The inflation news raged like a tsunami across financial media. Markets were impacted by this. Stock indexes recovered since May 20th but are now back at the same levels. A breakdown is looming but a double bottom outcome would be wildly bullish going into summer! While we are not forecasting any of the two outcomes, we are emphasizing that both outcomes will be strong. More importantly, there is not just one outcome, the one that you immediately derive when reading headlines. Watch out with the narrative is our best recommendation!

In one of the best articles we have ever written we recommended to be careful with narratives: 7 Secrets of Successful Investing. Not only that, we also noted that identifying turning points in markets is probably the most challenging thing for any analyst and investor. Interestingly, narratives prevent investors and analysts from finding turning points!

Successful investing secret #7. Identifying turning points in markets is the toughest challenge

A turning point in markets occur mostly unexpectedly. That’s because turning points come after a long bullish or bearish period. The mind of the investor gets used to a specific market direction (up or down). That’s when it gets tough for the brain to ‘see’ the trend change.

Markets can change fast. It is a fool’s game to try to hit the exact top. Being smart about exits is what you need to avoid mental stress but still be relaxed about securing profits (not selling too early). Sounds easy, but it really isn’t.

That said, we see some decisive setups in markets. While the breakdown risk in markets is for real, so is the double bottom scenario.

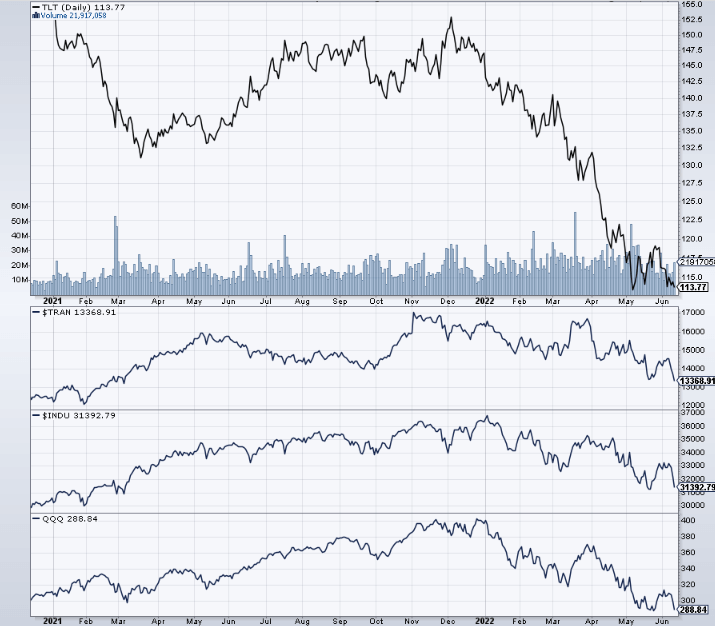

Below are Treasuries, Transportation and the Dow Jones index, as well as the Nasdaq. Imagine on all of these charts that we get lower lows. Also, imagine what the charts will look like if we get a few green candles which push all of these charts back to the early May levels.

Our point is this: narratives will make you see the former scenario (breakdown). However, turning point analysis suggests that a turning point is also a possibility, starting next week.

It will not be a fun week, both bulls and bears will be slaughtered, mark our words. Whatever happens, it is important to stay calm in any scenario. That’s why we neutralize emotions in our weekend alerts, particularly in Momentum Investing we are preparing a detailed view on the potential turning point scenario, worth your time!

Written by hdcharting.