InvestingHaven is very bullish on the stock price of Atlassian Corp. It was IPOed 30 months ago. As always, a couple of weeks after the initial hype, the stock dropped sharply (remember: never buy into an IPO), and it needed exactly 24 months to get back to the top after the IPO. Since then, Atlassian Corp is off to the races. We have a bullish forecast for Atlassian Corp’s stock price in 2019, and even a specific target for our Atlassian Corp stock forecast for 2019.

Atlassian Corp is a software provider that offers cloud based services like Jira, extremely popular among IT departments in almost any company nowadays. Also Trello is a very popular product by Atlassian Corp. It has a market cap of $19B at the moment of writing. As such it categorizes as an IT stock, cloud stock and software company, pick your choice.

As per our COF criteria we need 3 areas to line up: the chart and its trend, options market structure and financials/fundamentals of the company. Only if all 3 are bullish can we feel confident to make a reliable stock forecast. In this case we have reliable inputs to make a reliabe Atlassian Corp stock forecast for 2019.

Note: our Atlassian Corp stock forecast 2019 is just one of the many 2019 forecasts of InvestingHaven, many more will follow. Stay tuned!

Atlassian Corp Stock Forecast By The Chart

As per our ‘start with the chart’ principle we need green light from the chart before proceeding.

The weekly chart of Atlassian Corp is the only ‘long term’ timeframe we can rely on as this stock got IPO’ed in December 2015.

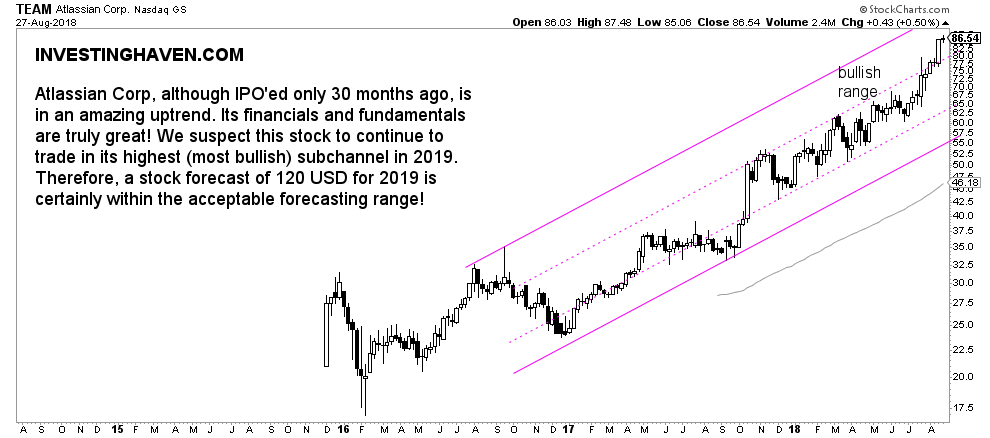

Below is the chart with a very simple though understandable setup. It all started with the typical hype around any IPO only to see a very sharp drop in the weeks after the IPO. That’s why one of our ground rules are to never (NEVER) buy into an IPO, that’s way too late or way too early.

After the IPO hype it took 24 months before the stock price of Atlassian Corp came back to test its post-IPO top. That was in November 2017.

Since then the stock is off to the races. It has climbed to the higher band in its rising channel.

Since last week the stock even climbed one level higher. We expect Atlassian Corp to remain in that highest band because of its underlying financials/fundamentals and constructive options market structure.

That’s why our Atlassian Corp stock forecast for 2019 will have price target in that highest band.

Atlassian Corp Stock Forecast By Options

The options market structure for expiry in 2018 are strongly bullish. There is one expiry month in 2019 which has a slightly higher bearish than bullish bet, not certainly nothing significant.

However, there is a seriously bullish bet on $110 for January 2020. Really serious, big volume, nothing compared to anything else in 2018 or 2019.

We see the options market structure leaning to a bullish outcome, which underpins our bullish stock forecast for Atlassian Corp for 2019.

Atlassian Corp Stock Forecast By Fundamentals

Financials of Atlassian Corp look gorgeous. This is a quote from the July 26th earnings report published here (look also at top level financial trends at a glance here):

Subscription revenue primarily relates to fees earned from sales of our Cloud products. The remainder of this revenue relates to sales of our Data Center products, which are Server products sold to our largest enterprise customers on a subscription basis. We recognize subscription revenue ratably over the term of the contract. For Q4’18, subscription revenue was $117.4 million, up 62% year-over-year.

When it comes to the outlook of this company we have to refer to this quote which says it all:

In fiscal 2019, we will deepen our focus on supporting the needs of IT teams across companies of all sizes – what we call the Fortune 500,000. IT departments are undergoing a significant transformation as they enable and support technology-driven innovation and manage the increasing number of applications entering their organizations through the ‘bring your own software’ movement. Modern IT is becoming more service-driven and agile-oriented, and our products are well suited to help them discover new and better ways to manage workflows across their organizations.

We can go on for a while but it’s crystal clear: top level financials are outstanding, growth is breathtaking, losses are contained and improving, signals for 2019’s business outlook are great. This underpins our Atlassian Corp stock forecast for 2019 in the most bullish range on its chart.

The somehow higher short float ratio of 7-ish percent (see here) is not going to provide much stopping power in our view.

Our Atlassian Corp Stock Forecast For 2019: Price Target

All in all all components of our COF method (Chart / Options / Financials and Fundamentals) are bullish. They underpin an Atlassian Corp stock forecast for 2019 in the most bullish area of its long term chart. That’s why we feel comfortable forecasting $110 for 2019.