The idea of a stock market crash continues to dominate media. It seems to be such a fascinating idea that experts keep on warning about a doomsday scenario which media are happy to pick up. Our market forecasts are not picked up and that’s fine because we are not here to sell clicks, we are here to share quality insights, as good as we can. All our 2023 forecasts are based on thorough research. Here are two strongly conflicting data points which suggest that economic experts are either lying or totally confused. Who knows, maybe it’s both.

The latest organization to shake up the world was the World Bank:

World Bank makes big cut to its 2023 growth outlook, says globe is ‘perilously close’ to recession

The World Bank slashed its 2023 global economic growth rate outlook to 1.7% from its earlier projection of 3.0%. We opened their Global Economic Prospects, a detailed pdf file, which starts with the following sentence:

The crisis facing development is intensifying.

This is the paragraph that follows the first sentence:

Our latest forecasts indicate a sharp, long-lasting slowdown, with global growth declining to 1.7 percent in 2023 from 3.0 percent expected just six months ago. The deterioration is broad-based: in virtually all regions of the world, per-capita income growth will be slower than it was during the decade before COVID-19. The setback to global prosperity will likely persist: By the end of 2024, GDP levels in emerging-market and developing economies (EMDEs) will be about 6 percent below the level expected on the eve of the pandemic. Median income levels, moreover, are being eroded significantly—by inflation, currency depreciation and under-investment in people and the private sector.

You would think that you are totally crazy if you continue to believe that a market crash is not imminent, right?

Almost the exact same day comes Atlanta Fed’s GDPNow tracking model which now estimates that real GDP will rise to 4.1% in Q4/2022 in the US. From their site:

Latest estimate: 4.1 percent — January 10, 2023

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.1 percent on January 10, up from 3.8 percent on January 5. After recent releases from the Institute for Supply Management, the US Bureau of Labor Statistics, and the US Census Bureau, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth increased from 3.2 percent and 5.8 percent, respectively, to 3.5 percent and 6.8 percent, respectively.

Interesting conflict?

There is even more.

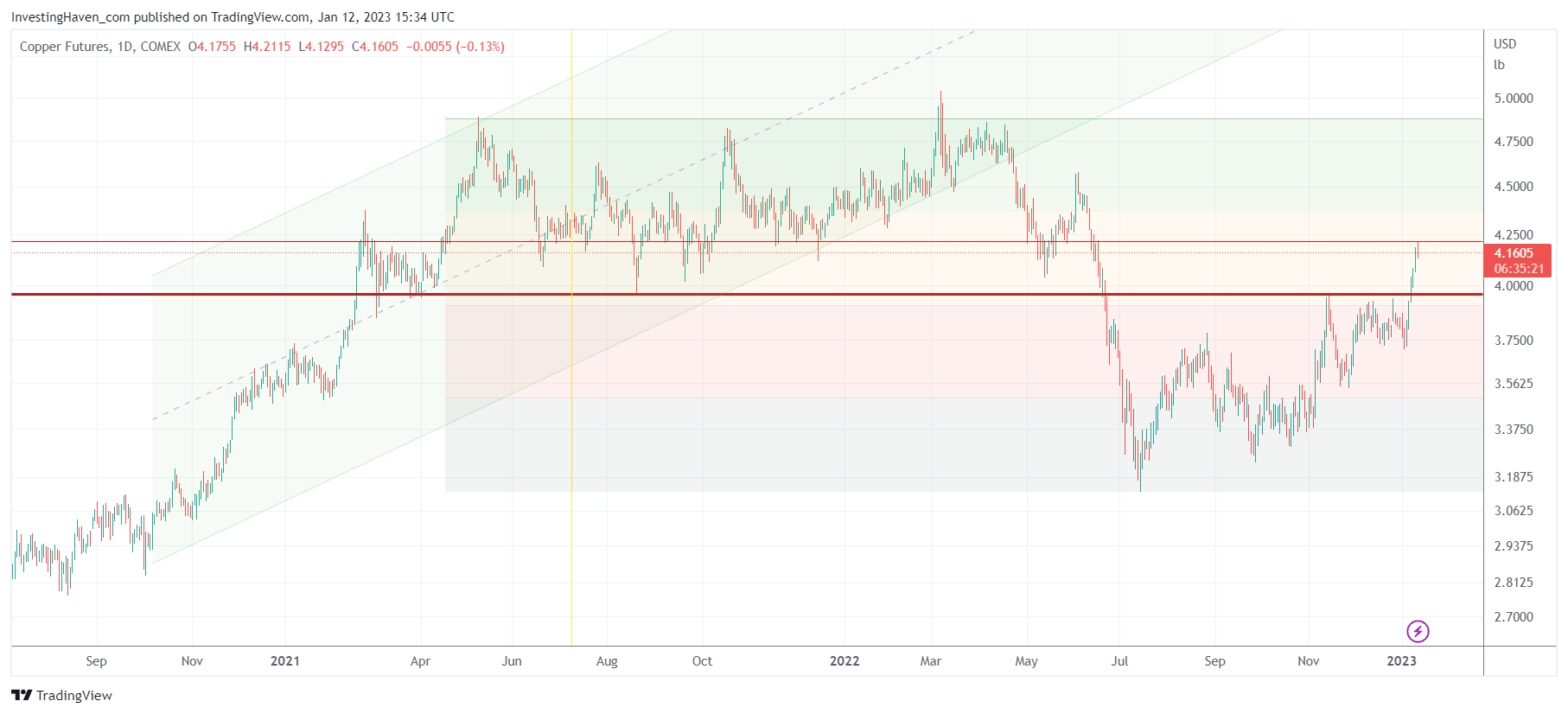

As suggested by Yardeni Research, there is another and even more conflicting data point: Dr. Copper.

Dr. Copper has a track record of tracking the world economy. It is a global indicator, in other words.

As seen on its daily chart, it now trades above its 50% reversal (in the yellow area). No crash nor global recession underway, is what copper as an indicator is suggesting.

The monthly chart is even more interesting: it recovered from a successful breakout test in 2022 and is now in a ‘breakout area’.

Although all these data points are subject to change they seem to be contradicting the doomsday warnings from the World Bank.

One of them is the The Single Most Important Chart Of 2023 that we published in the public domain last week. This clearly is suggesting a recovery of global markets, not a crash.

There are many more must-see charts available in our recent research work, instantly available in the restricted area of our Momentum Investing service. One of them is this must-read research note Must-See Charts: Q1/2023 Will Be Crucial, 7 Timing Conclusions, 2008 Comparisons.