It is so easy to get caught up into selling. Since May of 2022, markets went in overdrive. Above all, epic rotation started dominating markets. While many sectors sold off, some recovered, think AI-semis. We believe that recent weakness in the broader EV space (which includes EV producers & charging services, green battery metals) comes with an epic opportunity for investors with a long term timeframe, truly epic. While we only like a few pure play EV stocks, we see tremendous opportunities in EV charging. Again, not all stocks can be considered, but only the ones that are delivering value and have above average growth prospects.

Buying a downtrend is most often not a good idea.

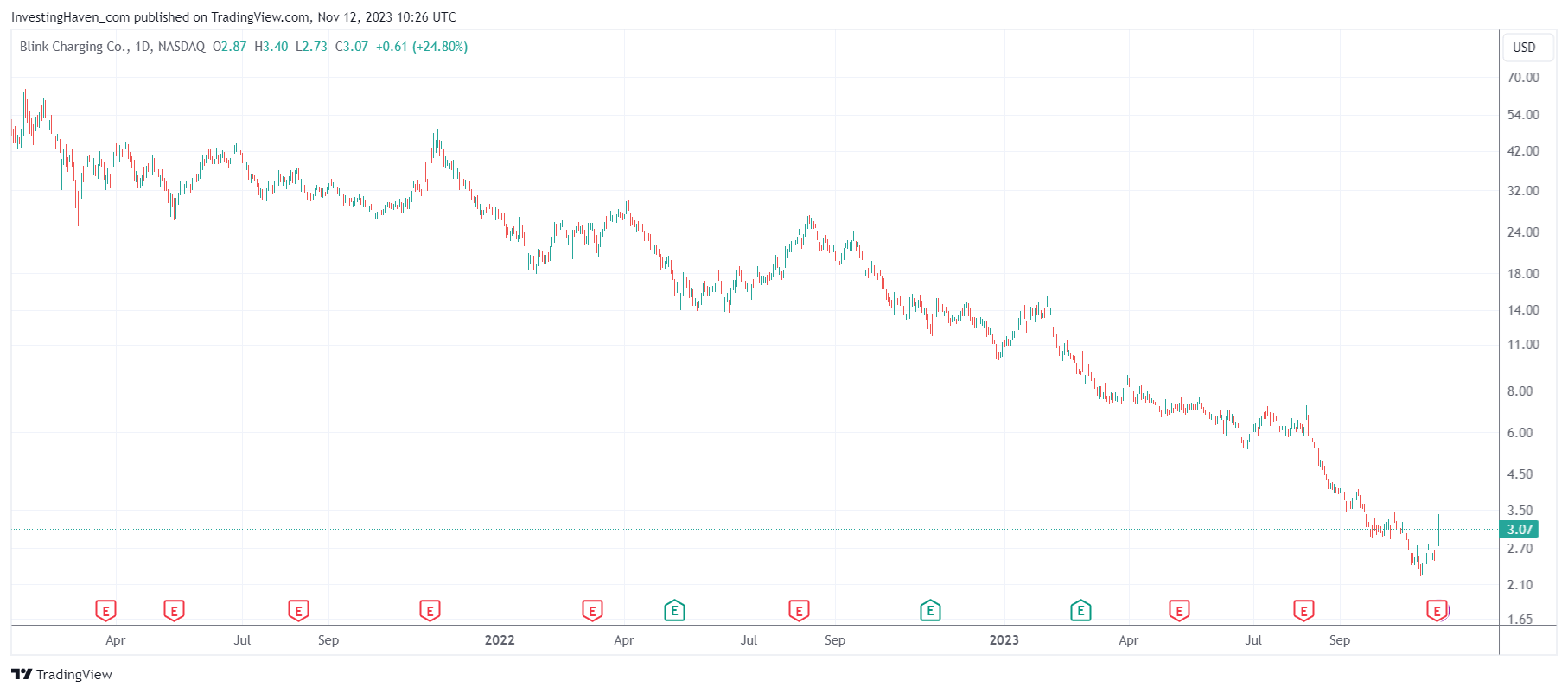

Case in point: the stock chart shown below is absolutely horrendous. The point is this: what is falling can fall lower, much lower.

The most important question to ask is whether a turning point is set. That’s not only the most important question to resolve, it also is the most complicated question to resolve. That’s why it’s probably the most profitable question to resolve.

That said, the stock chart at present day has no sign of a turning point. Or has it? We would argue it might be that the lows are set. IF that is true, and it requires confirmation before knowing for sure, the first upside target as per the chart structure is 11 (nearly 4x) followed by 18, and ultimately 24. That’s as close as a 10-bagger can get. Needless to say, the highest target will not be reached in 2024, although the lower target can certainly be tested in 2024.

