All eyes were on the federal reserve announcement this week. Word of the day: Historical.

- We have inflation hitting levels not seen since the early eighties, 1981 to be precise.

- We have a 75bps rate hike announcement. The last time the fed increased by that much was in 1994.

Right after the announcement, the stock market seemed to recover and even precious metals seemed to catch a bid. It looks like the market had already priced in the hike and is moving higher as the fed chose to take a severe measure to tame inflation. But is that really the case? Will the US stock market continue to move higher from here? Will this rate hike actually succeed in reducing inflation?

Let’s start by looking into the price action of the primary indicators to have a pulse on the market after the FOMC meeting today.

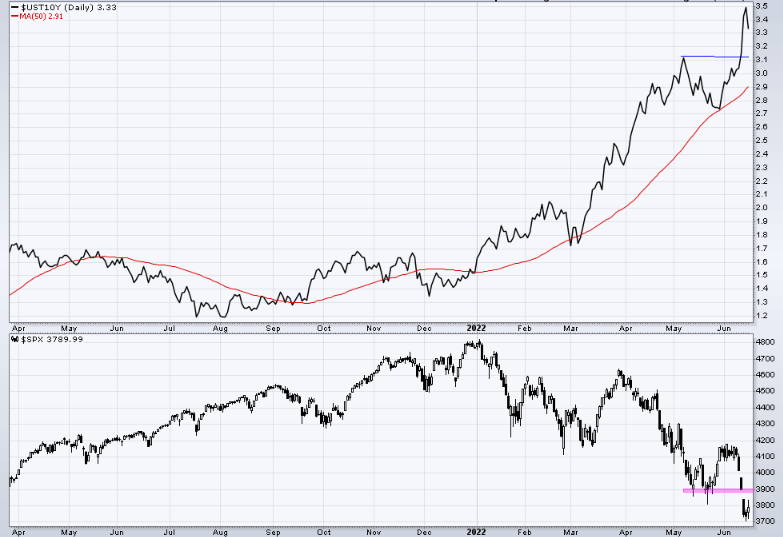

Treasury Rates Following The FOMC Meeting Today

Until yesterday, Treasury rates kept a steep push to the upside as seen in the chart below. However, the price started rolling over at the open.

Now when looking at the chart below, we see the following:

The Treasury rates clearly broke out and faced resistance at 3.5% while the SPX started what looks like a reversal.

However, none of these 2 moves are confirmed. For treasuries, we need to see the 3.15 level back tested successfully. For the $SPX, the price needs to cross and hold above 3900.

It is still possible for the 3.15 support area in treasuries to fail and also very likely that the $SPX gets rejected in the 3900 to 4000 area.

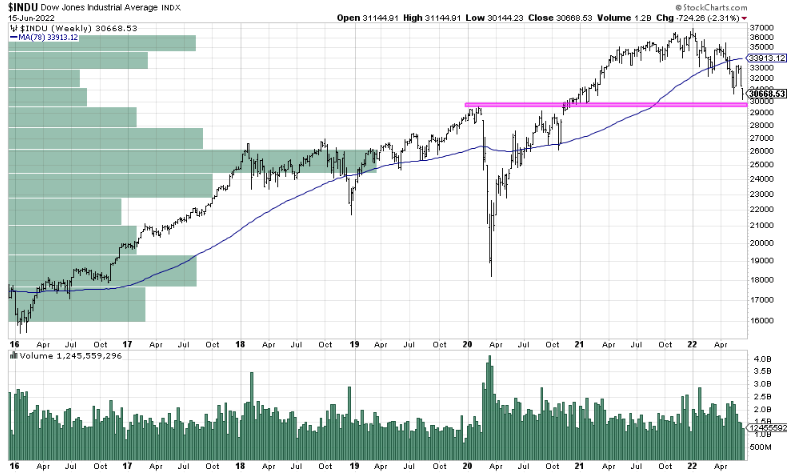

The long term chart below shows how the real breakout for interest rates may not have happened yet. There is clearly a lot of resistance in the 3.4 to 4 area.

The path of the least resistance here seems to be to the downside which should benefit the stock market.

