Lithium, a vital component in the production of batteries for electric vehicles and renewable energy storage, has been a focal point for investors seeking exposure to the growing clean energy revolution. In July of 2023, the lithium market presents compelling lithium investing opportunities based on three key charts that provide valuable insights.

We were able forecast this cycle as evidenced by our writings released a long time ago: How To Play The Green Battery Super Cycle In 2023. Moreover, in Which Green Battery Metal Looks Best As 2023 Kicks Off and Lithium Stocks Will Be Wildly Bullish In 2023 we confirmed the green battery metals sectors to focus on. More recently, we confirmed that Lithium’s The Mega Bull Market Is Resuming.

In this article, we confirm that it’s time to act. InvestingHaven’s research team spent countless hours compiling a report with top stocks report in the lithium & graphite space, based on deep fundamental analysis combined with chart analysis.

We suggest to stay away from the classic ‘which lithium stocks to buy’ articles as they feature the most obvious lithium stocks. To illustrate our point: the largest lithium miners, all present in those ‘lithium investing guides’, have activities in Chile which is close to nationalizing lithium properties on its soil.

Lithium Charts – Analysis

These charts reveal a potential stabilization and consolidation of the lithium price, a breakout in battery stocks, and the significance of retracement levels in determining long-term outlook. This article explores these charts and highlights the investment potential they offer for those interested in lithium investing.

This should not come as a surprise simply because there are plenty of data points that confirm the mega cycle in EV: China’s BYD EV sales are surging, Tesla confirms revenue targets, Rivian’s stock price is exploding, and so on.

