In the week of October 8th 2018 global stock markets led by the U.S. stock markets sold off heavily. Between Monday and Thursday the S&P 500 lost 6 pct and the Nasdaq 6.8 pct. Particularly the Nasdaq saw a 4 pct loss on October 10th which makes for one of the biggest losses after the 2008 crash. Is this the start of 2008-alike stock market crash? In other words is there a cataclysmic crash underway? Is this the start of THE stock market crash 2018?

We don’t think there is any reason to panic for reasons outlined in this article.

Note that there has been ‘proven’ damage on the uptrends that started in the summer of 2016. The perfectly rising trend that started some 2 years ago was violated this week with, so far, 2 daily closes below the uptrend. Friday’s 3-in-a-row would confirm the damage done.

However,there is strong support between 5 and 10 percent below current levels, say the 2009 uptrend support although not seen on any chart in this article.

Cataclysmic stock market crash underway? Look at 2 stress indicators.

Let’s look at 2 important stress indicators to understand if a stock market crash is underway.

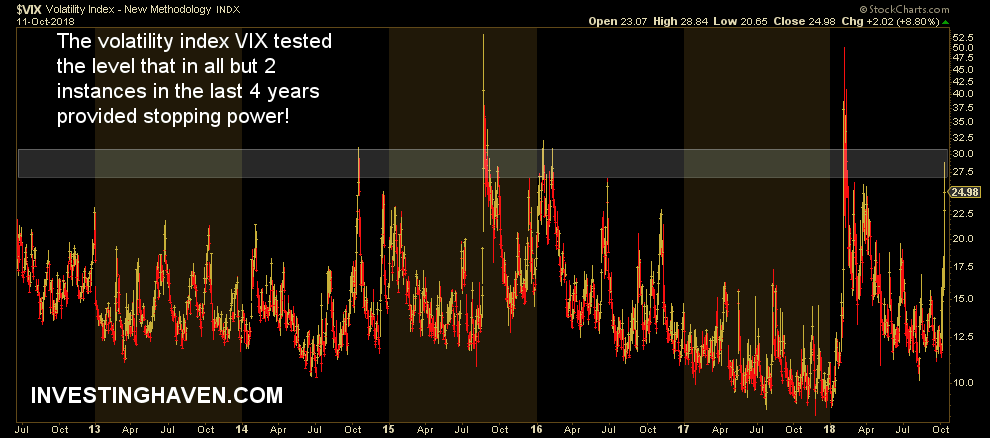

The volatility index rose fast this week. It is a stress indicator. It peaked near the 27-30 level which has acted as strong resistance in all but 2 instances in the last 4 years, arguably even 6 years (although there was no attempt in 2013-2014 to rise till that level).

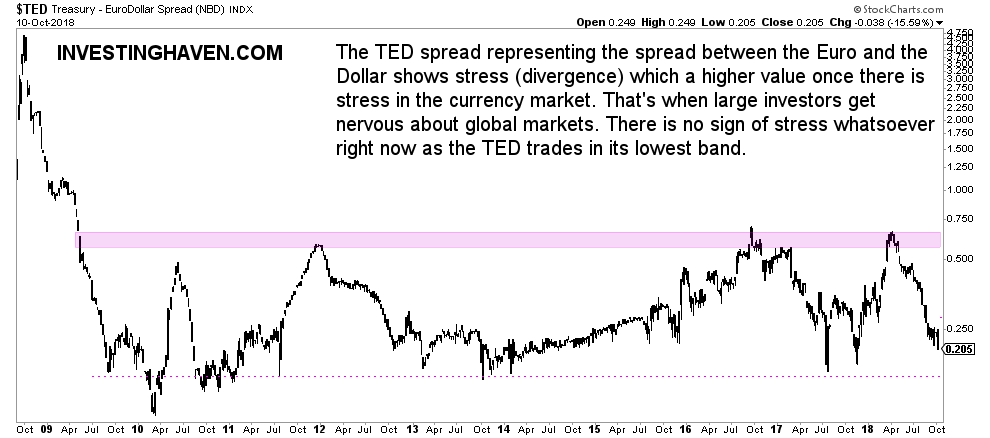

At the same time we would have seen turmoil in currency and credit markets if this was a 2008 or 1987 repeat. It’s not there, nothing is happening in currencies nor in credit markets. The only thing that happens is the bond market is selling off.

To illustrate this we have included the TED spread which is a good stress indicator for credit and currency markets. That’s where turmoil always starts before it trickles down to other parts of global markets like for instance stock markets. It is “the difference between the interest rates on interbank loans and on short-term U.S. government debt.” TED is an acronym formed from T-Bill and ED, the ticker symbol for the Eurodollar futures contract. It incorporates both interest rates and currency stress. But as seen on below up-to-date chart there is no stress whatsoever.

Our conclusion? No, THE stock market crash 2018 did not start. There is more downside potential in global stock markets in the next few weeks, arguably the next few months, but based on current market conditions and our 2 stress indicators it is not a cataclysmic stock market crash that is underway.