Edgewater Wireless, symbol YFI.V, is one of our favorite tech stocks in the nano market cap segment. With a $44M market cap and a great outlook this is a Ten-Bagger Tech Stock In The Making. And, more importantly, 2018 may be the last year in which you can buy Edgewater Wireless at a serious discount.

Note that we started covering Edgewater Wireless more than 2 years ago (read our 2015 article here). Since then the company has proven to have lots of potential because they have a great technological solution to a big problem: insufficient wifi bandwidth on large public venues.

We explained last year that we believe Edgewater Wireless has great fundamentals. This is what we wrote in our fundamental analysis section:

First, the company has clearly worked out a path to generate revenue. [The company has now] three product / market combinations which are worked out better than say one or two years ago. It suggests to us that the company is becoming better in getting successes, which, ultimately, is the basis of growth.

Second, the company is getting traction. That is an incredibly important pivot point for any startup.

Edgewater Wireless stock to buy in 2018?

The fundamental outlook for this company is great, and its chart looks also great.

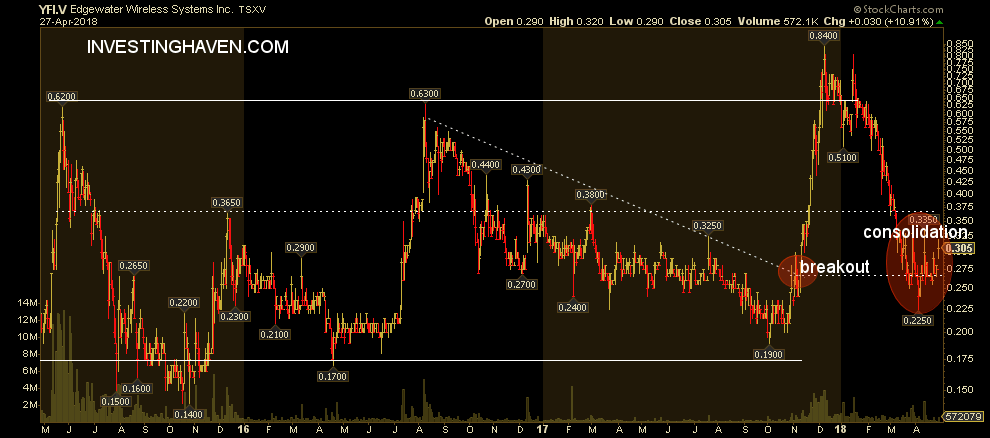

At first glance, it appears that the stock moves in one mega consolidation in the last 3 years. While that may be true it certainly is the 3-year view, not the 5-year view. Some 3.5 years ago the stock went from less than $0.10 to $0.62 in a matter fo months, a rally not visible on this chart.

In other words, once this long term consolidation resolves we expect Edgewater Wireless to go many multiples higher.

Why would 2018 be the year to buy tech stock Edgewater Wireless? Because this stock is basing 50% above it previous base. Note how $0.17 has been mega support in the previous 2 years. New support now comes in at $0.26, the breakout level of last November. The chart is clear, and it is an awesome setup!

This is not the type of opportunity you will get often. The chart has a clear message, the fundamentals are good, we believe this is a great nano cap stock with a very appealing risk/reward ratio. Note that this is a nano cap, always high risk, and investors must keep positions contained (max 2% of overall investable assets).