Let’s be very clear: no gloom and doom over here, never. Whenever we talk about market crash or flash crash it is not meant, in any way, to create fear. On the other hand, we want to be understand risk. We may favor some bullish cycles next year, as per our 2022 forecast and Dow forecast, we also expect a bullish 2022 for green battery metals. It doesn’t mean though that we won’t have a bearish cycle or event. A sell-off event will create opportunities for those that have some cash aside.

We mentioned today that fear is not far from extremes while markets are near ATH. Awkward? Extreme? Concerning? Probably a bit of a mix, and it certainly warrants to be very sharp now. Things might move fast, the only unknown is timing.

Not over-reacting is key for investors, and having a plan B in place is also crucial. No panic, but understanding and good timing of key decisions is what is required.

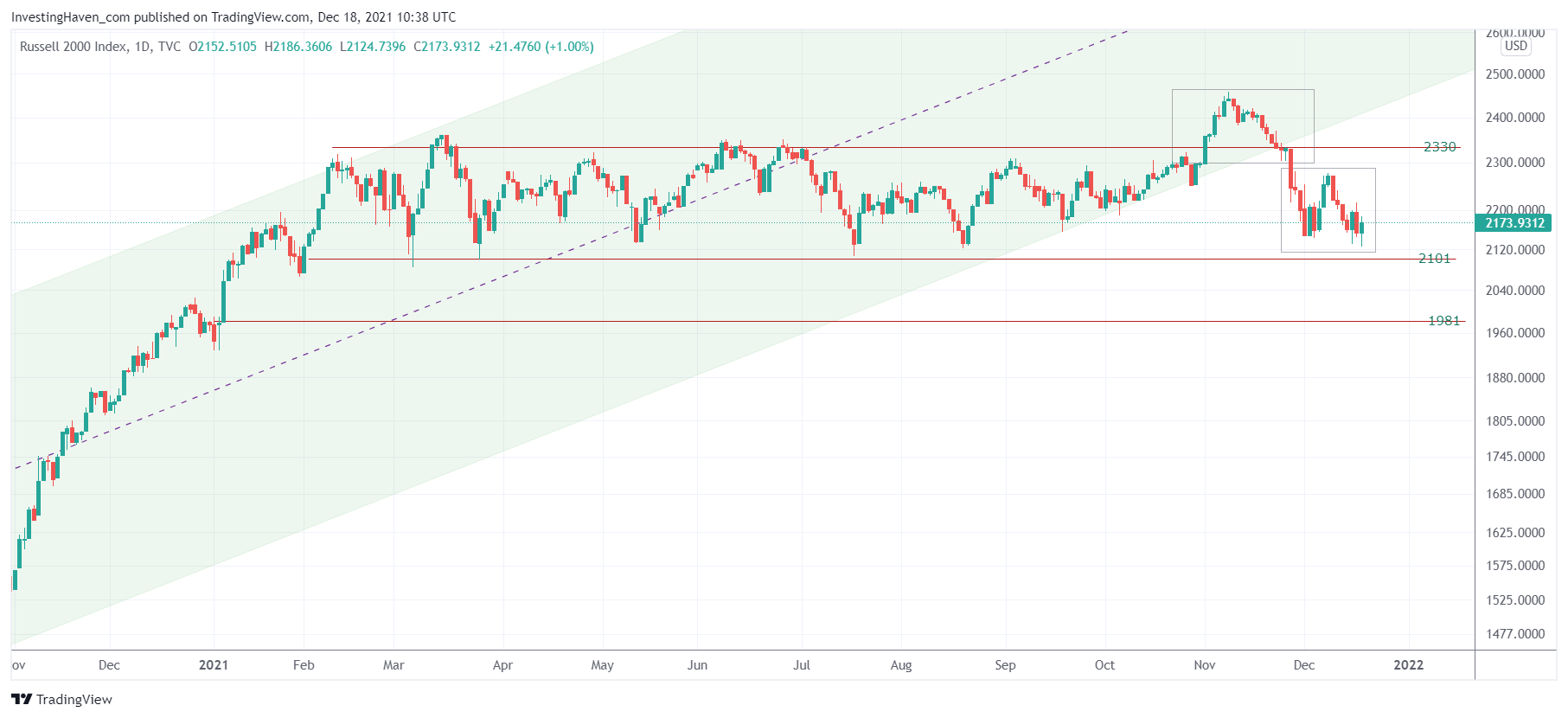

Below is the one chart we have featured a few times lately: the Russell 2000.

