So far the naysayers: markets did not crash, on the contrary. There were no signs whatsoever of a crash in our crash indicators. All we saw was a possibility of a healthy retracement, nothing more nothing less. However, the market decided to move higher. This is the start of a new 3 month cycle, so we pay extra attention to what’s happening at critical price points.

We focus on the S&P 500 in this article.

The chart we include in this short post comes from this weekend update, and exceptionally we’ll pick out a few quotes from our weekend reading to premium members.

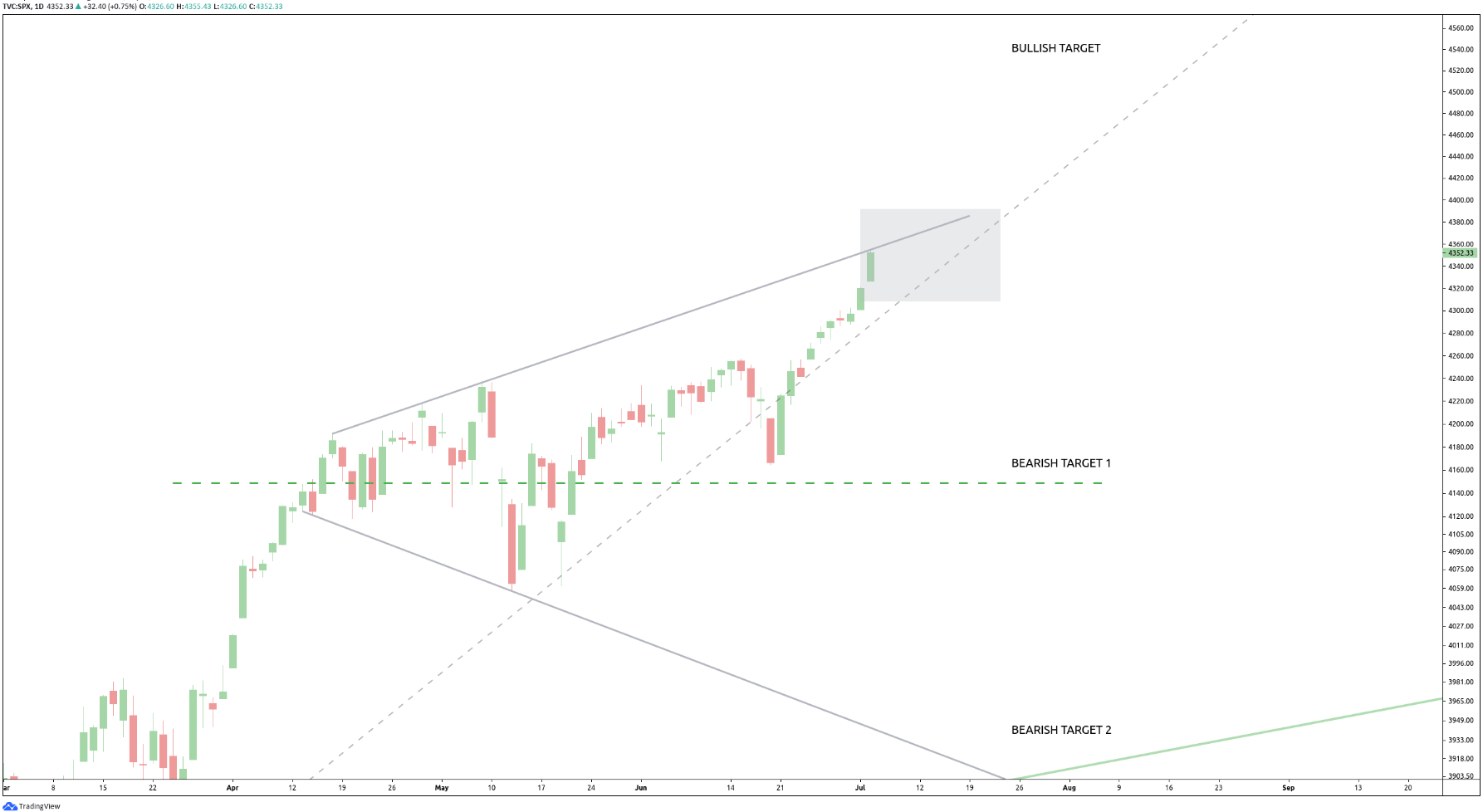

The S&P 500 daily chart has this megaphone pattern which we noticed more than a month ago. Note that we are not trading patterns, our algo flashes buy/sell signals based on price point analysis and calculations. However, as humans we can easily spot patterns which explain why our algo flashes signals.

Megaphone patterns on the daily chart are not common, is what we wrote in our premium service. From our research it appears that megaphone patterns are common on short term charts, but the difference between those patterns on short vs. long term charts is that they tend to lead to failed breakouts and failed breakdowns on the short term charts.

This is the way we read this chart, and what we copied from our premium research:

- The bullish outcome of the above megaphone pattern is a breakout above Friday’s high. This would open the door to 4570 points (approximately).

- The bearish scenario would bring the S&P 500 to the 4150 ~ 4100 area. Ultimately, this index may fall to around 3900 points. This is not a forecast, it’s a possibility.

We believe that the most likely scenario is bullish one. We cannot exclude a good consolidation with a some continuity reversals which will continue to push this index to a series of new ATHs.

Note that this is not a forecast. We rather outline possibilities. And short term trading requires market participants to have no bias nor be acting/thinking from forecasts. All that matters is factual price analysis and trend following. That’s why an algorithm is so important.