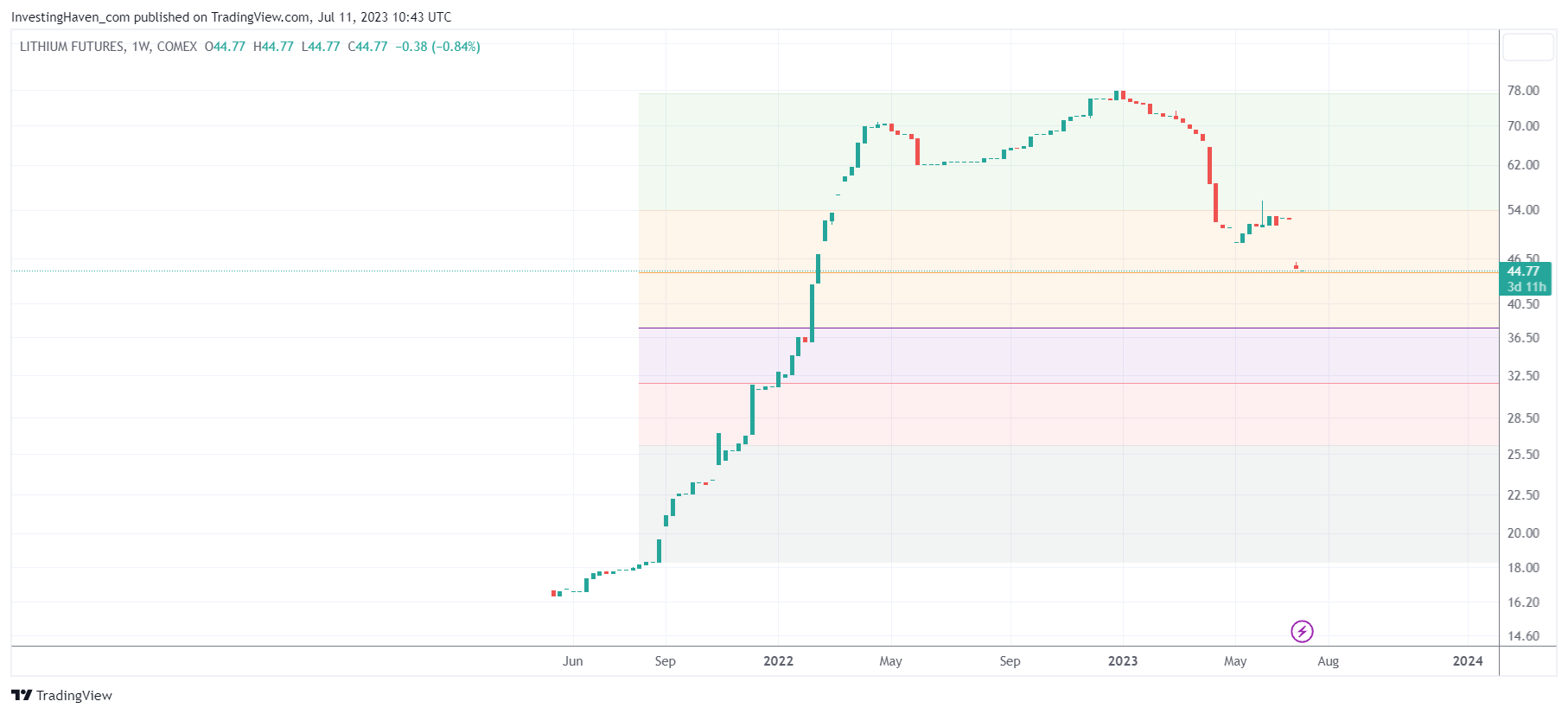

1/ Lithium Futures Retracement: The first chart demonstrates that lithium futures have retraced to the 38.2% retracement level, which is a significant support level. This retracement level often acts as a key inflection point, indicating a potential reversal or stabilization in price. The fact that lithium futures found support at this level suggests a favorable outlook for the commodity. Investors should monitor whether this support holds, as it could signal a resumption of the upward trend in lithium prices.

2/ Spot Lithium in China: The second chart focuses on spot lithium in China, which experienced a significant crash followed by a recovery. Currently, spot lithium is consolidating around the 50% retracement level, a critical level for assessing the long-term outlook. This consolidation phase at the 50% retracement level is encouraging, as it indicates a potential stabilization of prices. A stable lithium price is favorable for investors, as it suggests a more predictable market environment and a stronger foundation for long-term growth.

