We tend to hear the words ‘giant breakout’ or ‘huge breakout’ so often that we don’t pay too much attention any longer. Not so over here at InvestingHaven. When we say a ‘giant breakout’ we really mean a ‘giant breakout’. The tech sector that may be in the situation of such a ‘giant breakout’ (without exaggerating) is biotech stocks. We are preparing a 2020 forecast which shows a very bullish potential, obviously provided this breakout materializes first. As ‘risk on’ returned to markets, and based on our Dow Jones Forecast For 2020 And 2021 (32,000 Points) we believe biotech stocks may be one of the sectors that may do extremely well.

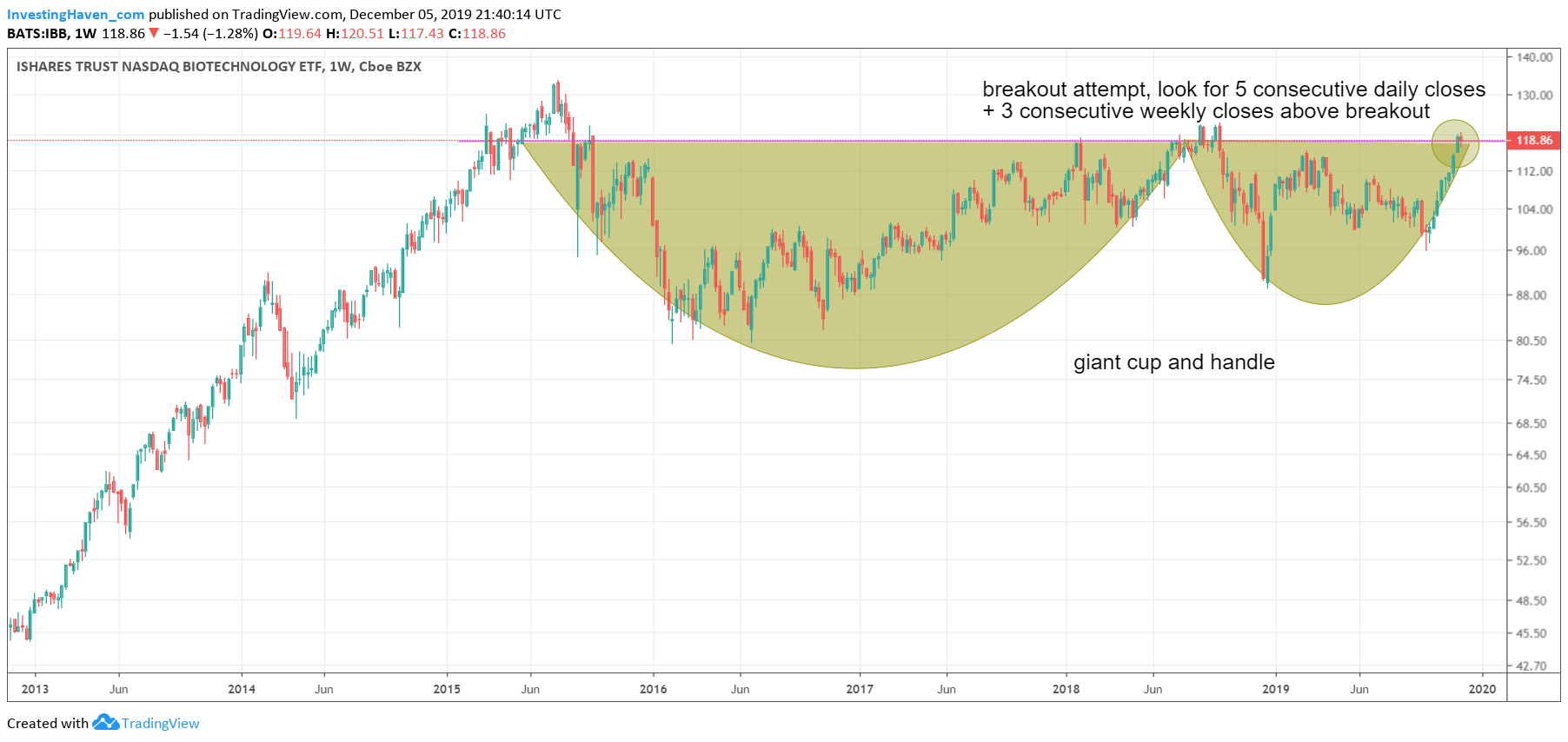

Not only because of ‘risk on’ but more importantly because the sector has essentially gone nowhere (trendless state) for 4 to 5 full years now! Because of this the biotech sector ETF IBB has created a horizontal resistance pattern which if broken to the upside becomes a ‘horizontal breakout’. That’s the most powerful breakout pattern possible. The combination of this ‘horizontal breakout’ potential with the very long basing period (4 to 5 years) in a ‘risk on’ environment is tremendously powerful if and when this long awaited breakout takes place.

Think of it as the crypto space in 2017. Multi baggers all over the place is what we expect to see in the biotech space if and when this horizontal breakout takes place!

When do we know for sure that ‘it’ has started in the biotech space?

Well, looking at the top gainers in the Nasdaq in the recent days makes you think that the biotech space is already close to a top. Nothing is further from the truth. Although the top gainers this week, every day, were 80% biotech stocks, with gains of 20% to +100%, the space officially did not break out yet!

Once the IBB ETF succeeds in closing for 5 consecutive days above 119 points, and does so for 3 consecutive weeks, we know for sure biotech stocks will be like crypto in 2017.

Watch out though, extreme volatility comes with extreme risk. Knowing how to play highly volatile stock sectors is an art. A decent exit plan is the key for success. Protecting the downside, protecting your capital, managing risk tend to become irrelevant but are more relevant than anything else in any sector, especially high beta sectors!