Last week we wrote Emerging Markets Chart: A New Must-See Trend For 2020. In that article we identified a new secular bull market in the group of emerging markets. This is in line with our annual forecasts in we predicted many months ago that emerging markets will be bullish in the next 24 months. We believe that 2020 will be mildly bullish. Even though we selected 4 Top Emerging Markets for 2020 being Brazil, Vietnam, Australia and potentially China. In this article we review the general trend in emerging markets which looks gorgeous (with each passing day better) as well as China and Japan which are continuously improving as well.

This article is all about monthly charts, in other words the secular trends. These are the trends investors want to be look for, and invest in the most bullish ones.

Secular bull markets can double our capital in 24 months, with just two well thought through positions.

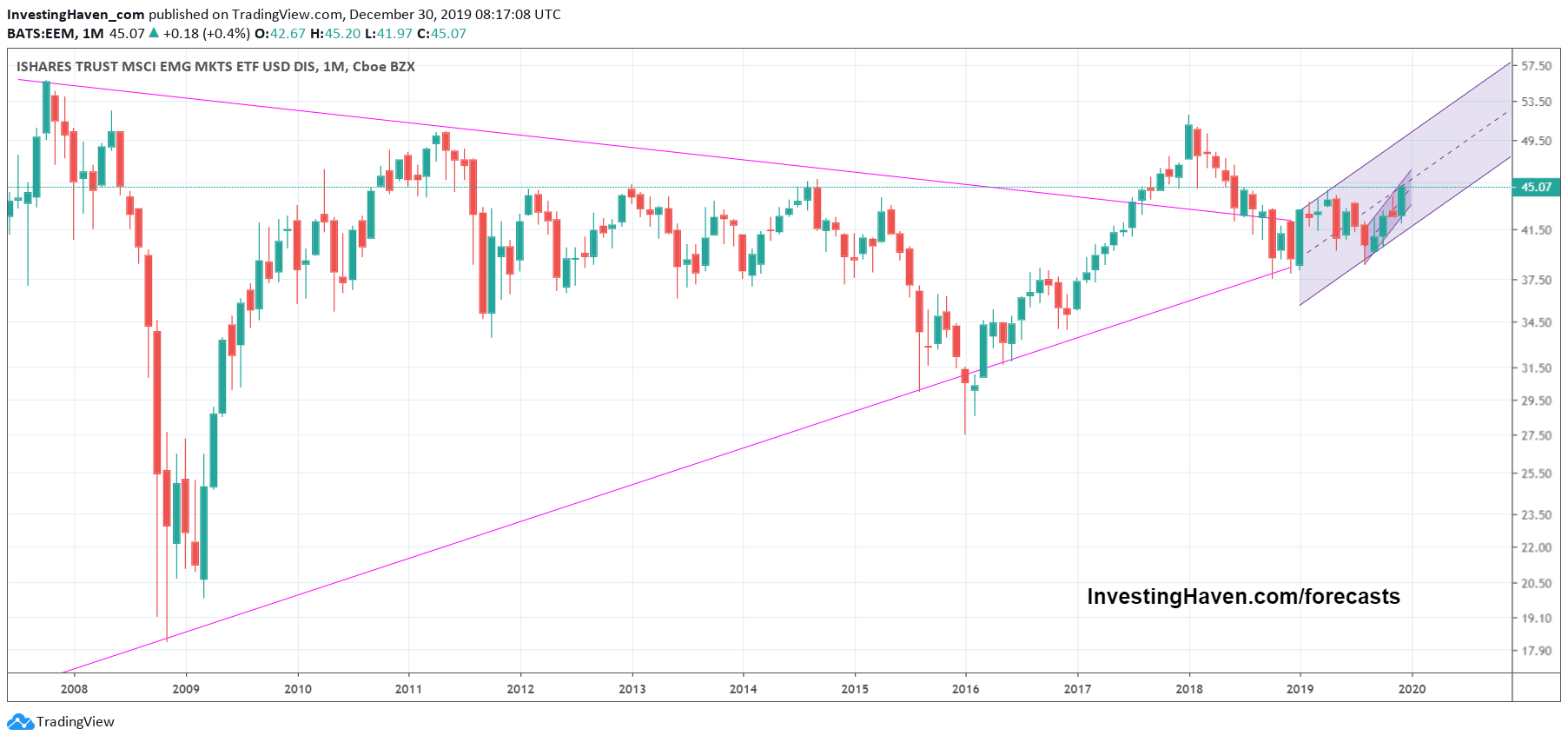

The monthly emerging markets chart features a giant triangle pattern over almost 2 decades.

However, THE most important observation on this emerging markets chart is the inception of the new trend in the form of a rising channel.