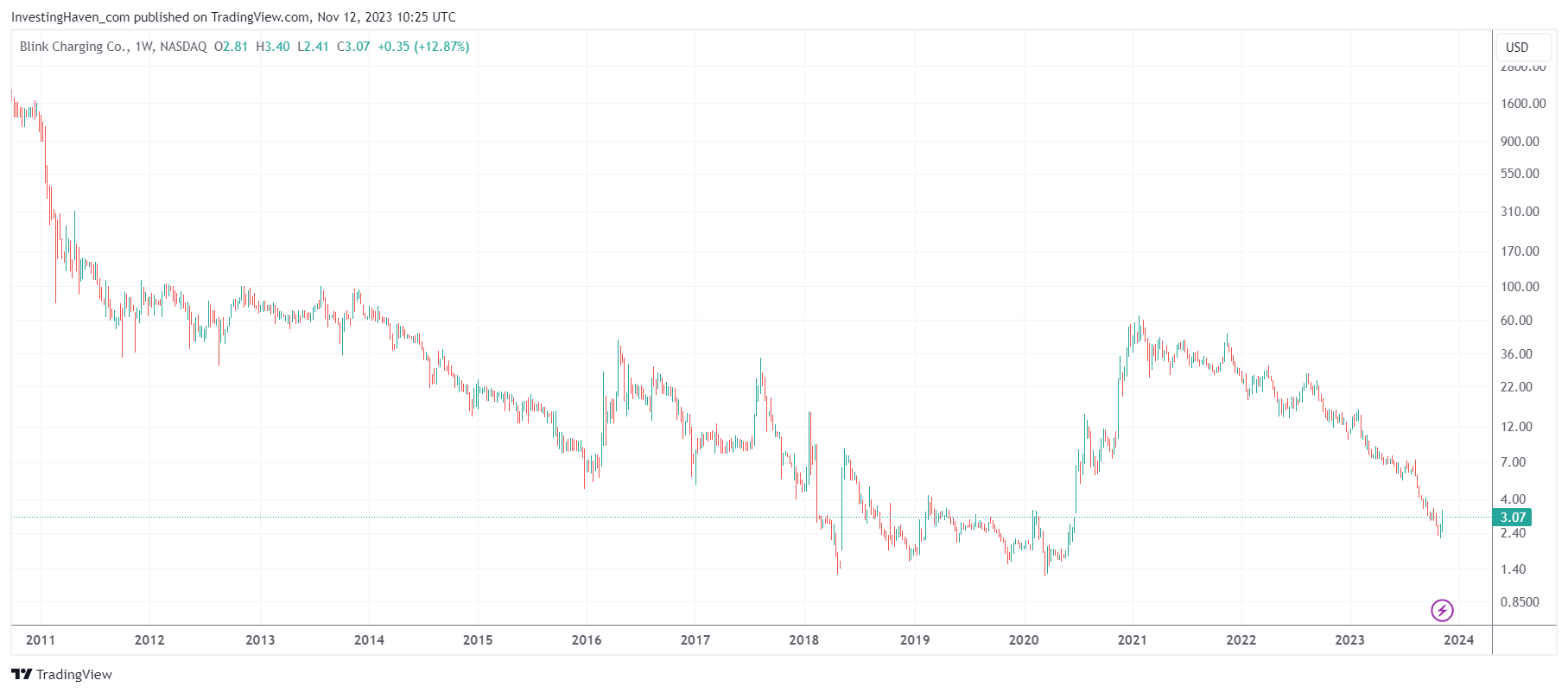

The picture becomes very different when we add two more elements into the mix:

- The longer term chart. Clearly the big rise of 2020 qualifies as a potential mid-point of a larger W-reversal. IF this is true, it would imply that the area 36 to 45 would be a reasonable long term target, say in 2025 or 2026. That’s not a typo, it’s what this chart setup suggests.

- The second, and probably more important element, is the fundamental situation of this company. There must be unusual growth potential in order for this stock to get back to its 2020 highs. Well, truth to be told, the growth potential is epic. Equally interesting are the recent results, communicated with the latest quarterly earnings, which are truly astonishing.

With all that said, how is it possible that this stock has fallen so low? One answer: sector weakness. That’s a problem for those that bought in 2021, it certainly is a huge opportunity for those that want to enter in 2023.

We will include more analysis of this stock in our Momentum Investing weekend edition: we include multiple charts, details from the recent earnings, a trading strategy to accumulate an increasing number of shares over time. Above all, we will track this stock, along with our favorite EV stocks, as we believe the upside potential is tremendous.