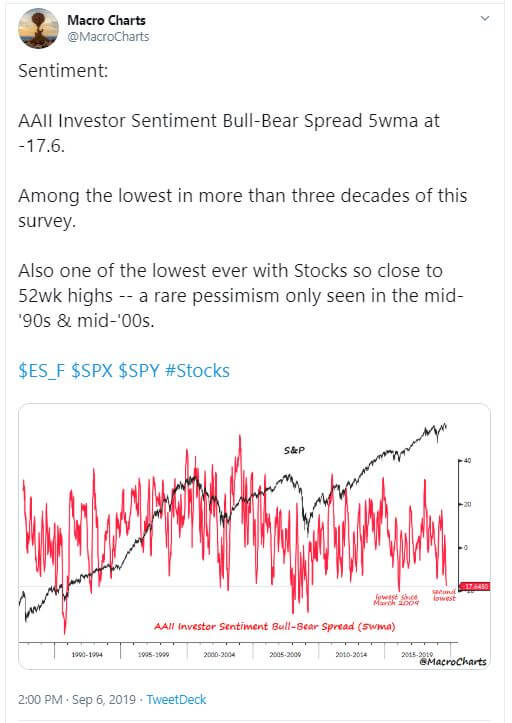

Market sentiment is absolutely horrible mid 2019. Not only do we have anecdotal evidence from our followers (the typical emails which suggest investors lost faith in traditional stocks) but also do we see it in official data points. An illustration of the latter showing this horrible market sentiment is the AAII Investor Sentiment data (source). Particularly the bull vs bear spread is at levels only seen 10 times before in the last 32 years! Interestingly, this happens right at a time when stock indexes like the S&P 500 and Dow Jones Industrials are near all-time highs, and the RISK ON indicator Russell 2000 is some 6% below its RISK ON breakout level. This is the ultimate contrarian signal that stocks will go higher which is why we forecast a bullish stock market for 2020 followed by a stock market crash in 2022. This is also the basis of our vision to identify top investing opportunities in the next 6 to 18 month timeframe!

Being contrarian is not easy.

Who dares to aggressively buy stocks in the light of tariffs, trade wars, negative yield curves, shrinking economies, massive lay offs, and so on forth.

Let’s face it, financial media is all about one and only one thing today: the endless number of concerning facts on economic, fundamental and financial areas.

It is that bad that some are talking about a ‘fear bubble‘.

WE LOVE IT.

We like this a lot!

News is one of the ultimate contrarian indicators. It is as bad as it can get. Think about this: major crashes started when everyone, literally everyone, was convinced that a market could only go higher. Today, all news is about concerns in markets.

Consequently sentiment among investors is horribly bad. Look at this tweet to illustrate this:

And let’s do the math ourselves.

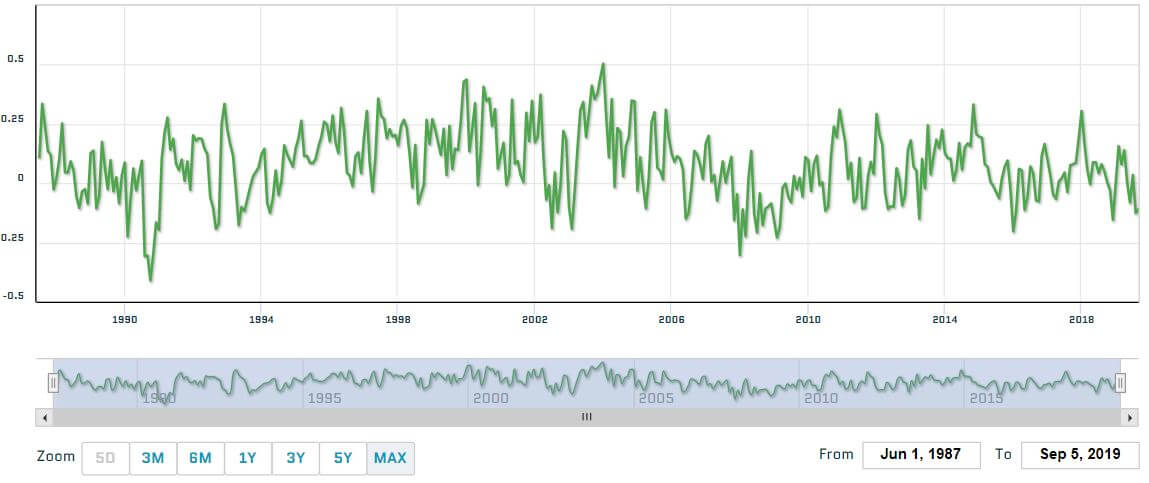

The following chart comes from the source itself: AAII Investor Sentiment data.

It shows the spread of bulls vs bears over the last 33 years.

Only 10 times before did we see similar or worse reading, with significantly worse readings only 3 times before (1990, 2002, 2008).

At InvestingHaven we are on record calling for a bullish outcome in 2020 (starting anytime soon). Want to stay up to date with our vision and specific buy and sell alerts? Subscribe to our ‘investing opportunities service‘: premium research insights for free until Nov 2019.