajectories that digital assets might traverse. Whether you’re a seasoned investor or a curious enthusiast, navigating the crypto landscape requires adaptability and a keen eye for emerging trends.

Sign up to get top token tips which we will not feature in the public space >>