Is First Majestic Silver (AG) a silver stock to buy now or at a later point? The answer, most likely, is at a later point, although speculation could drive this stock significantly higher anytime soon.

According to our ‘start with the chart’ principle we have to check what the stock chart of First Majestic Silver says, preferably the long term chart (monthly timeframe, +10 years).

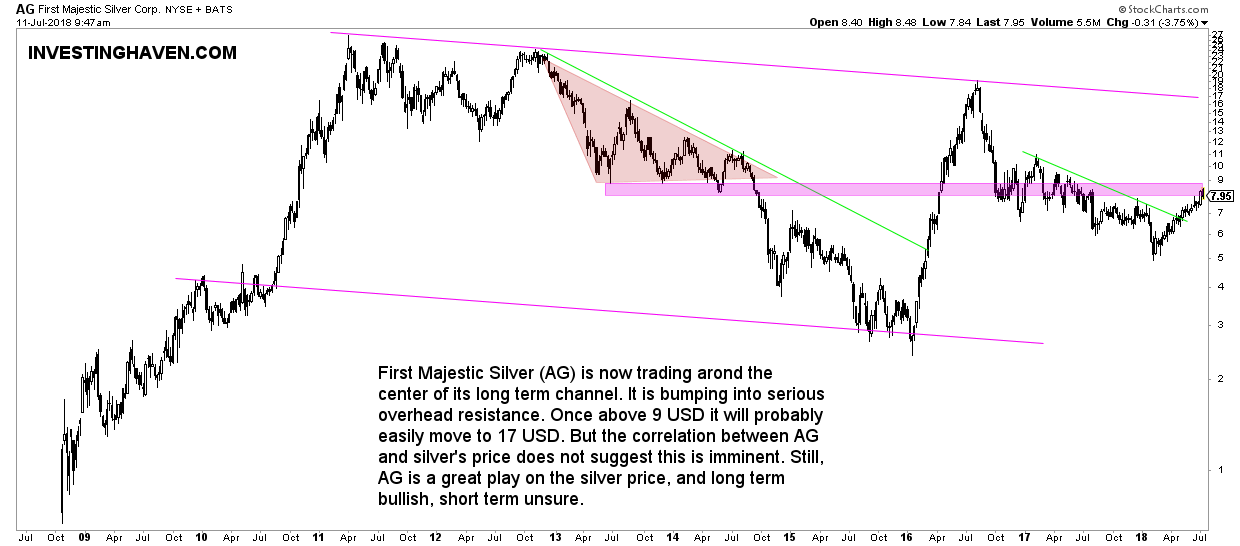

The long term pattern is a channel between $2.50 and $17, with a strong area at the center (purple bar). First Majestic Silver is now trading almost at the center of this range, right at resistance.

Note how a beautiful breakout took place (overcoming the green bear market line) in April of this year.

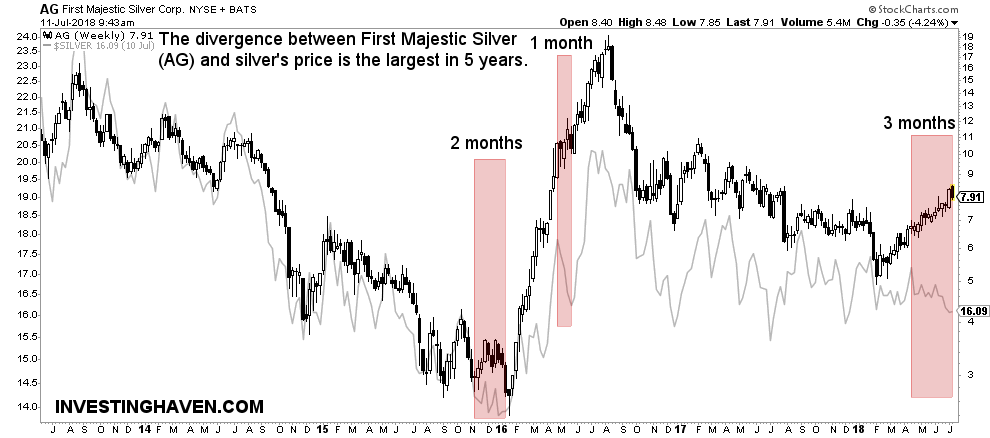

What is most surprising is that in the last 3 months First Majestic Silver has been rising while the silver price was declining and other silver miners (SIL) were flat. How is this possible, and what could it mean?

Interestingly, as the second chart shows, First Majestic Silver shows a strong divergence with the silver price. In fact, it is the strongest divergence in the last 5 years. The red bars indicate when First Majestic Silver was rising while the price of silver falling.

What could this divergence mean?

According to latest financial results of First Majestic Silver, published here, in May of this year, we see a healthy set of data: good production volume, costs under control, buyback of shares, healthy stream of projects.

However, we also find this statement: “Looking ahead, we plan to provide an updated production, costs and capital expenditure guidance in July to reflect the integration of the San Dimas operation.”

The only explanation that makes sense is that First Majestic Silver has been rising with a falling silver price because of speculation. Somewhere this month we should see an announcement on one of their projects. Maybe the market knows more or is anticipating an answer.

Given all this, we believe that First Majestic Silver is bought on speculation. Prices can certainly go higher, but given the speculative nature the question is whether it is justified to go long at this point from a risk management perspective. Likely not, unless its price breaks strongly above overhead resistance in which case it may be eyeing $17.

For now, we believe that First Majestic Silver is a great long term play, though the short term is unsure.