As per our methodology we consider the Euro to be the leading indicator for global financial markets. That’s a big bold statement, as what we are saying is that the direction of the Euro strongly influences the direction of global markets. As stocks are moving to all time highs, as per our Dow Jones Forecast 2021 and many of our other global forecasts and 2021 forecasts, the Euro suggests the end of this bull run is not in sight yet.

How To Forecast With The Euro

Combining chart analysis with intermarket analysis gives you a very powerful combination: it helps understand which assets get a capital inflow.

In doing so we combine two important investing principles, as per our 100 Investing Tips For Long Term Investors. The first one:

The art of understanding intermarket dynamics is the combination of 3 things: identifying leading assets + reading charts of those assets and respecting chart characteristics of each asset separately + identifying major turning point for each asset. Once this is in place it becomes obvious which asset has a primary or dominant force influencing other assets. This is what we derive from intermarket dynamics, and this is the key to forecast markets.

Moreover, and further to the previous principle:

All major moves in markets, especially market crashes, start with major turning points in credit and currency markets. That’s why 10 and 20 year rates, as well as leading currency pairs, have the most influence on all other markets, including stock markets around the globe.

In other words we have to check currency and credit markets first, understand where they are in their dominant trend(s), and hold this against other asset classes and markets.

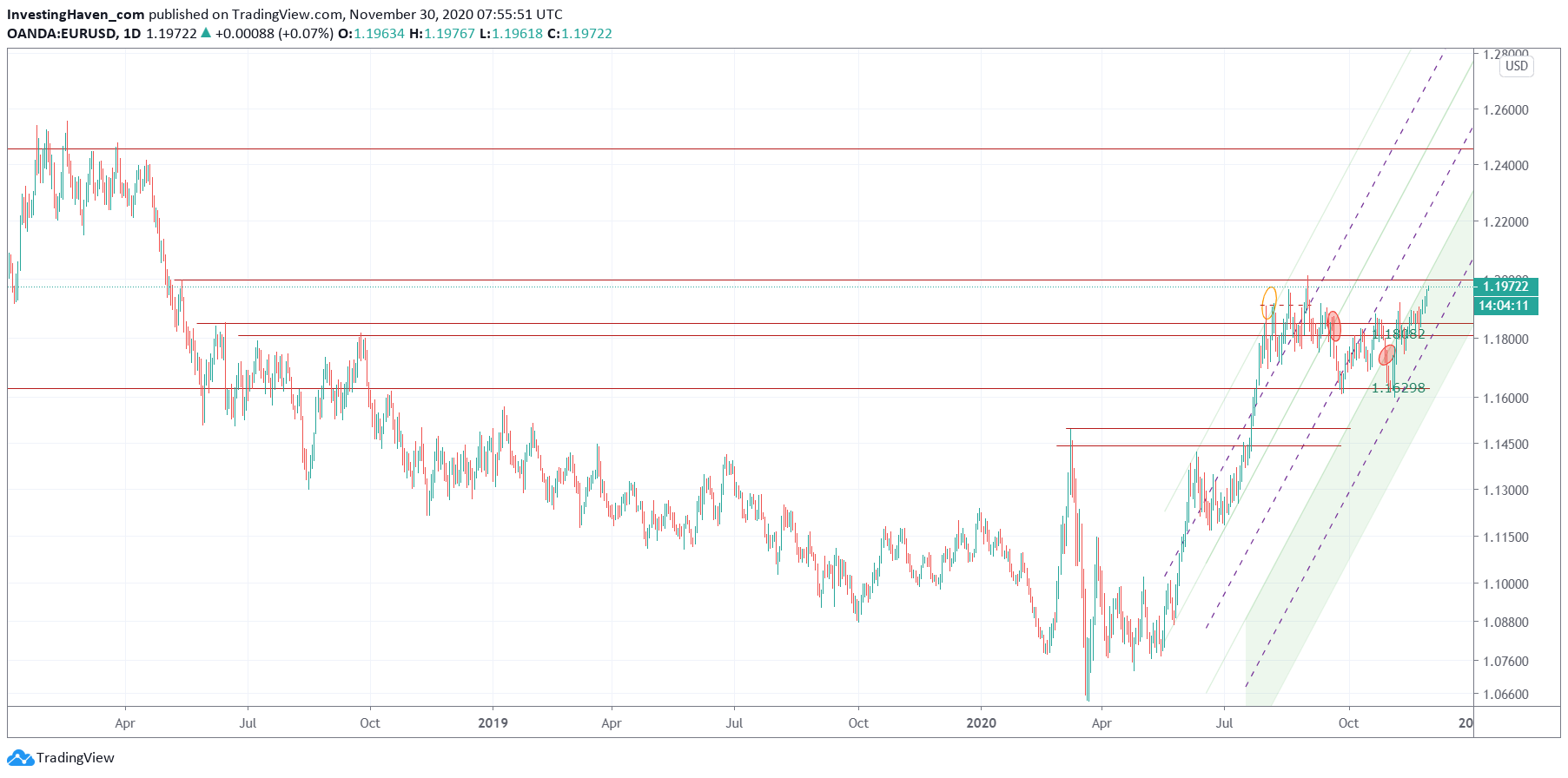

If we apply all this to the current state of the Euro we see a pretty powerful setup. The daily chart below, which has lots of annotations, shows a giant bullish reversal with an attempt to break above 1.20 points.

If and when successful we have sufficient evidence to believe that the Euro will move to 1.25, where it will meet a pretty powerful resistance area. Between now and then, provided 1.20 is cleared to the upside, it will ensure that there is RISK ON sentiment in global financial markets.