In the not-so-distant past, the market experienced a rollercoaster of uncertainty, chiefly fueled by inflationary fears. The consensus was for a stock market crash to occur, the base case expectation was a recession to occur. None of it really happened. What’s in store when it comes to inflation in 2024, and how concerning is the topic of inflation for investors in 2024?

From the onset of 2022 until the summer of 2023, volatility was the norm as inflation made its presence known on the input side – influencing wages, commodities, and raw materials. Investors found themselves navigating turbulent waters, grappling with the uncertainty of how these inflationary pressures would translate to the revenue side of the equation.

Inflation Readings Going Into 2024: Subsiding Storm

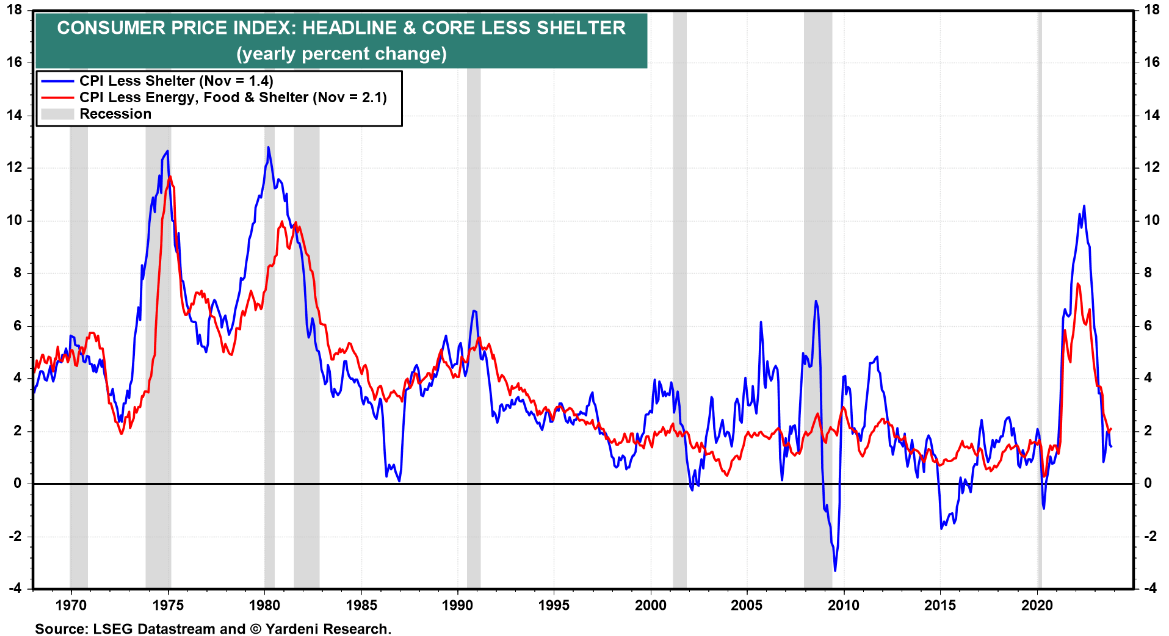

Fast forward to the present, and the economic landscape has undergone a notable transformation. Inflation, once a towering concern, has experienced a significant descent. From a peak of 9% year-over-year in May 2022, the latest inflation readings reveal a remarkable turnaround. The most recent data, excluding shelter, indicates a modest 1.4% year-over-year inflation rise. This dip brings inflation comfortably below the Federal Reserve’s target of 2%, signaling a crucial shift in economic dynamics. Chart courtesy: Ed Yardeni.

2024 – Market Focus Shifts and Investor Considerations

As we step into 2024, investors find themselves at a crossroads. The falling inflation trend implies a positive shift, relieving the market of a substantial source of uncertainty. This newfound clarity is undeniably good news for investors. However, it also beckons attention to the next challenge on the horizon.

Inflation, while a major concern in the recent past, is no longer in the spotlight. Investors must now shift their focus to discerning the factors that will shape market sentiment in the coming months.

In essence, the market is seeking the next narrative, and investors need to disengage from the singular focus on inflation. Understanding that the economic landscape is dynamic and multifaceted is key. As we bid farewell to the inflation-dominated headlines of the past, the investment community is tasked with identifying the emerging trends and challenges that will define 2024.

Conclusion: Inflation’s Retreat Marks a New Chapter

The retreat of inflation signifies more than just a statistical downturn; it marks the beginning of a new chapter for investors. While the market’s dance with inflation was intricate and unpredictable, the evolving landscape demands a fresh perspective. As we navigate the uncharted waters of 2024, understanding that the market narrative is ever-changing empowers investors to stay ahead and make informed decisions in the face of uncertainty.

In order to diversify your portfolio in 2024, you might want to consider our passive income service >>