Stock market investors better be careful in February of 2020. This one important leading indicator for stocks warns stock investors for more trouble ahead in February. Even though it may additional turmoil may be short lived it certainly doesn’t make us feel comfortable holding to many stocks at this point in time. Yes our bullish stock forecast for 2020 is still valid, but does not mean there is no additional pain before there is gain in 2020.

The long term charts all still look great, and will continue to look great. Think of the Dow Jones Long Term Chart on 20 Years as well as the Nasdaq Long Term Chart On 20 Years, both pivotal in our research.

However we are really concerned about the near term, and February of 2020 may bring some unpleasant surprises especially for stock investors.

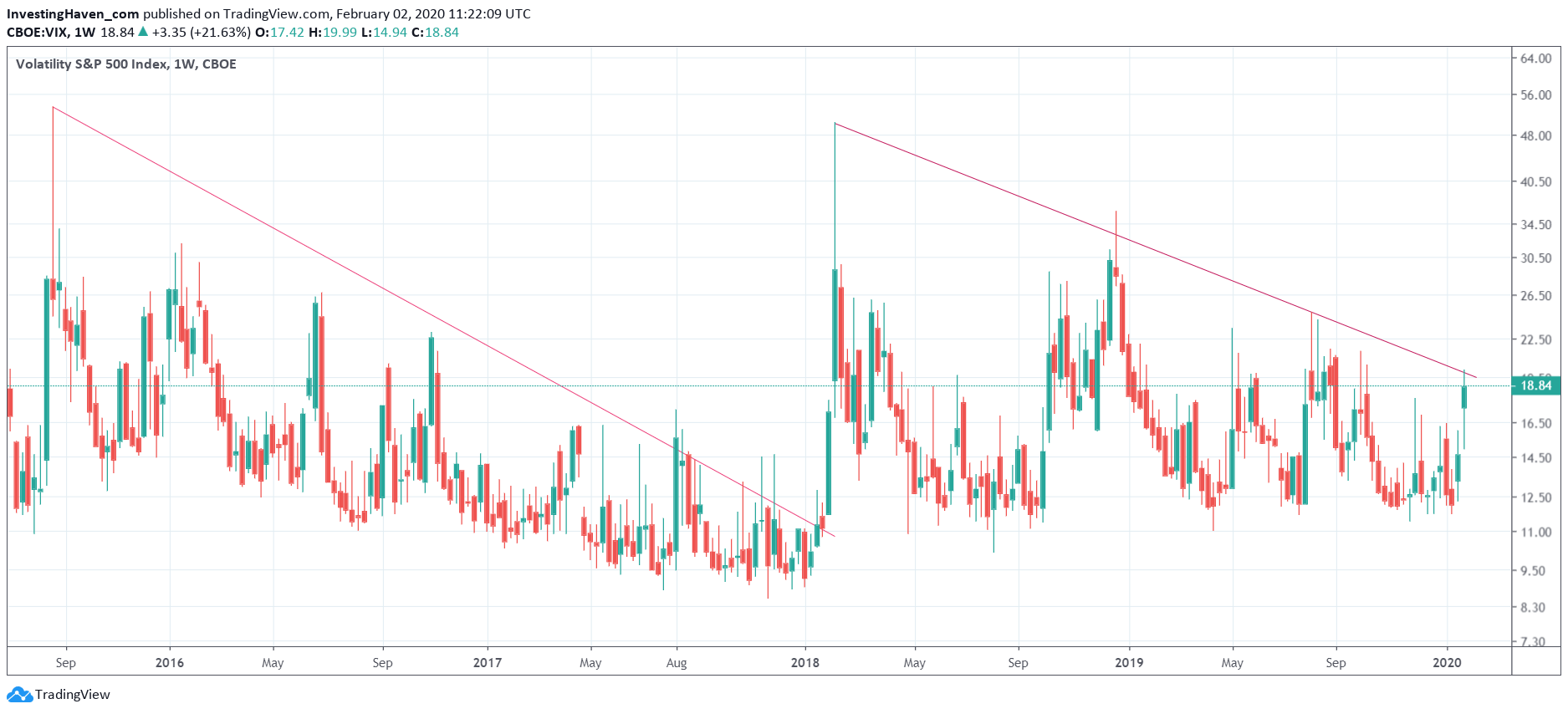

The chart we feature in this article is the VIX index. Look at the weekly chart below. Look what happened last time it broke to the upside: stocks broke to the downside.

This is a red flag, and it says you better had taken some capital out of stocks in Jan of 2020. That’s *exactly* what we did in our Momentum Investing portfolio with a methodology which is designed to turn 10k into 1M by 2026 as per our Mission 2026.

We got out of stocks, and we hold 2 positions that may do exceptionally well in February of 2020 as stocks may be selling off. You can discover here which positions are allocated to our Momentum Investing portfolio.

There is also a positive message in below chart. In case it breaks out, and stocks go 10 to 15 pct lower in February we can add our favorite stocks with a huge discount. That’s exactly what we will do especially in our Momentum Investing portfolio.

Most likely those positions will come from the 6 Best Sectors In 2020 which we identified a few months ago, and are still very actual.

It will be an interesting month for sure, especially for our cryptocurrency members that are looking at giant breakouts as stocks are selling off.