The two grey boxes might be rejection scenarios, where the recent one (in development) has still a possibility to become a bullish W reversal. We cannot exclude a bearish outcome, and the line in the sand was 2101 points (ultimately 2070).

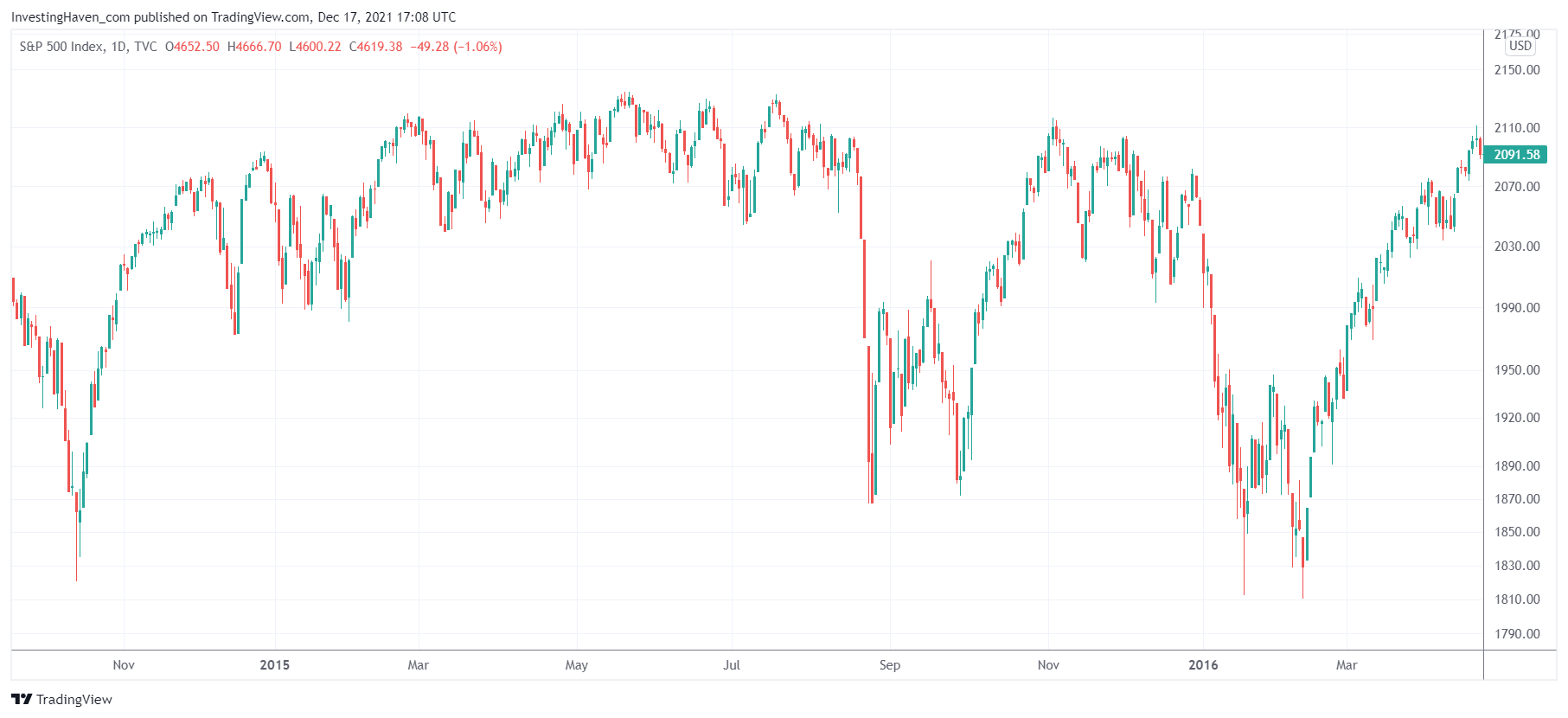

Let’s go back to 2015.

Look what happened when the S&P500 was going through a similar distribution setup which took 9 months to resolve. Some of our readers might remember the flash crash of August 2015.

The outcome though was lots of volatility, with a bullish W reversal between mid-August and mid-September that resolved in a 6 week bull run. The market came back down in December and January though.

Are we saying that the Russell 2000 will flash crash in the exact same way as the S&P500 back in 2015?

No, we are saying that there are similarities. And whenever there are similarities we better pay attention.

Risk is rising, and we need leading indicators to confirm a bad outcome. They are not in an alarming area yet, but they are also not far away from a concerning setup. We are sort of in a limbo state, right below ATH in several leading indexes (not so in the Russell 2000 though).