Today nobody expects emerging markets to be bullish because of trade wards, fears, economic recession, etc. As per Tsaklanos his 1/99 Investing Principles we expect 99% of investors to think this way, nicely lured into a bearish perception created by financial media.

We are on record here at InvestingHaven to be part of the 1% that is bullish on emerging markets, and that we will be part of the group of investors that will take 99% of profits. Note that we launched a method to even increase the profit potential with our newly launched emerging markets trade alerts.

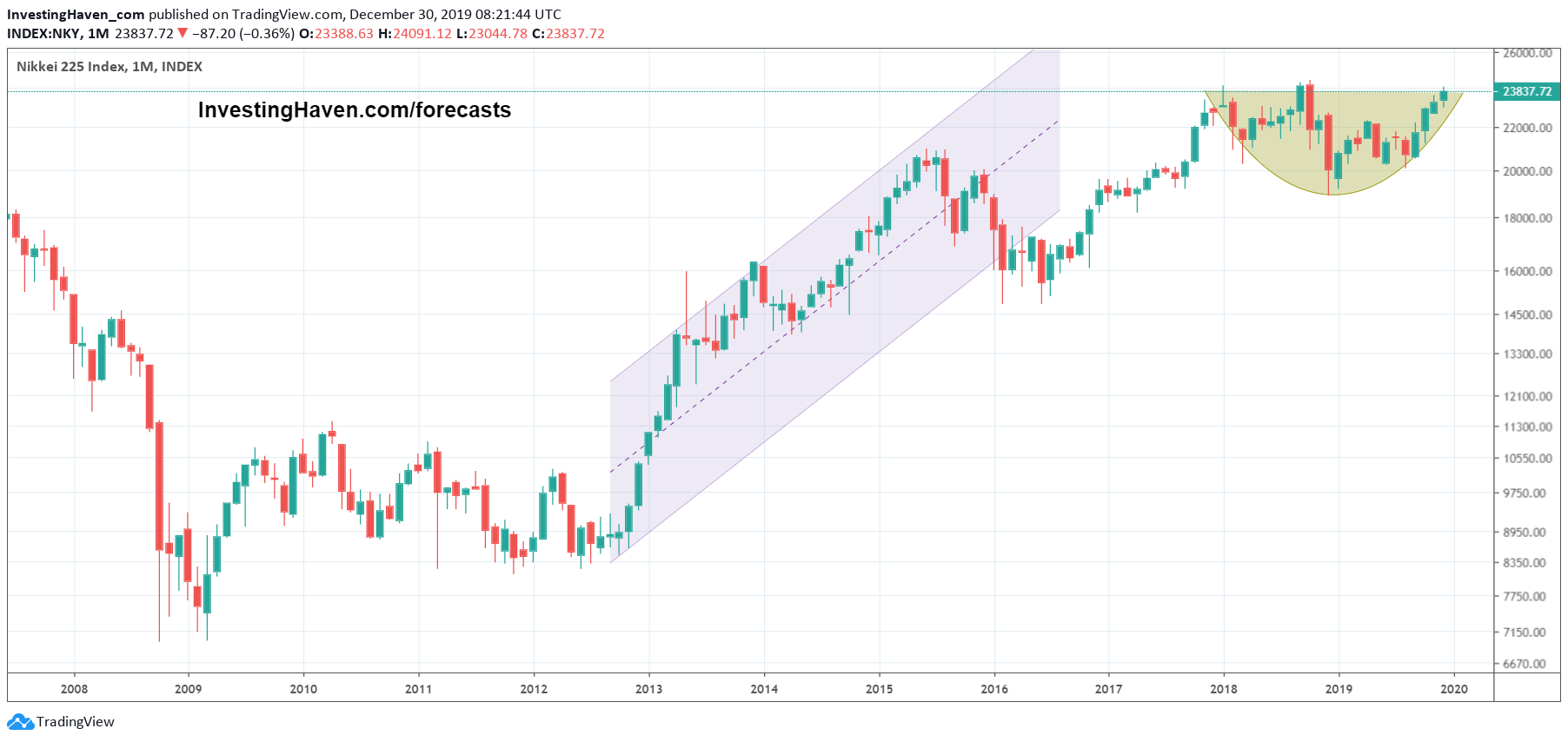

More specific is the Japanese stock market index Nikkei 225 featured below.

The Nikkei 225 is known to have powerful uptrends. Case in point: 2012 to 2015, a 225% rise in less than 3 years!

What we like a lot about this chart is the rounding bottom, a saucer base, which looks set to break out now.