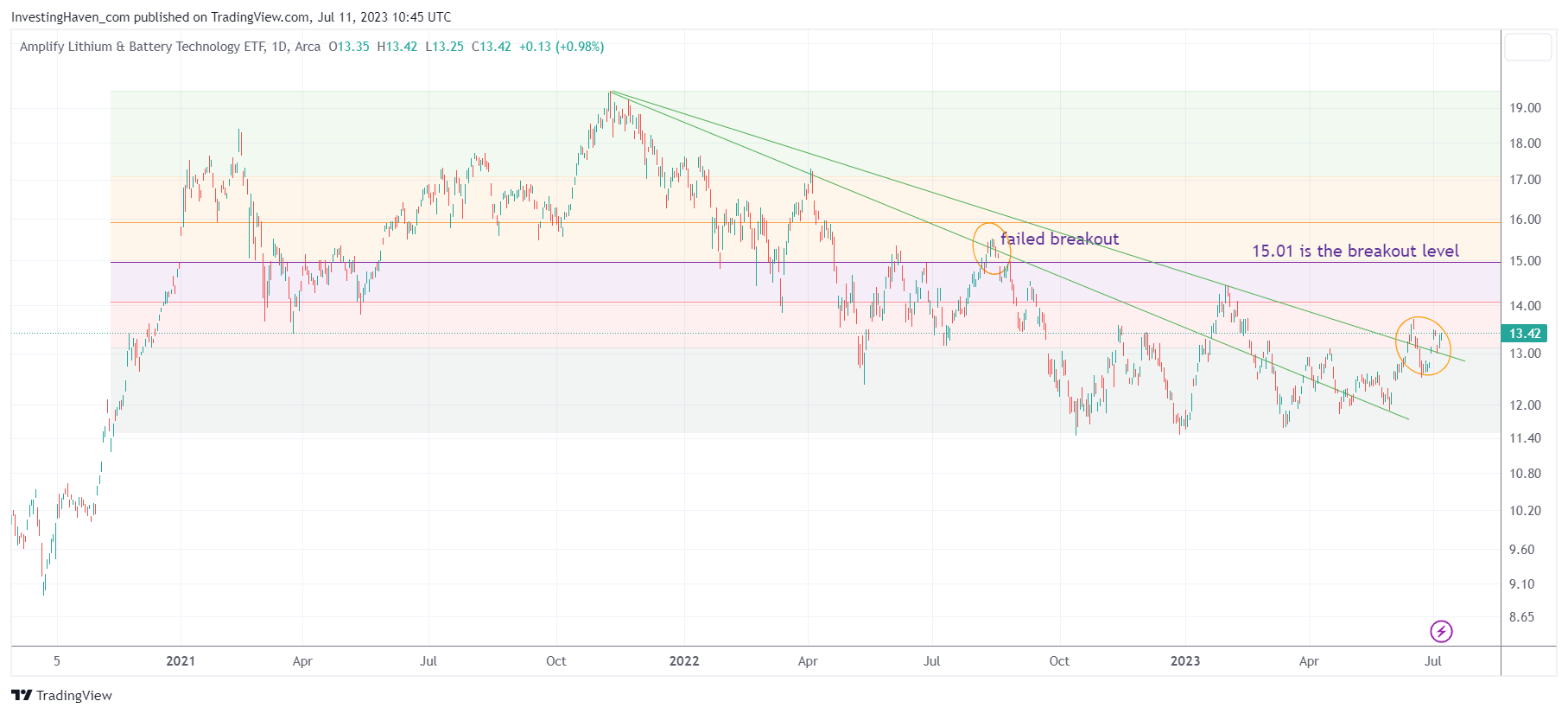

3/ Battery Stocks Breakout: The third chart highlights the performance of battery stocks as represented by the BATT ETF. It reveals a breakout in these stocks, indicating a shift in momentum and bullish sentiment. The long-term bullish reversal nearly reaching completion suggests that battery stocks are poised for a significant run. This breakout is noteworthy for lithium investors, as the demand for batteries is a key driver for the lithium market. Investing in battery stocks can provide exposure to the growing demand for lithium-ion batteries in various sectors, including electric vehicles and renewable energy storage.

Lithium Investing Opportunities

Based on the analysis of these charts, the lithium market presents compelling investment opportunities in July of 2023. The stabilization and consolidation of spot lithium prices, along with the support level found by lithium futures, suggest a positive outlook for the commodity. Investors looking to capitalize on this potential should consider quality lithium and graphite stocks.

The breakout in battery stocks, as indicated by the BATT ETF, further reinforces the optimistic outlook for the lithium market. Battery stocks can provide exposure to the increasing adoption of electric vehicles and renewable energy solutions, which will drive the demand for lithium-ion batteries. However, investors should exercise caution and conduct thorough research to identify quality stocks within the lithium and graphite space.

Quality stocks in the lithium and graphite sector offer the best opportunities for investors seeking to participate in the lithium market. These stocks possess strong fundamentals, robust growth potential, and a solid market position. By focusing on quality, investors can minimize risk and maximize their chances of capitalizing on the anticipated growth in the lithium market.

Conclusions

The charts showcasing the retracement levels, spot lithium consolidation, and battery stocks breakout point towards promising opportunities in the lithium market in July of 2023. With the potential stabilization of lithium prices and the positive outlook for battery stocks, investors have a favorable environment to explore investment opportunities in the lithium and graphite sector. However, it is crucial to conduct thorough research and select quality stocks to maximize returns and mitigate risks. By seizing the current momentum and focusing on quality investments, investors can position themselves to benefit from the epic lithium investing opportunities that lie ahead.

We highly recommend reading our detailed report with top stocks report in the lithium & graphite space, which we created based on deep fundamental analysis (deposit size, grade, richness, location, mining type) combined with chart analysis.