2023 is around the corner. In our most recent Green Battery Metals Forecast we stated that lithium, graphite, cobalt, nickel should do really well. We also mentioned that all these green battery metals will move in cycles. In this short post we look at spot lithium, cobalt and nickel to understand how they look medium term and long term. We assume no market crash in 2023 but rather a constructive market environment in which green battery metals can thrive.

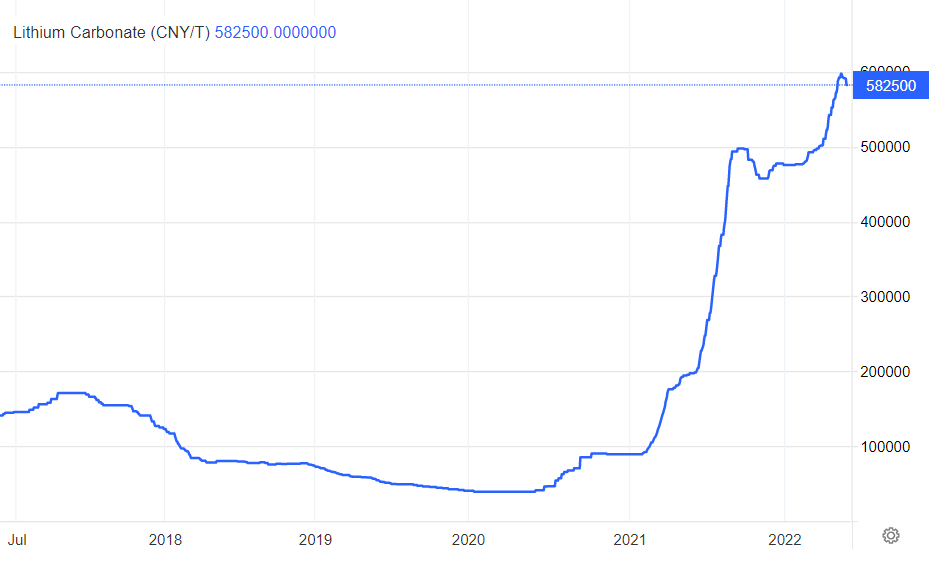

About a month ago, we observed Lithium Price Breaking Out Aggressively, Lithium Miners Will Follow Suit.

The price of lithium was accelerating its move higher while lithium miners were lagging behind. Lithium producers went sharply higher in the last 2 months, most of them peaked around all-time highs. Juniors are yet to follow.

The lithium price chart looks insanely strong. The million dollar question is where the turning point comes in. Presumably, there is no turning point yet, a consolidation right below 60k is likely.

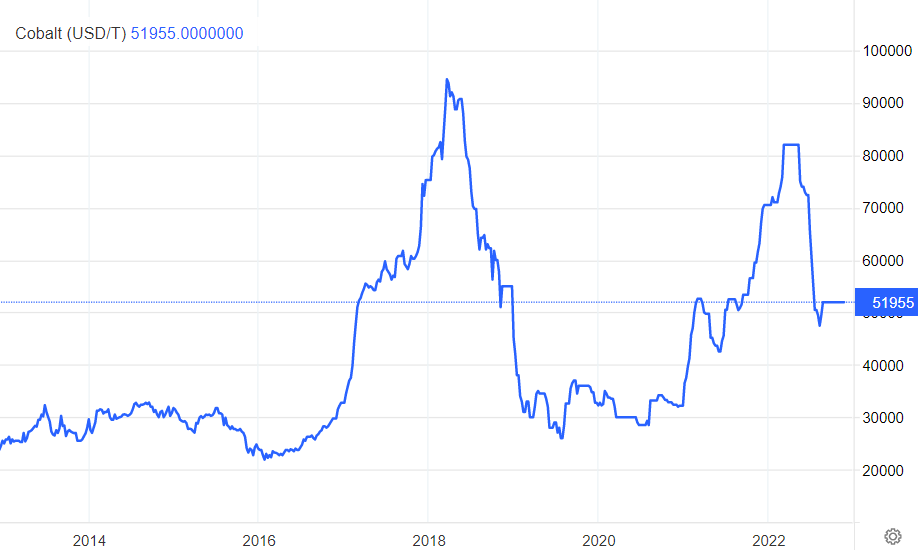

The price of cobalt has a very different chart setup.

Early this year, the fast move to 80k USD/t coincided with a turning point. A fast decline occurred around spring and summer. Since then, the cobalt price is flat. We believe it is flat before a next run higher. Based on this chart, we can vividly imagine that 2023 might be bullish for the cobalt price (also for most cobalt stocks although it is a niche market).

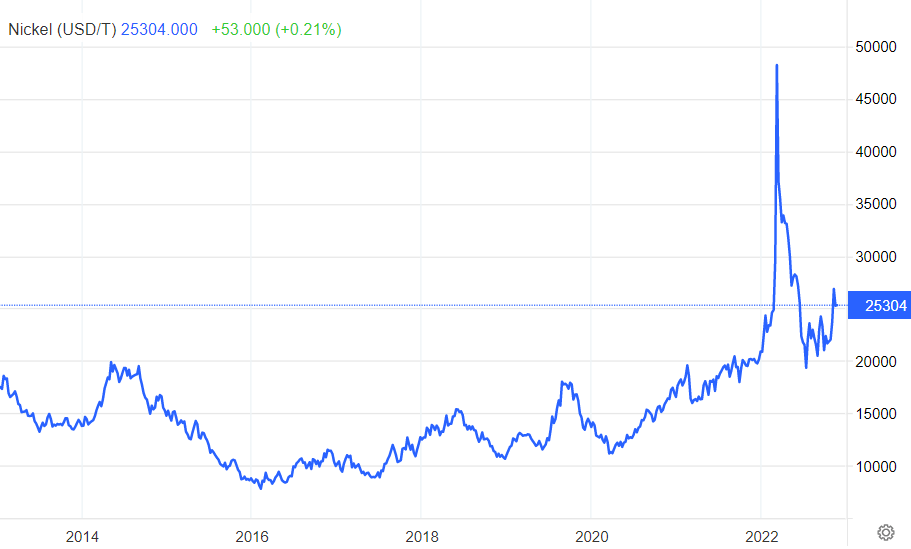

Last but not least, the price of nickel.

When the Russian invasion in Ukraine occurred, the price of nickel exploded. However, the price rise was too fast and the subsequent decline was furious.

After a few months of a consolidation, we currently see a ‘juicy’ setup. This means that the potential for a continued rise in the price of nickel is very high. We believe that nickel will do well in the short to medium term. Consequently, nickel miners should do well. Note that nickel miners are a niche market, similar to cobalt miners. Investors need to thoroughly understand players and their resource(s) when picking nickel or cobalt stocks.

Investors interested in capitalizing on the long-term uptrend of lithium stocks should consider consulting our top lithium & graphite selection. In it, we share a very clear investing strategy based on risk/reward considerations. Out of hundreds of lithium & graphite stocks, we did make a selection of 15 top lithium & graphite stocks, based on fundamental analysis (including grades, deposit size, year of production, location) combined with charting analysis.