Interesting enough, the Dow Jones industrial seems to be around an important support area:

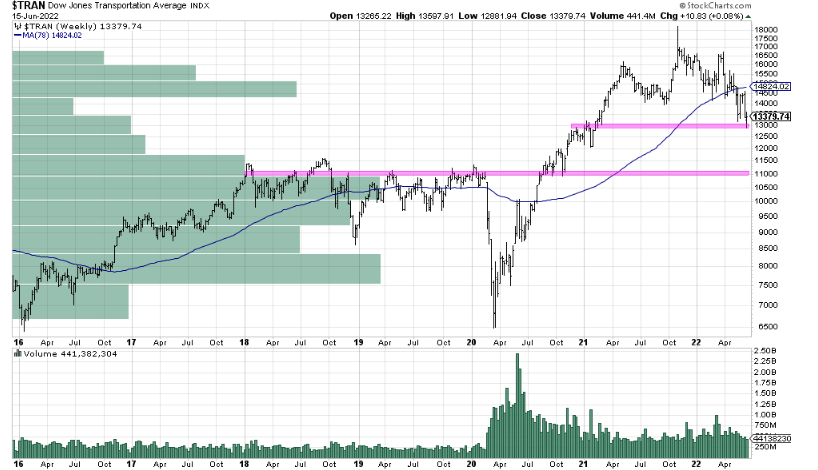

Same thing could be said about the Dow Jones transportation which seems to confirm.

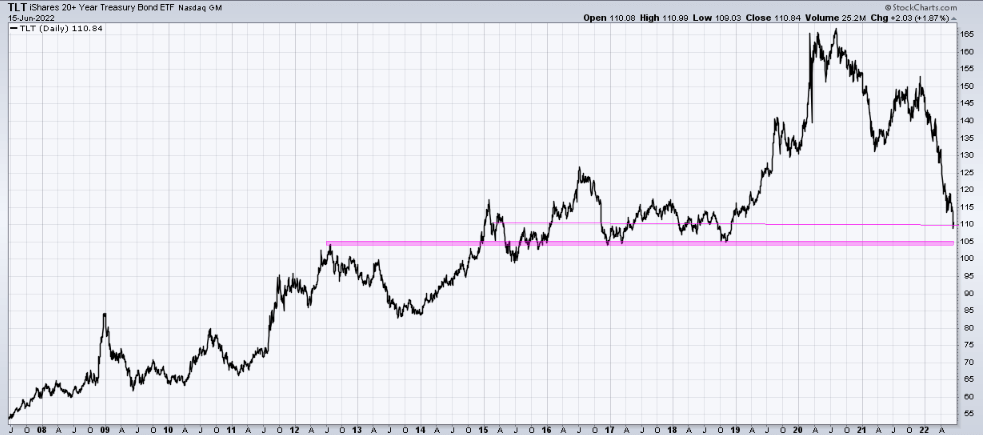

Bonds broke down after a massive head and shoulders. However, they are in a major support area and the target price for a head and shoulders break down was reached. It doesn’t mean it can’t go lower but no trader in their right mind would enter a short position here.

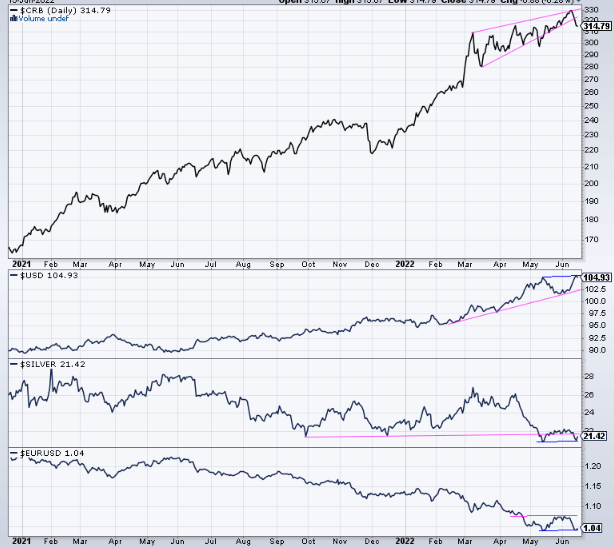

The Commodities Index, Silver, Euro and the USD after the FOMC Meeting Today

The commodities Index could be breaking down here. That’s not to say that some select commodities will not perform well. But overall all we see signs of topping in this index and the price dropped below the important 315$ level that we highlighted here. Soft commodities might be the ones taking a breather here especially considering that many fertilizer stocks have a rounded top pattern therefore rolling over.

Silver has a double bottom but has to clear that $22 resistance soon. We covered the 3 possible scenarios for Silver price extensively here.

Similar to Silver, the Euro seems to be making a double bottom but has a clear overhead resistance level to clear.

The US Dollar seems to be the master puppeteer here especially recently. The price is trading below the Bullish $105 level and could have made a top here. You can find the details of potential future moves in the US dollar in our recent article Where is the USD heading Based on this important secular chart.

To close, we don’t want to make assumptions as to what the US stock market direction will be next. But the charts are showing the inception of what could become potential tops or bottoms in the making. Those price levels will be our indicators to see if the trade is still working.

There is no way to confirm if the hike was priced in unless the US stock market confirms a reversal from here. As for the rate hike and impact on inflation, the increase was accelerated by the war in Ukraine and the impact on energy prices and supply chain. Best to stick to the chart and not get lost in the reasons behind every move for they are too complex and can be misleading.

Written by hdcharting.