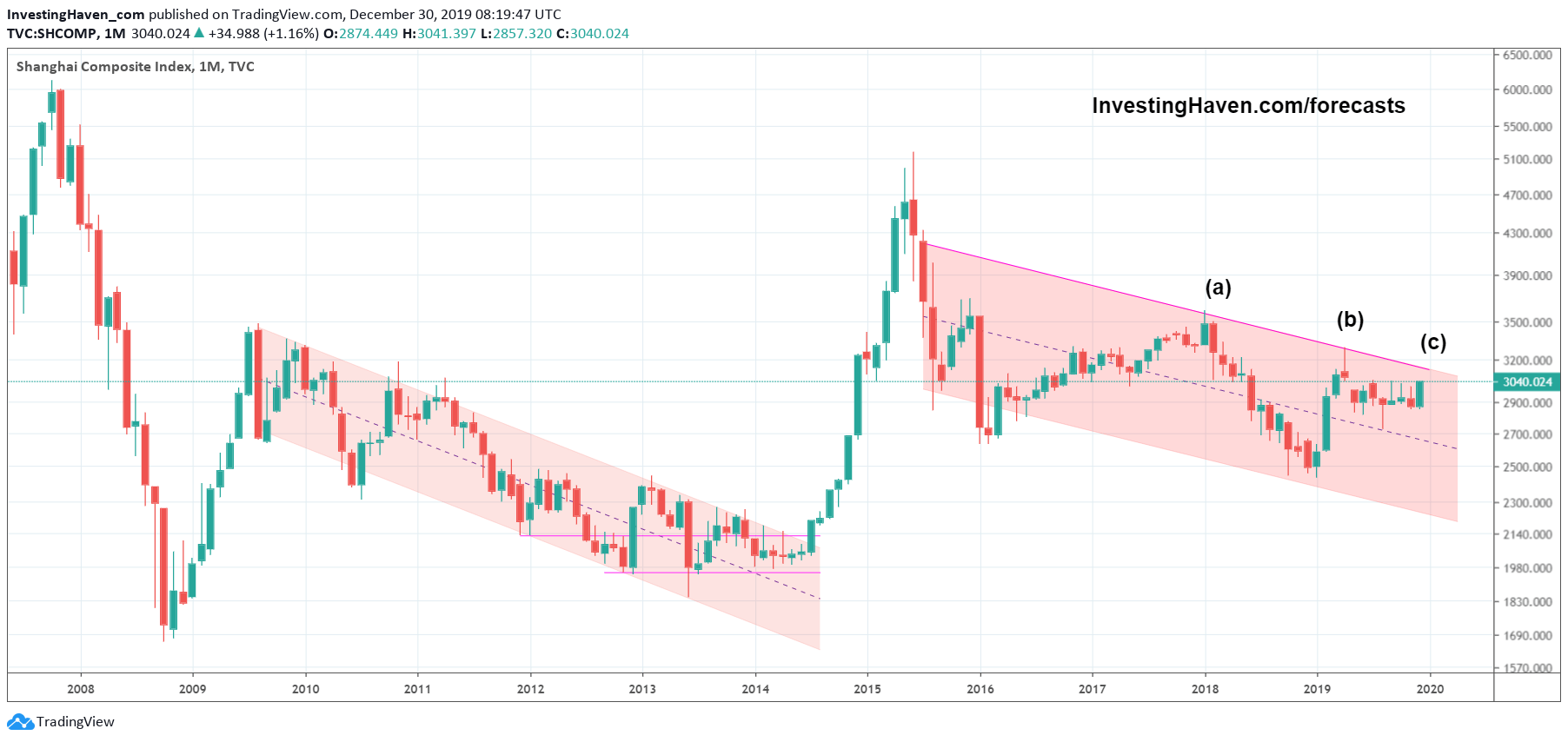

Moreover, China is one of the most profitable emerging markets (look at the breath taking 2014/2015 rally). China’s stock index SSEC is ready to test resistance for a third time. As we all know the third test often results in a breakout. Will this time be different? We will soon find out!

As said before this type of powerful new bull market need a special approach. We recommend doing 2 things simultaneously:

- Pick two long term positions. Buy and hold the most promising assets in emerging markets, for instance small caps in Brazil combined with the Vietnamese index. This is just an example, not meant to say we absolutely recommend doing this. It’s an illustration.

- Complement these long term holdings with with shorter term trades! Why? Because of the reinforcing effect they have. That’s why we strongly suggest to consider shorter term oriented trades in emerging markets as well (on top of long term holdings). Our trading algorithm specifically designed for emerging markets delivered a return of 393% in 2019. This can be verified with our detailed trade log book featured in our premium trading service. However, this algorithm is designed to perform even better in strongly trending emerging markets. As emerging markets clearly started a new powerful bull market we expect better results then 393% in 2020.

That’s why we strongly believe that the next few years will be amazing for our trading algorithm, and that our emerging markets category in our trading service will deliver phenomenal results.