The Euro is testing an unusually important area. Is a major breakdown underway? We are not convinced the breakdown will happen, although the current environment is unusually challenging to forecast.

The Euro is a leading indicator in our methodology.

We don’t look at the Euro as a trading instrument. We analyze the Euro chart to understand the cross market (intermarket) impact it might bring. A rising Euro is good for stocks (broad market), metals and momentum assets like crypto.

As seen on below chart, the weekly Euro, which exhibits long term trends, the EURUSD paid came down from 1.22 points last summer to 0.99 approximately at the time of writing. The recent decline was steep.

More importantly, the EURUSD is now trying to avoid a breakdown scenario. The breakdown would occur once parity gives up. Parity has a double significance currently: it is an important number (psychological, symbolic) but also support of a long term trendline.

Will the EURUSD break down or not?

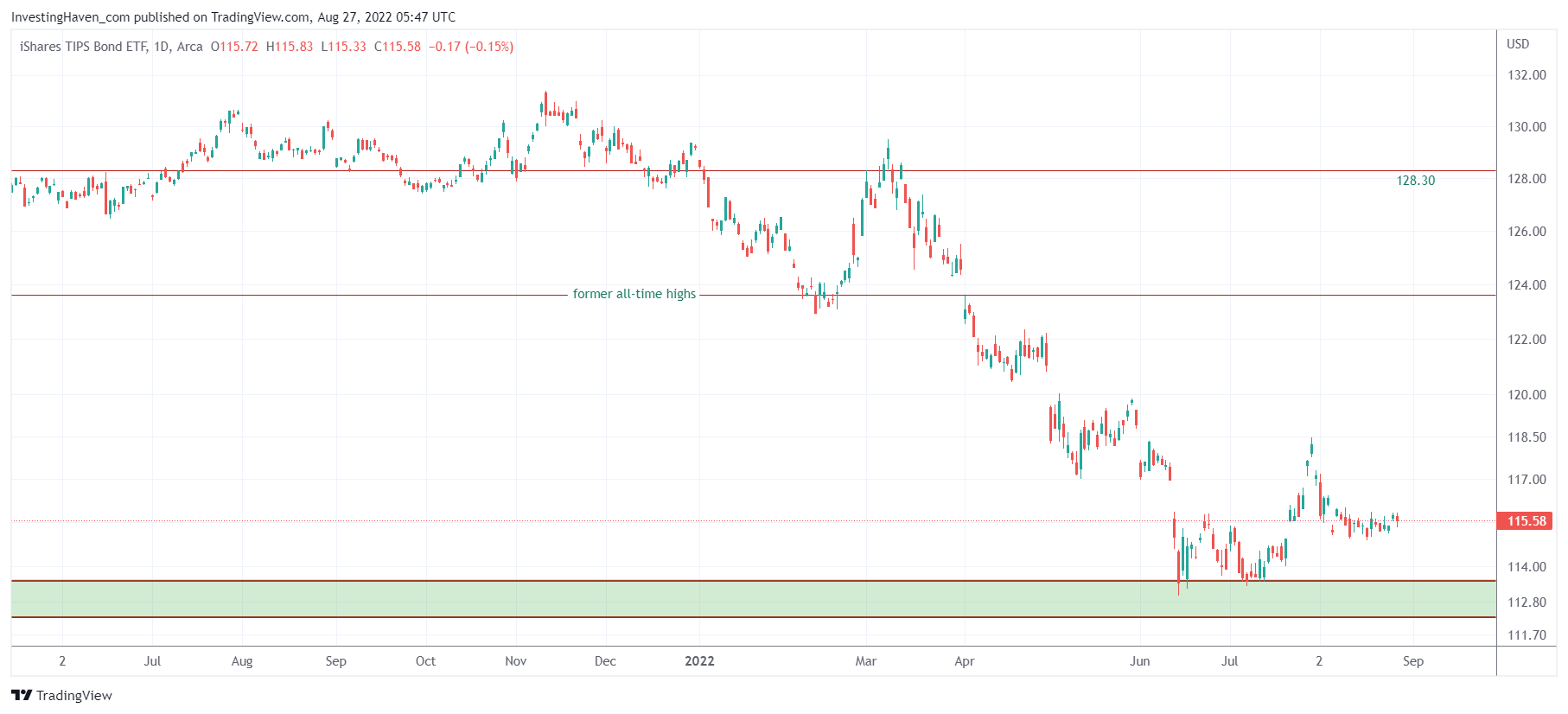

Although very challenging to do a forecast in this current environment, we look at the inflation expectations indicator which is muted lately. Even on Friday, a pretty violent day for stocks after Powell’s speech, inflation expectations did not change as per TIPS ETF.

While this current environment is very complex and multiple leading indicators should be considered, we have a hard time seeing an epic breakdown in the Euro / breakout in the USD.

Our viewpoint is an inverted head & shoulders in the Euro which comes with a head & shoulders setup in the USD. This might be too optimistic, the USD might be in the process to create havoc, in which case inflation expectations will move back lower in the next few days and weeks. We want to look for inter market confirmation of a bad outcome, is the point we are trying to make.